The Deipnosophist

Where the science of investing becomes an art of living

About Me

- Name: David M Gordon

- Location: Summerlin, Nevada, United States

A private investor for 20+ years, I manage private portfolios and write about investing. You can read my market musings on three different sites: 1) The Deipnosophist, dedicated to teaching the market's processes and mechanics; 2) Investment Poetry, a subscription site dedicated to real time investment recommendations; and 3) Seeking Alpha, a combination of the other two sites with a mix of reprints from this site and all-original content. See you here, there, or the other site!

31 October 2005

Time & the Art of Trading

TRADERS´: How did moving from the floor to the screen change your trading approach? You must have had to completely re-learn trading?

Van der Vorm: Yes, completely. On the floor you have your eyes and ears; on the screen you only have your eyes. You have to try and translate what the prices are telling you and judge from that alone how you are going to trade it.

TRADERS´: Did you find yourself trying to recreate the same kind of trades you were doing on the floor?

Van der Vorm: No, what I was trying to do was to visualise the floor. I’m a big believer in trader psychology and how that moves markets. So I had to learn how the markets behaved, particularly the DAX (future), just as I had spent years on the floor learning how the FTSE future behaved. The difference being, on screen I wasn’t able to see who was doing what, basically similar to trading without an arm or a leg, but I soon got the hang of it and started trading the DAX.

Alas, this interview is a .pdf file that I am unable to upload to this site and with no available link (yet). If you are interested in reading a copy, please email your interest. My reply will include the file attachment.

Google Wants to Dominate Madison Avenue, Too

"As it turned out, the safety net was a trampoline. Those little ads - 12 word snippets of text, linked to topics that users are actually interested in - have turned Google into one of the biggest advertising vehicles the world has ever seen. This year, Google will sell $6.1 billion in ads, nearly double what it sold last year ... That is more advertising than is sold by any newspaper chain, magazine publisher or television network. By next year, Mr. Noto said, he expects Google to have advertising revenue of $9.5 billion. That would place it fourth among American media companies in total ad sales after Viacom, the News Corporation and the Walt Disney Company, but ahead of giants including NBC Universal and Time Warner."

Gosh, so much for that argument of over-valuation ($100 billion market cap), especially when compared to Time Warner et alii. Google/GOOG just keeps on truckin'...

30 October 2005

How To Make a Killing...

"Even if it’s true, which I doubt, that the people who bother to “get the news from poems” die better deaths than, say, their local Cadillac dealers, no one will believe it. Not with poets everywhere hanging themselves, sticking their heads in gas ovens, drinking themselves to death. At this point most people take a miserable death as the mark of the poet."

... You need not even be a fan of poetry to chuckle. Try it, you'll like it!

Turing's Cathedral

"The whole human memory can be, and probably in a short time will be, made accessible to every individual," wrote H. G. Wells in his 1938 prophecy World Brain. "This new all-human cerebrum need not be concentrated in any one single place. It can be reproduced exactly and fully, in Peru, China, Iceland, Central Africa, or wherever else seems to afford an insurance against danger and interruption. It can have at once, the concentration of a craniate animal and the diffused vitality of an amoeba." Wells foresaw not only the distributed intelligence of the World Wide Web, but the inevitability that this intelligence would coalesce, and that power, as well as knowledge, would fall under its domain. "In a universal organization and clarification of knowledge and ideas... in the evocation, that is, of what I have here called a World Brain... in that and in that alone, it is maintained, is there any clear hope of a really Competent Receiver for world affairs... We do not want dictators, we do not want oligarchic parties or class rule, we want a widespread world intelligence conscious of itself."

and

"Hardware-based content-addressable memory is used, on a local scale, in certain dedicated high-speed network routers, but template-based addressing did not catch on widely until Google (and brethren) came along. Google is building a new, content-addressable layer overlying the von Neumann matrix underneath. The details are mysterious but the principle is simple: it's a map. And, as Dutch (and other) merchants learned in the sixteenth century, great wealth can be amassed by Keepers of the Map."

Continue reading here...

28 October 2005

... and calamity begets (portfolio) crisis

And so at last we enter the land of portfolio blowout. "Get me out!" the institutional portfolio managers scream. "Sell at any price, just lose the position!" You can see this transpire in the daily action of the stocks themselves -- if you're watching each tick; if not, it also is apparent in the daily bars on the stock charts. At this moment, I see no respite to continued selling and lower prices. I suppose a Fibonacci retracement of 61.8% is in order, but recall that number is a retracement of a primary move, not a 'haircut' from an arbitrary high (as most technical 'analysts' believe) -- even if that high trade is the all time high.

I created the following list of homebuilder shares during the Spring, as a means to monitor the group and forecast future price action. They are ranked from strongest to weakest performers, especially based on recent performance. (Many others are excluded due to comparative illiquidity, etc.)

Strongest:

Brookfield Homes/BHS, William Lyon/WLS

Strong:

Beazer Homes/BZH, Centex/CTX, KB Home/KBH, Lennar/LEN, MDC/MDC, DMI Homes/MHO, Meritage/MTH, NVR/NVR, Orleans/OHB, Pulte/PHM, Ryland/RYL, Standard Pacific/SPF

Weak:

Comstock/CHCI, DR Horton/DHI, Dominion/DHOM, Hovnanian/HOV, Toll Brothers/TOL

These portfolio blowouts (of a specific group or sector) tend to occur regularly; typically, because a group or sector has become over-owned and over-valued. The rationale for holding -- and continuing to buy anew during June, July, August, and September 2005 -- defaults to the same old thing: "It's different this time." Of course, the purveyors of this 'logic' do not state it exactly that way, but the result is the same. They have become embroiled in attempting to convince themselves, as much as convincing you. They too will sell sooner or later; convinced as they are of the supremacy of their rationale and the higher prices yet to come, their sell orders will occur later rather than sooner.

So watch for a capitulative low that marks the end of this profound down trend; the shares will gap down big (5% or more) on the opening on "bad news", and then reverse intra-day (in fact, very early) and head higher. That early morning low should represent a tradable low for the intermediate term, and possibly the low. It does not mean, however, this group will resume its status as bull market leader any time soon; individual opportunities might shine but the rest of the group will be a market performer, at best. If you, like me, prefer to invest among the leaders, then you will hunt in different savannahs for the big 'game'.

This post likely represents my final entry re this group (homebuilders); little remains to be said. I have only continued this thread for as long as I have (four months!) to illustrate how to discern a final high, sell into it, and then stay away from the group (or short it). Most investors, unable to discern a critical reversal and change in trend (direction), continue to buy the dips, believing higher prices lurk around the bend. I could, of course, write a post during that critical reversal day, if you prefer, when you can buy as all others have finally given up (hope) -- and sell.

This link will take you to an interesting article re this group.

27 October 2005

Trading the market

What to sell, what to sell? Easy answer that -- Apple/AAPL. It looks likely to endure a "trader's break" of ~$5-15/share. In the swap, I sell AAPL for $56.74 and purchase AFL for $46.75, thus reducing net exposure to the market by $10 and selling one trending and acting toppy (AAPL, near term) for one just breaking out (AFL). Of course, I could re-purchase AAPL, especially if the shares do suffer that trader's break.

Bill Gross/PIMCO

"...tighter money and higher yields in the intermediate portion of the curve unfold over 1-2 year cycles and generally in the magnitude of 200 basis points... The current upward cycle is now 27 months in duration and 230 basis points in magnitude, enough by historical standards to slow an economy or even produce a mild recession given increased leverage and the exogenous shock of energy prices..."

Continue reading...

The crash test

"By all appearances, the internet industry is now in the early years of the long boom. The companies that survived the bust (Yahoo, eBay, Amazon, Google et al) should be able to enjoy several decades of above-average growth. Whether they capitalise on this depends on them - being at the right place at the right time with the right assets is a major advantage but doesn't guarantee a thing - and the industry's development will likely be far from smooth. The roughest part of the ride, though, should be over.

"The opportunity, moreover, seems as big or bigger than it did in the late 90s. The growth and profitability of Yahoo, eBay, and Amazon are the envy of most traditional media and retailing companies, and they have achieved their profits with a tiny fraction of the usual invested capital (it costs more to make a movie, print a newspaper, or open a store than to record mouse clicks). Given the dynamic evolution of the industry, all three companies face continual challenges, but the growth of the medium relative to that of traditional communications, media, and commerce channels gives them a leg up.

"And then there is Google, whose development has been so dissimilar to that of the average media and communications company that it belongs in a freak show. A mere seven years old, Google is on track to book about $6bn of revenue this year. More impressively, the company is so profitable that it already generates almost half as much cash as Time Warner, a global media conglomerate with online, cable, film, TV, and magazine divisions and some 85,000 employees (Google has 5,000). And unlike Time Warner and other traditional competitors, Google is still growing at a rate of nearly 100% a year."

Although the snippet above might lead you to believe that the entire article seems focused on Google/GOOG, such is not the case. And, as mentioned, it is worth your time. Continue reading...

25 October 2005

Updating "Perk up"

"Note also that lows A & B are 2/3 of a potential double bottom, which require a trade (preferably, a close) above point C ($56.90) to confirm the pattern; call the breakout as $57 to include PnF analysis."

The $57 level equals $28.50 post-split; the shares traded yesterday as high as $28.25...

[click to enlarge]

[click to enlarge]The trade at $28.50 is the final holdout that transmutes this pattern from possible top to probable bottom. I have argued repeatedly that it (SBUX) is in the process of building a bottom, becoming more vocal (contentious?) the past month, as you know. No matter how long this base requires to complete itself, I see nothing but blue skies ahead.

Watch me change

Check it out, and then tell us what you think of the ad. And if you can explain in layman's terms how it is done, please do!

24 October 2005

Dorsey Wright offers comments

Coach/COH (Textiles / Apparel): The technical attributes of COH remain very strong and the stock continues to make a textbook series of higher highs and higher lows. Most recently, COH has just reversed up to make a higher bottom. The weekly momentum has been negative for 11 weeks; this is an extended period of being negative. Okay to buy COH here with a stop/hedge point at 28, a double bottom. This is also a stock to put on your shopping list of ideas for once the indicators turn back to positive.

EBay/EBAY (Internet): The stock itself meets the criteria that we had laid out in Wednesday’s report. More specifically, EBAY is in an overall uptrend, having held its bullish support line back in April; we have seen higher bottoms since. As well, the stock is a 5 for 5’er, so it obviously has positive relative strength. EBAY has formed a triangle of sorts, setting up the potential for a triple top breakout at 43, while forming good initial support at 39, right at the middle of the ten-week trading band. The upside bullish price objective is 59; and with a stop loss point of 36 initially (a violation of the uptrend line), EBAY sets up as a good risk-reward play. Also, the weekly momentum has just turned back to positive after having been negative for seven weeks. Given this positive technical picture, EBAY is one to consider for your shopping list. Ideally, we would like to see the stock breakout to 43 before buying.

Google/GOOG (Internet): On strong earnings news shares of GOOG ran through previous tops at $320 to complete a shakeout pattern upon a triple top break at 324. The stock continued higher to the top of the 10-week trading band at 336 in fact. Clearly, the trend remains positive and the stock is still a 5 for 5'er, though overbought near-term. Wait for pullbacks to initiate new exposure going forward. Expect initial support at 320.

QUALCOMM/QCOM (Telephone): Shares of QCOM have been acting very well of late, moving to a new high in October and setting up another reversal up that would form a higher bottom and move the stock toward a potential bullish catapult formation. A break at 47 would complete that pattern and overall this is a bright spot within the tech universe. QCOM is a 4 for 5'er and may be bought. Traders may choose to play the reversal up at $45 with a stop loss at $41, which would then be a first downside break.

If you have not already subscribed, please consider doing so. The DW service is worth your time and money.

22 October 2005

Rethinking the Social Responsibility of Business

"The business model that Whole Foods has embraced could represent a new form of capitalism, one that more consciously works for the common good instead of depending solely on the “invisible hand” to generate positive results for society. The “brand” of capitalism is in terrible shape throughout the world, and corporations are widely seen as selfish, greedy, and uncaring.This is both unfortunate and unnecessary, and could be changed..."

Mackey also steals my thunder (and this introduction) by comparing and contrasting the financial record of Cypress Semiconductor and Whole Foods Markets. I would take his argument one step further and suggest everyone take a peek at the 20 year chart of each stock. It seems to me [that] Mackey is on to something.

21 October 2005

Leaders lead; investors invest

This type of action sounds precisely appropriate for what I seek as an investor, as I lack the necessary intestinal fortitude to own and hold weaker-than-the-market investments. Do not misunderstand; if I indicate I invest in something (e.g., Google/GOOG, of which more anon), that means I expect its declines to be comparatively shallow in price and brief in time. You should deem these bases as opportunities to invest. I do. (The past 3 months, and today's opening for GOOG, points to the validity and truth of this statement.) While it seems everyone everywhere caterwauls about the parlous state of the market, many stocks buck the obvious. And if it is obvious, might it be time to consider an alternate perspective?

Another difference between an investor and a trader, especially a trader reliant on incorrect and improper technical analysis, is that the investor invests (buys) whereas the trader looks for moments to sell or even not buy. Okay, okay, this last point is arguable, but I have seen too much and for too long to believe otherwise. You could argue differently (please do!), but the truth of this statement remains like so much effluvia. For example, while I have been screaming for the past two (2) years to perceive Google/GOOG as a Singular Opportunity™ and sui generis, others elsewhere have been exhorting that it is a head & shoulders top, overvalued, and headed down, down, down. Yawn.

My cash position and flexibility to maneuver increased substantially after selling earlier this month the less liquid trading opportunities I had owned. As I warned then (and will suggest many more times), these trades are fine in a rising market but when the market turns tail -- lose them. Do not hold awaiting breakdowns -- they will break down. Instead, reduce to the irreducible, cash and long term investments. This is a good moment to share once again my portfolio investments, including those I watch closely as pending opportunities...

Current investment holdings:

● Apple Computer/AAPL: strong up trend in all periodicities

● Coach/COH: long term up trend, intermediate term base. Left side (decline) of that base now complete.

● Google/GOOG: Today will be an important day. After hours trading yesterday and today's projected opening represent a breakaway gap, and not an exhaustion gap as suggested elsewhere. Moreover, block activity (1 block = 10,000 shares or more) during yesterday's after hours session represents a sea change in perspective: a sudden, fundamental revaluation upwards. This manifests immediately in the share price (and thus the market cap), as institutional investors purchased block after block after block. You do the math. But let's not gloat; plenty of investors, including many readers here, still have yet to invest in this opportunity. They believed then that GOOG would "decline big time from $100/share... er, make that $200... I meant $300." Whatever.

● Pan American Silver/PAAS: A hedge -- but also a losing position. With the $ gathering upside momentum, and the resources stocks (oils, commodities, uraniums, etc) all losing steam, this group quickly loses its luster.

● Starbucks/SBUX: Splits 2 for 1 effective Monday. Despite the contention of many, definitely was not a short. Much higher price yet to come.

● Teva Pharmaceuticals/TEVA: Recall the Daily Graphs relative strength line at only 73 when I recommended the stock ~3 weeks ago? Well, now it is at 87, and climbing fast. Great opportunity.

● Whole Foods Markets/WFMI: Only two weeks ago I was asked whether WFMI was a good short. I said, "No. Why short a leader? In fact, buy leaders and sell (short) losers. Unfortunately, most investors buy losers and short leaders (such as Google)." Go figure.

● Yahoo/YHOO: A massive base in the building. YHOO approaches the paid search market differently than does Google, focusing on content and human editors. Thus, it represents another investment opportunity in this sector. (Thanks, AP!)

Pending:

● Corning/GLW: building intermediate term base

● eBay/EBAY: Is this an intermediate term base or does the market fear for ebay's future in a Google world? We will know soon, as it nears a low risk entry point ($36)

● Genentech/DNA: building intermediate term base

● Hansen/HANS: building intermediate term base

● Qualcomm/QCOM: Building an odd base. Startling lack of volume on up days.

and the previously mentioned (in the post below):

● Dress Barn/DBRN: building intermediate term base

● Joseph Bank/JOSB: Fundamental #s especially intriguing, and building intermediate term base

● Urban Outfitters/URBN: building intermediate term base

In addition to these, add Cheesecake Factory/CAKE and PF Chang's/PFCB as likely bottoms. (Yes, that recent low quite probably is the low for PFCB.)

I could go on and on, listing one excellent opportunity after another. Each shares certain similarities:

● Each qualifies as institutional (the institutions can and do invest),

● Enjoy sufficient liquidity (average daily volume), and

● Each lies somewhere within its intermediate term base.

Which is also the key difference of each: where each currently places within its continuum. How early do you want to buy? Do you prefer (to purchase) the low of the intermediate term base, assuming the risk the decline will continue vs the sharp snapback (ala PFCB)? Do you prefer to purchase in the base, and if so when -- early at an assumedly lower price or later at an assumedly higher price? Do you prefer to purchase as it breaks out from the intermediate term base?

Each particular moment brings with it its own set of risks and rewards. You can do any or all of them; purchase for a fast upside trade as the price trends higher, but risk increases (price = risk) or purchase at the low end of the intermediate term base, thus subject to less immediate reward but also less risk.

While the market dances its minuet, and most investors focus on minutia, leaders lead. Oh, and investors invest. They do not seek reasons why they should not purchase and own Google/GOOG et alii, but instead seek reasons to do so. And are paid handsomely for that decision. I look forward to the opening for Google/GOOG. It promises to be 'fun'... if you're long. If not... oh well.

Questions? Comments?

19 October 2005

Housing still strong

"Housing starts exceeded expectations by 7% last month, as the hurricanes affected only a small part of the huge U.S. economy, and the fundamentals (low taxes, low interest rates, strong income growth, healthy economic growth, demographics) remained favorable.

"As the chart shows, the housing construction sector has been in a bull market since 1991. It indeed appears to be the case that the business cycle is much more benign than it used to be. And despite the fact that the population has grown some 50% over the period represented in this chart, the level of housing starts today is still lower than it was in the early 1970s. No sign yet of any popping of the so-called housing bubble."

18 October 2005

Trawling for opportunity

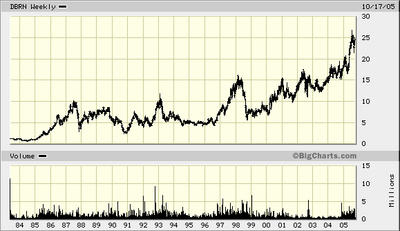

Dress Barn/DBRN is a member of the Retail sector. This particular group is getting pretty oversold with its BP down to 42%. Underneath the surface, the sub-sector Retail Apparel still has its RS chart in X's; DBRN is a member of this sub-group. DBRN itself is in a strong uptrend with excellent RS; this is easily seen by its 5 for 5'er positive technical attribute reading. In fact, both of its RS charts gave buy signals (vs. Market and vs. Peers) just a few months ago, which suggests outperformance by DBRN for the next couple of years. The stock recently reversed up to make a higher bottom at 22, and now has the potential to complete a bullish catapult formation at 27. The upside price objective is 44.50, and the weekly momentum just turned back to positive this week after having been negative for 14 weeks. We also noticed that DBRN shows upward earnings revisions, too. All told, DBRN sets up as a good risk-reward trade here. Ok to buy the stock here (or calls as a stock substitute), and then use 21 as the initial stop/hedge point as that would break a double bottom.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Okay, that's enough to get me going. The very next item I do is check the long term chart; if the shown history is more than 10 years, I consult Big Charts...(See chart below.)

Dress Barn/DBRN required 22 years to rise from ~$1 to $25, so other opportunities have been more dynamic; if however, you prefer dependable long term growth with little grief, DBRN would have been a fine addition to your portfolio. And the fact is, the chart does look good; moreover, I have always liked this sector and group (respectively, retail and specialty retail). The next thing I do is check out the competitors' shares -- do they trade bullish or bearish? As it happens, I am familiar with and especially like Urban Outfitters/URBN, Coach/COH, Joseph Bank/JOSB, etc; each has the appearance of building an intermediate term base.

Next I visit the company's website, and begin my due diligence re the company (not the shares). Assuming it passes muster (it does), I finally check the daily chart...

And now the opportunity begins to look especially tasty. It is building a base, likely 6 months in duration; thus, it is not quite midway through the process. Of course, the base might be of only 3 or 4 months in duration, so I do not drop it from my radar but instead add it to my monitor under budding set-ups.

I seek and would purchase:

1) A second decline toward $22-21 double support -- tested twice previously and the vicinity of the 200-day simple moving average (sma). (Also indicated as support by Dorsey Wright.);

2) A completion of the pattern based on time. This would occur during January/February.

Three caveats:

1) When buying retailers, you worsen the odds because you combine the whims of fashion with the vagaries of Wall Street. (I like those odds!)

2) Dress Barn/DBRN is not the leader of the specialty retailers; at this moment, that is likely Urban Outfitters/URBN.

3) Dress Barn/DBRN lacks liquidity (average daily volume) relative to others in the group, relative to the market, and relative to my (portfolio's) needs.

Thus, while I note the positive pattern abuilding for DBRN, I likely will purchase others as an investment. For example, Coach/COH, which is one of the few specialty retailers not subject to the whims of fashion because what they manufacture and retail is considered by many as timeless. (Arguable, I know.) While I might not invest in Dress Barn/DBRN, I will trade it, however. It weaves a pattern for future trading success!

A side comment about that pattern...

• During an intermediate term rally (trending up in price for 3 months or more), purchase pullbacks in price to the 50-day sma to capture future upside price momentum. When the pattern is an intermediate term base (trending sideways in price for 3 months or more), purchase tests of the 200-day sma.

• During an intermediate term price rally, the share price can approach or tag the 50-day sma many, many times; during an intermediate term base, the price should test the 200-day sma no more than twice.

In the former instance, you trade around the continuing uptrend (trade the trend's momentum). In the latter instance, you accumulate an investment position -- the first time down (test of the 200-day), should precede a bounce-back rally to a test and failure of the 50-day. The second time down is a test of the first test, thus building a double bottom within the intermediate term base. The pattern is near complete at this moment. The base typically is six (6) months because that is the difference in time between the two moving averages; when they converge (the Gordon Squeeze), the smart thing to do is close your eyes, hold your stomach, and buy the stock. (A third decline and test typically has bearish ramifications.)

I should mention this pattern is perhaps my favorite. It affords me the opportunity to invest in a long term winner (the market has already betrayed its proclivity) at a reasonable price, value, and substantially less risk. Other real time examples of this pattern include Corning/GLW, Genentech/DNA, Hansen/HANS, and the previously mentioned Joseph Bank/JOSB and Urban Outfitters/URBN, and many others including Google/GOOG (which is an especially shallow version of this base).

Questions...?

Two articles, worth reading

Some intriguing comments and insights occur in this discussion...

"I'd like to make a distinction between change and progress. A lot of what we've been talking about falls in the category of change, not progress. To use a prosaic example, technology related to golf has improved and will continue to improve dramatically. Golf clubs are way better today than they were 10 years ago, and will be way better 10 years from now. Golf scores, however, have remained absolutely stable. This is an important distinction because historically when we talked about the future, we always talked about the possibilities for progress. Today when we talk about the future, we talk about the possibilities for change, which says that either we have deliberately lowered expectations or we're playing a game where we're pretending what we're talking about is progress when all we're doing is talking about change."

Read it here...

2) I was in the mood for a chuckle or two, when I came across this humorous anti-portfolio update (investments the firm did not make) from Bessemer Venture Partners (a venture capital investment firm). Definitely what the doctor ordered. Of course, I will showcase the comment as to why the firm did not invest in Google:

"Cowan’s college friend rented her garage to Sergey and Larry for their first year. In 1999 and 2000 she tried to introduce Cowan to “these two really smart Stanford students writing a search engine”. Students? A new search engine? In the most important moment ever for Bessemer’s anti-portfolio, Cowan asked her, 'How can I get out of this house without going anywhere near your garage?'"

Continue reading here...

CPI and Federal revenues

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

In the 2005 fiscal year just ended, federal revenues surged 14.6% from the prior year, exceeding forecasts by more than $100 billion. This ranks as the best year for the government's coffers since 1979. Spending rose at a much slower rate, 7.9%, but still faster than nominal GDP, which grew approximately 6%. As a result, the budget deficit fell from $411 billion last year to $317 billion this year, just 2.5% of GDP. A few years ago the deficit was projected to exceed 4% of GDP by this time, but stronger than expected economic growth and surging profits worked wonders to make things better. Many analysts have dismissed the strong revenue numbers this past year, arguing that they were a one-time result of big bonus payments late last year. However, the ongoing strength of revenues suggests there is substantially more activity going on out there than has been generally thought. It's also a great confirmation of the Laffer Curve: in this case, lower tax rates led to stronger growth, which in turn boosted revenue.

The CPI rose 1.2% in September, due mainly to soaring gasoline prices in the wake of the Gulf hurricanes, and is up 4.5% in the past year, the biggest annual rise since 1991. Ex-food and energy, the core CPI rose only 0.1% in September, and is up only 2.0% in the past year. Wholesale gasoline prices have recently fallen below pre-Katrina levels, so energy could subtract from the CPI this month. Still, it is likely that the CPI will finish the year with a rise of 4% or so, which will be substantially higher than the 2% increase in core inflation.

It's worth recalling that the rationale for excluding food and energy from any measure of inflation follows from the observation that those two items are unusually volatile on a month-to-month basis. Core measures of inflation are therefore less volatile than their headline counterparts and over short periods can give a better indication of underlying inflation trends. But to ignore energy after it has risen steadily for the past 3 years is a practice that needs to be called into question, even though the Fed has declared that the core PCE deflator is its preferred measure of inflation. Energy costs have indeed raised the cost of living, and not by an insignificant amount: the headline CPI index has increased 4.5% more than the core CPI in the past three years. There is no assuming this away, unless you are absolutely convinced that energy prices will return to the levels of three years ago, when oil was $30. If oil prices manage to hold at current levels, then the true measure of inflation will be the headline number, not the core number.

This raises another very important issue, since the Fed's focus seems to be on whether higher energy prices are feeding into other prices. The ongoing gap between core and headline inflation, and the fact that core inflation measures are hovering around a relatively low 2% level, would seem to suggest that they are not. Does it therefore follow that the Fed is doing a good job, and that the rise in energy prices simply represents a supply/demand imbalance in one sector of the economy and is not contributing to a rise in the overall price level? Not necessarily. If the Fed were tight, higher energy prices would force other prices to decline. When oil rose from $10 in late 1998 to $30 by late 2000, the headline CPI rose from 1.4% to 3.7% while the core CPI rose from 2.1% to 2.7%. Gold prices fell over that same period, however, and commodity prices were flat to down; real yields were exceptionally high, and the dollar rose against most currencies (meaning that the price of almost everything outside our borders, except oil, was falling). Ignoring energy back then was the right thing to do, because the balance of sensitive inflation indicators suggested that money was tight and higher oil prices were forcing other prices lower. Today, gold is rising, commodities are rising, real yields are low, and the best one can say about the dollar is that it has not fallen in the past year. This all suggests that the Fed is still accommodative and therefore higher energy prices are more likely today to find their way into the rest of the price level than they were a few years ago. Already we see anecdotal evidence of firms finding they have the ability to push through price increases.

There is another important issue these days which relates to how inflation is measured. Instead of using home prices and/or interest costs to measure the cost of housing, the BLS uses Owner's Equivalent Rent, which attempts to guess how much you would be paying in rent for the house that you currently live in. This constitutes 23% of the CPI, and was up only 0.1% in September, and only 2.25% in the past year, in stark contrast to the 14% average rise in housing prices across the country. The gap between home prices and rents has persisted for quite some time, but can be explained rather easily. Low interest rates, favorable tax treatment, and strong gains in income and wealth have fueled very strong demand for home purchases, with tthe result that there is a relative glut of homes for rent and a shortage of homes for sale, and this in turn has kept rents depressed relative to home prices. (Thus, paradoxically, the Fed's efforts to keep interest rates low in recent years have probably contributed to artificially suppress inflation.) (Interesting footnote: David Malpass notes that rising energy costs actually work to reduce owner's equivalent rent according to BLS methodology.) At some point this situation is likely to reverse, and when it does, we are likely to see housing contribute significant upward pressure to the CPI as the gap between rents and home prices narrows (e.g., rents are likely to rise as housing prices flatten or fall). This dynamic could offset most or all of any future decline in energy prices. Incidentally, using home prices rather than rents would have added about 2.5 percentage points to both the core and headline CPI in the past year, and that would put inflation substantially higher than the Fed's comfort zone.

My larger point here is that one's definition of inflation is critical, since two simple assumptions (to exclude food and energy, and to use rents instead of housing prices) can make a world of difference. As a bond market vigilante (one of an apparently vanishing breed, to judge by the 2.6% breakeven spreads on 10-year TIPS), I am loathe to give inflation the benefit of the doubt, especially when the Fed describes its own posture as still "accommodative."

Conclusion:

Inflation is a problem, and it's uncomfortably high.

17 October 2005

The SEARCH

I just completed reading John Battelle's excellent book, THE SEARCH. The book is not solely about Google/GOOG. In its pages, John does a masterful job explaining the history of the search industry, the genesis and IPO of Google, fills in the background of its current crop of competitors, and limns scenarios for possible and potential futures that will leave you gasping for air and quivering with excitement. John also states emphatically and repeatedly that search drives commerce, which is an interesting argument; many people believe the opposite. (The argument being that people know what they desire to buy, and merely search for best price and/or availability; commerce drives search.) I agree with John, perhaps because I am wired similarly or because of the quality of his arguments. This book reads quickly and easily, and might even have you reach for a share purchase ticket... or two. I recommend this book both for purchase and of course to read! (I provide a link to the book's Amazon page in the sidebar to the left.)

John also references Paul Ford's entertaining and enlightening article, August 2009: How Google beat Amazon and Ebay to the Semantic Web. (Yes, it is worth your time to read.)

Last, Google/GOOG reports Q3 earnings this Thursday. Go here for the webcast of the conference call...

Ray Fairfax on market leaders

~~~~~~~~~~~~~~~~~~~~~~~~~~

David,

I've been trying to figure out a way to help you get your message across about market leaders. This note represents my (inadequate) attempt to do so.

This chart represents, since IPO, what I believe to be the market leader of the past several years, Coventry Health Care/CVH.

(Please ignore the rsi indicator on the Bigcharts long term chart. I thought I was getting "strength relative to spx" like on stockcharts.com.)

(Please ignore the rsi indicator on the Bigcharts long term chart. I thought I was getting "strength relative to spx" like on stockcharts.com.)After topping in 1995, this stock takes a long big slide to it's ultimate low in Aug.1998. A runup to June of 1999 sets it up for the test of the bottom in the fall of 1999.

While the general market is in the throes of it's final upward blowoff, this stock has already done so and is declining. As the general market really gets going to the downside in the spring of 2000, this one has already bottomed and is on the way back up, breaking out on the upside cross (50, 200 day moving averages) in mid April 2000.

A several hundred percent run up from October 1999 to December 2000 sets it up for it's long CANSLIM base, culminating in the January 29, 2002 "breakout". Yeah, I know, the pivot point wasn't breached to the upside 'till several weeks later, but the volume spike on 1/29/02, in your words, spoke volumes. This stock appeared in the 1/29/02 "stocks in the news" charts in IBD. The charts therein are generated by Bill's proprietary CANSLIM computer model and often "break the rules" laid out in his book.

If you look carefully at the rest of the trading history of this stock you will see that it has consistently broken out ahead of the general market over the ensuing years, and still leads the way. And the IBD relative strength line has consistently moved to new highs before the stock did on each breakout.

Look at the big break in October 2004 that should have broken this chart but only served to re-set the base count.

To borrow a phrase that you like to use -- clear as mud?

-- Ray Fairfax

14 October 2005

Cri de coeur

I screwed up. I sold my holdings in Apple/AAPL when instead I should have purchased more shares. This is not the first time I have committed this 'error', nor will it be the last. Now, however, I believe I have a fiduciary responsibility, of sorts, because of you, my reading audience. I cannot simply buy and sell quickly and adroitly as I typically do, I believe I have a responsibility to share what I do, as I do it.

In one of my earlier incarnations, I was a 'retail' stockbroker for Merrill Lynch. At the time (and perhaps still), Merrill had the strictest internal compliance of any firm on Wall Street. Among the many rules was this one, "If you buy or sell the same investment as your clients, your order always comes last." I took to heart this message, and have allowed it to guide me in all I do throughout life. This acknowledgement includes my buy and sell recommendations on this blog; I will not front-run.

Among the recommended books in the sidebar, is one that includes an interview with me. (Only one of several.) In this interview, I say something akin to this, "Who you are as an investor and who you are as a person are not mutually exclusive; each bleeds into the other. Especially if a person is successful at one or the other. That is, if you are successful as a person you likely will not be consistently successful as a trader; if you are successful as a trader, you likely will not be successful as a person. You cannot, for example, have an argument with your spouse, and shout, 'I stop you out!' as you can stop out a stock that gives you and your portfolio too much grief..."

Note the denotation of time; if you invest (greater time frame), it is possible to be successful at each, whereas investing as a trader (lesser time frame) tends to make the objectives mutually exclusive. This point is arguable, but I contend in favor of the non-parcellated mind; that one is unable to comparmentalize specific aspects of one's life and be successful in their general application. The one bleeds into another.

As a person, I am a failure. This is not a whine, but a statement of fact; an acknowledgement I came to grips with long ago. It enabled me to focus on my perceived task, to make money. But I also learned (and posit in my profile above), that there is more to life than the pursuit of (more) money, there also is the pursuit of good times with good friends. This is the worthier goal. (Would you rather die leaving behind many friends or much money?) I suppose, in retrospect, that this blog is my obvious and shameless attempt to win friends and influence people by sharing my 'expertise' re investing.

In the post below (Follow the market leader) occurs a conversation. I included already my 2¢ but forgot to mention that when trading the leaders, one hopes to capture the $5, $10, or $50 of the 100s of dollars the stock will ultimately move. Isn't that better (simpler? easier? Tom, I mispoke earlier: investing might be simple but rarely easy.) than isolating and trading for a $5 profit a stock you believe will move only $6? But this trading decision is one we all fall prey to, including me. I attempt to keep it in check by having in place one rule that states I will buy only the leaders, the long term winners.

But how do you know that the stock you just purchased will be among the rara avis, the few that trend higher for 100s of dollars? There are techniques, some that I have shared here, others I have yet to share, and many of which I am unaware. It adds up that among the many, many stocks you buy for your portfolio, you hold a positive outlook for each. You believe each will be among the few that trend higher for 100s of dollars but along the way, you sell many for a measly $5 profit, or $10 profit, or even for a loss. But you continue the quest, and continue to buy and sell, seeking to buy and (to) hold long term the rara avis. I believe Google/GOOG merits inclusion as a market leader, as a long term winner, as sui generis. You might argue this point; the market argues it each trading day.

Okay, so I sold Apple/AAPL. I also repurchased it yesterday, albeit fewer shares than I had owned. The market has me hornswoggled, mis-reading too much, too easily. I also feel bad(ly) that I was unable to mention this re-purchase to you.

But more to the point, rather than re-initiate my complete holding, I instead swallowed whole gulps of Starbucks/SBUX. Its shares are approximately the same price/share, but I assume less risk for the holding because, as I argue, it remains in a base of long term proportions. Assuming as correct that perception, its upside moves will be mute relative to a stock such as Apple/AAPL that is in the throes of its uptrend. Buying Starbucks/SBUX as a long term holding, however, makes it less likely that I will upchuck it in a manner similar to what I did with Apple/AAPL. My concern was the intermediate term uptrend would suddenly expire.

Simple, but never easy. Omelettes and lemonade. Omelettes and lemonade. Ommm...

Thanks for reading this post. I welcome all comments.

13 October 2005

Follow the Market Leader

And yes, I play the role of scofflaw this one time more -- copying & pasting from a subscribers-only website. Follow this link to the source, however, as this magazine, too, is worthy of your attention. And, arguably, your subscription.

Follow the Market Leader:

Identify Market Leaders and Follow Them to the Top

by: Dan Zanger

No access to information that major market players have? OK, but you can make your move by spotting a few characteristics of leaders and acting on them.

Have you ever felt sure that the market was heading in one direction only to get slammed when it turned around and caught you off guard? How many times have you waited for a bounce that never came, causing you to cover your position, then watched the market rally with a vengeance a few days or weeks later?

Who says you can’t time the market? What those who say you cannot time the market are really saying is that they cannot time the market, and they don’t know anybody who can! That does not mean you cannot. One of the best clues is to find a market leader and follow its signals.

Learning the Signals

A great example of a market leader, since it became public back in August 2004, is Google Inc. (GOOG). The stock formed a base in August 2004 for about a month after it became public while the NASDAQ was bottom testing. While the market bottomed in August, GOOG hovered between $95 and $112 for a few days then took off in the first few weeks of September. It ran hard to early November when it hit $200, doubling in just two months. In fact, it led the other Internet stocks and the NASDAQ.

In Figure 1 we see that GOOG bottomed in September and took off. Let’s move ahead to the period between December 2004 and April 2005. The NASDAQ was in a downtrend and dropped 12.5 percent while GOOG barely dropped at all. Nearly 30 trading days before the NASDAQ bottomed in late April, GOOG began to move higher. This showed GOOG’s tremendous relative strength and potential. More importantly, it provided a heads up that the market was in the final stages of the correction and was getting ready to turn up. If there was ever a leader of a market move, it was GOOG – no debate. By taking a cue from GOOG as a leader, you would have been in the market when it took off or reducing positions when the stock started to move horizontally.

Traders’ greatest mistakes are being late to the game and being afraid of the biggest movers in the market. The fast pace of big-moving stocks, like GOOG, often keeps traders frozen in fear, not unlike the fear of either failure or success that prevents many people at low-paying jobs their whole lives from doing what they truly want to do. Those who achieve success in trading often do so thanks to a no-fear attitude and deep-seeded desire for financial success.

(I disagree with the interpretation of this chart as a cup & handle, but that point is immaterial to the greater argument. --dmg)

(I disagree with the interpretation of this chart as a cup & handle, but that point is immaterial to the greater argument. --dmg)Obviously, one of the single best ways to maximize profitability in the market is to have a great deal of money in the biggest-moving stocks at exactly the right time. Not only can the leader show when the market will take off or top; it also will convey a number of other things that are going to happen in the market days before they occur. This is because the “fast money” seems to be in the know about Fed actions and earnings reports of other leading high-beta stocks. The fast money gets in or out of the leaders due to the predictive high-beta movement before the news hits the television or the Internet.

But how do we find the big movers? What are some glaring similarities that all of the leaders share?

A Marriage of Fundamentals and Technicals

Most long-term investors tend to concentrate strictly on corporate and market fundamentals and ignore technical chart analysis. Most short-term traders ignore fundamentals and focus on the charts patterns. But the best traders use both technicals and fundamentals, and the weighting they place on each depends on their average time in the trade.

Because volatility has increased over the last decade while time in the trade has decreased, emphasis has shifted to using technicals — and for good reason. It also has become obvious in the last few years that stocks exhibiting certain chart patterns exhibit strong fundamentals. Often the bullish chart pattern will appear in advance of an earnings report or news release, and traders who know what to look for can use this to great advantage. Our top-ten list of both fundamental and technical characteristics of a market leader and how to use them appears across the bottom of these pages.

SIDEBAR

The Top-Ten List

#1 – Earnings Power

To be a real winner a stock needs earnings power – and plenty of it. Look for companies with earnings up more than 70 percent in the most recent quarter. Also, look for earnings results to have accelerated during the past two to three quarters. This means that earnings are still ramping up on a percentage basis. Most of the big movers have earnings up 150 to 400 percent quarter over quarter. For example, Taser Inc. (TASR) made a more than 5,000-percent move in 2003 and 2004 while earnings and revenue growth exceeded 200 percent or more every quarter for about six quarters. Another big mover that started in April 2003 and had similar earnings growth was Research in Motion (RIMM). See Figure 2.

#2 – Market Domination

Another aspect to look for is a stock in which the company was the dominant leader in its respective field. Qualcomm (QCOM) went from $225 to $800 (pre-split) in just six weeks. Yahoo! (YHOO) went from $80 to $400 (pre-split) in just three months in 1998 before GOOG was on the scene. Others include CMGI (a big mover during the Internet bubble that made a move of more than 6,000 percent in 20 months) and DELL, which went from $50 to $2,000 (pre-splits) over three years. All of these companies dominated their industries. DELL changed the way computer products were marketed, carried a small “just-in-time” inventory, in-home warranty service and the fastest computers of the day. This combination crushed competitors Compact and Gateway, and in so doing, made its shareholders rich. Market domination is the most overlooked aspect of selecting big winners in the market.

#3 – New Stocks, New Markets

The next piece of the puzzle is that all of these stocks were new or relatively new to the market. Also, most of them had new products that were being widely accepted, not only in the U.S., but also in most of the developed and emerging markets. Companies like GOOG are known and its products used around the globe – as are YHOO and RIMM.

#4 – Use Market Direction. Don’t Fight It

Most traders know that 60 to 70 percent of a stock’s move is determined by the overall direction of the market. But what is the best way to gauge which way the market is heading? Is there a better way than examining advancers minus decliners, waiting for an index trend-line break, or moving average crossover? Yes, and that is following the leader of the market. All that being said, however, even a strong stock will be fighting an uphill battle in a bear market. Look for strong stocks in a bull market – and laggards to short in a bear.

#5 – Little Known and Under Owned

The total number of shares that the public can buy is known as the float. Stocks that have a limited number of shares in the pubic float (less than 100 million shares) can experience explosive upside movements once they are discovered due to the small share supply. Taser (TASR) is good example of this. It started out with a float of just three million shares and now has a float of 57.2 million due to numerous stock splits. The stock price went ballistic in the process. There should be no more than 100 million shares in the float and the lower the better. Ideally, the goal is to find stocks that institutions are beginning to accumulate. This includes those with a higher degree of corporate executive insider ownership.

#6 – Patterns Tell the Real Story

This is where the fundamentals and technicals complement one another. Chart patterns will tell the trader that the stock is walking the fundamental walk and the market is recognizing this. You want to see the stock show good price action such as holding support and breaking resistance on increasing volume. Some of the best indicative patterns include bullish flag and pennant continuation patterns and cup-and-handle continuation patterns that show consolidation (see Figure 2). Remember bullish patterns are an indication of institutional accumulation.

#7 –Volume Holds the Key

Volume is the true indication, for those who know how to read it, of what market players are doing. During extended periods of consolidation, patterns like saucer and cup and handles are good indications that a move is imminent. But patterns by themselves are not much help unless there is volume support. Are traders buying dips or selling rallies? The first is bullish and is recognized by volume spikes following weakness or after a prolonged down move. The second is bearish, especially if volume builds after an extended up move, and means that either shorts are capitulating and covering or that Johnny-come-latelies are jumping on board. If volume increases as the stock drops, it means that the smart money is using rallies to unload and the shorts are borrowing to sell the stock short. When this happens, the ride usually is over. Bullish continuation patterns should show volume dropping as the pattern forms with volume spikes on the breakout. If there is no spike, the breakout is suspect.

#8 – Let the Leaders Tell You When to Go Long and When to Go Short

Never marry a stock (or the market). There are times to buy and times to sell, and market leaders provide advance warning that a reversal may be imminent. If the leaders begin to break down even in the face of good fundamentals, the market is probably not far behind. Once the market has turned, even a leader cannot fight the gravitational pull for long. No point in trying to trade or invest counter to the primary trend. When the market is going up, leaders will keep you in the trend, and when the market reverses and heads down, they’ll tell you when to sell and when it’s time to look for laggards to short.

#9 – Bullish Continuation Patterns

In a true bull rally, you should see a number of bullish flag and pennant patterns as well as gaps that generally aren’t filled for a while. It often appears as a stair-step-like pattern on the chart. When the breakouts happen on less volume than the prior breakout or gaps begin to get filled, the move is running out of gas. Sentiment also can be helpful. In a rally, stocks discount bad news. In a bear situation, they discount or ignore good news. Bad news, good action = bull. Good news, bad action = bear.

#10 – Other Considerations

Watching chart patterns and volume are two of the most powerful tools in picking market leaders. Other tools can be helpful, too. Technical tools such as trendlines, moving averages, the McClellan Oscillator, seasonal cycles and time cycles are examples. Look at the daily chart over a nine- to twelve-month period. Are there rhythmic dips and seasonal patterns? Resource and commodity stocks often exhibit distinct seasonal patterns based on growth and market cycles. Another important consideration is price. Cheap stocks rarely lead. Best to wait until they are more than $50 and become interesting to institutions.

------------------------------------------

Melding the Pieces

Each trader has his or her own criteria for picking a winning stock. But instead of just looking for stocks to buy or to sell, true leaders also can be used as a market proxy and provide a good indication of future market movement. Leaders that hold their ground when the market appears to weaken signal that the rally still is in play. When the market gets going again, the leaders will take off. Give yourself the proper time to understand fully the process before investing real money. Before trying any new methods, always paper trade it until you feel comfortable. Once you have mastered the art of identifying and playing the market leaders, you will be amazed at what can be done. No longer will you have to suffer the pains of trying to follow the pack and be a late to the party. And no longer will you have to suffer sub-par returns with sub-par stocks. Learning to identify market leaders is a no easy task, but efforts in that direction will be well rewarded. With your newfound skills, you will be the one to follow!

11 October 2005

The Blackboard of His Eyelid

It seems like forever ago, but it has been only hours that I wrote about metaphors and closing the loop. Only poets and husbands (well, the dastardly type at least) get away with not closing the loops. This poem includes metaphors aplenty and closes nary a one; doing so is left to you and your imagination...

David

From FUGUE

by Michael Bassett

If he had Becky Wilson here,

he'd make her confess that she had lied

about how his parents make him drink

from the toilet and sleep

in a rabbit cage. A pale and skinny

clump of literature, always out past

the curfew of acceptance, behind

enemy lines of imagination, he plays

torturer of the inquisition,

brandishing the garden shears.

On the playground, while he practices

impossible contortions

of introspection, they bloody his nose,

hating the secrets hidden

in the scriptorium of his oddness.

They crack his sharp ribs, desperate

for the futures he reads

on the blackboard of his eyelid.

They shake from his green satchel

two dung beetles, most of a Mabel

Garden Spider, a scab from his skinned

knee, a sliver of bailing wire,

a cat's eye marble, and a quart

of Quick Start lighter fluid.

He's a Chihuahua-eyed chicken boy

with hundreds of freckles

his mother swears are seeds

from the pumpkin they carved

him out of. But he knows where

babies come from. He knows the darkness

of the closet, where he listens

to his mother's crying. He learns, under

the henhouse, the weasel's way.

He can't stop thinking about apricots

shriveling, paint belching, tiny frogs

dripping above matches. Outside

his secret fort, yellowing

sycamore leaves crackle.

What was I thinking?

Note the reversal days (red bars in chart above): the stock opened on or near the daily high and closed on or near the daily low. Moreover, the weakness the past week (since the all time high) took the stock to a low beneath that of 28 September ($50.59). This is a technical no-no for an up-trend in simple peak & trough analysis, and serves to:

Note the reversal days (red bars in chart above): the stock opened on or near the daily high and closed on or near the daily low. Moreover, the weakness the past week (since the all time high) took the stock to a low beneath that of 28 September ($50.59). This is a technical no-no for an up-trend in simple peak & trough analysis, and serves to:

1) Create a pattern of lower highs and now lower lows;

2) Flatten the chart to (at best) a base from an uptrend;

3) Round off a top. The chart has the appearance of concavity (bearish in a rising trend) rather than convexity (bullish in a rising trend).

The best thing that could happen (post-opening tomorrow) would be a rally back to $48-50 based in part on tomorrow's 'surprise' corporate announcement and that the shares have been straight down since the all time high, setting up tomorrow's opening lows as the moment of "obscene weakness" (following a period of "extreme weakness"). My hopes for this rally back are not too high, however, as the pattern now is broken. Where it now trades (~$46) is just above the first level of support (~$45), then the rising 200-day sma ($41.30). Ouch, this hurt hurts.

Kindness

"An old and wise friend gave me some sage advice recently, “Be kind,” he said, “everyone you meet is fighting a battle.” Life is a battlefield, although for some of us including yours truly, it seems that fate has chosen marshmallows or water balloons instead of hand grenades and M-16s as the weapons of destruction. Still we all suffer. Coming into this world must have been no treat, going out most definitely won’t be, and everything in between - well, the “eat, drink, and be merry” of Omar Khayyam is often overwhelmed by the pain of loss, personal debilitation, or simply the overwhelming deluge of circumstance. It’s under these conditions, as my friendly advice-giver would agree, that kindness is the temporary salve that heals. My wife Sue is the kindest person I have ever known; not because of publicized acts of generosity of which there have been some, but because of everyday acts of kindness, of which there have been multitudes. There are hundreds and hundreds of people who would choose to be one of her best friends if the time were available - some on the A-list, but most of them category B’s and C’s - waiters, repairmen, average people with greater than average battles being fought behind sometimes cheerful facades. Sue brings music to their quiet desperation.

"I have observed through her that being kind involves sacrificing the inward/personal moment for an outward reaching smile. It includes a heartfelt, not conversationally correct, “how are you” with more listening than talking. And it can involve, given enough hours in the day, a follow-up good deed or a simple reminder of empathy and caring. Kindness comes in other forms too. Jonas Salk was very kind, as are doctors, teachers, or any working person whose outward reach often exceeds personal gain. Lovingly raising a family is an act of kindness. People that write checks for Katrina or African relief are kind as well. I guess when you get down to it, kindness comes in many shapes, but the important thing is that it keeps coming. We’re all fighting a battle whether it be in New Orleans, Darfur, or Newport Beach, California."

Bill continues with his thoughts re the FRB, bonds and interest rates, and the current state of the housing market. Click here to read the remainder...

10 October 2005

A perspective of a different type

This first photo (below) was captured while playing with depth-of-field...

This pumpkin (below) is one example of the chefs' labors...

I really like this photo (below). It sometimes seems you cannot go anywhere without seeing these 'mimes', but this time amid all the surrounding motion -- people strolling by, the wind howling through the palm trees -- is this fellow (jeans and flowered shirt) who unintentionally mimics the mime's motionlessness while studying him.

This final photo (below) was fortuitous. Amid all the colors, are this mother and her beautiful daughter. Based solely on her beauty and expressive features, I think this little girl has a big future as an actor.

Three Questions That Count

"Question two: Can you fathom the unfathomable? If you have the right instinct for turning market statistics into buy-and-sell signals, you seek correlations first, then causal relationships that would explain them."

Read the complete article. (Please feel no compulsion to pay heed to Ken's specific investment recommendations.)

08 October 2005

Jobs and Oil

Jobs:

"According to the establishment survey, jobs fell by 35,000 last month instead of the expected 150,000. According to the household survey, however, jobs rose by 116,000. As the chart shows, and if we assume that the household survey is better at picking up changing trends than the establishment survey, jobs growth was accelerating in the months leading up to the Katrina disaster, and that explains why today's numbers were better than expected. Over the past year, the household survey has reflected jobs growth averaging about 250,000 per month, or 2.2% per year, whereas the establishment survey was showing growth of about 200,000 per month, or 1.7% per year.

"On balance, then, it seems that the economy was on more solid ground than many thought, and should therefore be able to absorb the Katrina damage without too much difficulty."

Oil:

"In order to produce a unit of output, the U.S. economy today requires about one-half as much oil as it did in 1970.

"The U.S. economy's oil efficiency, measured in terms of oil consumed per unit of output, has improved at the rate of about 2% per year since 1970. In other words, oil consumption per unit of output has fallen by about 2% per year. Oil efficiency rose about 3.5% per year from 1979 to 1989, a period during which real oil prices were historically high. Since 1990, oil efficiency has increased at about 1.5% per year, a period during which real oil prices have been on average much lower than they were in the early 1980s.

"High real oil prices, such as we saw in the late 1970s and early 1980s, were the likely cause of rapid gains in oil efficiency in the 1980s.

"The real price of oil today is at approximately the same level as it was in 1979, but the economy requires about 45% less oil today to produce a unit of output. Adjusting for the economy's oil dependence, we might say that real oil prices today are about half of what they were in 1979-80. The economy grew very strongly (4.8% per year) in the 1982-1986 period, despite oil prices that in "adjusted" terms were higher than they are today.

"Significant changes in oil prices are a good leading indicator of drilling activity. Since oil prices started rising in 1999, the North American rig count has roughly tripled. The U.S. rig count has doubled since early 2002. It takes several years at least for increased drilling activity to result in higher production.

"High oil prices do not suck money out of the U.S. economy. Oil producers cannot spend their "windfall" revenues as fast as oil prices are rising. Thus, most of the extra spending in the U.S. on oil is simply recycled by oil producers back into the U.S. financial markets. In a sense, rising gasoline prices make it easier for homeowners to refinance their mortgages.

What this suggests:

"Adjusting for inflation and the economy's oil dependence, oil prices are high, but not exceedingly so in an historical context. Current oil prices are not by themselves likely to put a serious dent in the economy's ability to grow. Indeed, high oil prices are better thought of as a barometer of how strong the economy is. Still, today's oil prices are probably high enough to result in increased conservation and substitution efforts on the margin, resulting in a softening of U.S. demand for oil in the years to come. This is probably true for most industrialized economies. Chinese demand for oil, however, is likely to continue to be very strong, even though their energy efficiency is much lower than ours and could improve significantly in the years to come. If China's oil efficiency were to improve to current U.S. levels, and its economy were to grow by 10% per year, Chinese demand for oil in 20 years would still more than triple, to eclipse current oil consumption in the U.S.

"Increased exploration activity is likely to result in substantial increases in oil supplies in the years to come. Whether and when this will exceed the world's increased demand for oil, thus bringing prices down, is the $64,000 question.

"Since the Federal Reserve is still somewhat accommodative (per their own admission and judging by the relatively weak dollar, rising gold prices, rising commodity prices, rising real estate prices and low real yields), oil prices today likely contain some "inflation component" in the sense that the demand for oil is being boosted by the desire of producers and consumers to hold higher-than-normal inventories of oil. At the same time, accommodative money policy means that it is relatively easy for businesses to "pass on" higher energy costs to consumers.

"For the next year or so, oil prices could remain at current levels without causing significant harm to the U.S. or global economy. However, higher oil prices are likely to find their way into core measures of inflation, with the result that U.S. interest rates are likely to be higher at some point than the market is currently estimating."

07 October 2005

The Good Doctor

The Good Doctor is Damon Galgut’s fifth novel, a finalist for the Booker Prize and Winner of the Commonwealth Writer’s Prize for the region of Africa. The novel, which offers a pessimistic view of modern South Africa, centers on a hospital, built by the apartheid government in one of its former homelands. With political change in Pretoria, the homeland has disintegrated, and the hospital no longer has a reason for existing.

The story is narrated by a disillusioned Dr Frank Eloff, whose main ambition is to succeed his black female boss, when she is promoted. Her public viewpoint reflects the new South Africa of change and innovation, but privately she takes no action on her own initiative, and moreover is a very poor surgeon. Into this situation comes Dr Laurence Waters, an idealistic young graduate, who has chosen to spend his required year of community service at the most remote hospital he can find. Not unnaturally, being the only two whites at the hospital, they are forced to share a room.

Waters is the antithesis of Eloff. He is enthusiastic and has an ability to believe, and a desire to participate, in the “new” South Africa. Eloff, who grew up in, and who served in the military of, the “old” South Africa, is unable to embrace this viewpoint as he is far too cynical, and is aware of the hypocrisy that permeates this ideal.

The interplay between the two doctors is where Galgut is at his best. Often, what is left unsaid is as important as what is said. Eloff’s character is well developed, and portrays a Southern Africa that I grew up in. One particularly telling image is of Eloff having an affair with a black woman, with him only knowing her anglicized name. Waters character is not as strong, but it appeals on a humanitarian level.

Any novel dealing with this subject matter is bound to be compared to J.M. Coetzee’s Booker Prize winning novel, Disgrace. Disgrace is a more in-your-face novel, delivering its message up front. Coetzee shocks you. Galgut uses a different style, far more muted and fluid. Coetzee’s style could be described as more like a portrait, in that you concentrate on the core theme, while Galgut’s is more like a landscape, where it is important to take in the entire picture.

One style is not necessarily better than the other, and for anyone interested in Southern Africa, reading both will provide a better understanding of the country, and some of its people.