From "and so it goes" ... to "and so it ends."

Yes, I perceive this phase of the market decline (in place since May) is probably complete, and the entire decline (bear market, whatever) that began approximately 9 months ago, in October 2007, is possibly complete. Readers of this blog have their buy lists ready, and recognize specific investment opportunities actionable in his or her time frame.

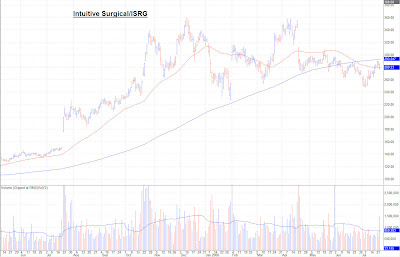

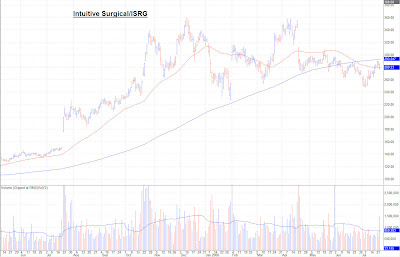

I note happily that Intuitive Surgical/ISRG, one of my Core Opportunities, and the stock so many investors chose to be bearish on at prices lower than yesterday's close, is set to open higher, much higher. I mention this reality not as an I told you so, but as an opportunity for us each to study and learn from errors of perception. Investors who perceived the bearish future, Jim Cramer included (who recommended his epigones sell ISRG in mid-March at ~$275 and purchase Hologic/HOLX at ~$30 -- yikes!) and the very few investors who recognized the bullish pattern, the truth.

[click on image to enlarge]

Deutsche Bank notes ISRG reported very solid second quarter results, with better-than-expected da Vinci placements and utilization drivingupside to estimates. Growth remains robust across surgical specialties, with GYN the star performer in the quarter. As supported by higher guidance and their surgeon due diligence, Deutsche believes the outlook for Intuitive remains attractive. Accordingly, they reiterate their Buy rating and have nudged up their tgt to $365 from $360.

Merriman notes ISRG posted modest upside to revenue estimates and strong gross margins drove EPS nicely above published estimates. While management raised revenue guidance for all contributing line items, it also noted that dVH and dVP growth guidance remains unchanged, and that the upside to procedure growth stems largely from new indications. The firm continues to feel that the current environment may delay purchasing decisions; therefore, they maintain their Neutral rating.

Leerink Swann says ISRG's excellent 2Q08 results are particularly encouraging in the context of recent investor concerns over possibly tighter credit and decelerating hospital capital equipment spend. Driven by a still-expanding installed base and rapidly-growing new procedures, ISRG's 2008 procedure growth outlook has moved higher and the overall growth outlook remains exceptionally strong. They continue to recommend ISRG.

(Thank you to Briefing.com for these research notes.)

Markets, in and of themselves, do not manifest as risk, but are all about the transference of risk; the result of your assumption of risk and embrace of uncertainty is a greater return, not increased risk. Of course, that reality occurs only if the investor can perceive correctly the opportunity, and then apply correctly the principles of sound investing. Which, I admit sadly, most investors simply cannot do... and display zero interest to improve.

Full Disclosure: Long Intuitive Surgical/ISRG.

-- David M Gordon / The DeipnosophistLabels: Chart analysis, Company analyses, Humanities, Lessons, Market analyses