CapEx slowing + Year end peace and tranquility

CapEx slowing...

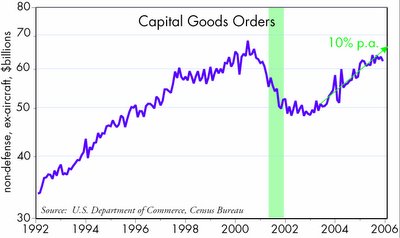

Durable goods orders rose 4.4% in November, and were up 12% over the previous year. Capital goods orders rose 14% in November alone, and were up a very robust 27% in the past year. But most of the strength in these numbers came from aircraft orders. As the chart shows, after subtracting orders for aircraft and defense, capital goods orders have really slowed down, rising only 1% year to date through November after growing at a 10% pace for the past several years.

Outside of the aircraft industry, business "animal spirits" seem to have cooled. This is the first palpable sign since 2000 that the economy may be slowing down. This series is quite volatile, however, and dismissing the massive strength in the aircraft industry may exaggerate the degree to which the economy has actually slowed. But nevertheless it bears watching. I have thought that double-digit growth in this indicator was a key reason to be bullish on the economy over the past few years, so now, on the margin, the bullish case is harder to defend.

Year end peace and tranquility

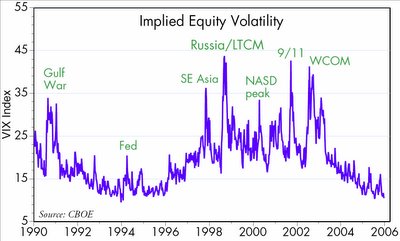

As the first chart shows, the volatility implied in equity options doesn't get much lower than it is today.

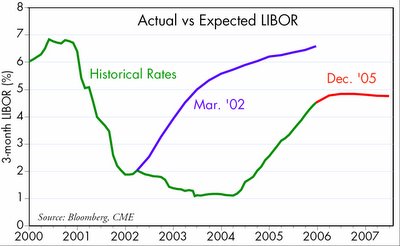

The bond market is pretty calm as well, with 10-year Treasury yields trading in a flat range for almost two and a half years, something that hasn't happened since the early 1960s. As the second chart shows, the bond market is fairly confident that we are only 50 bps away from the end of the Fed's current tightening cycle.

Only in the third chart do we see that things aren't totally ideal, since credit spreads are somewhat higher than their all-time lows reached in 1997.

But as the fourth chart shows, emerging market spreads are currently at all-time lows, and by a significant margin.

Overall, it probably doesn't get much better than this. There are few if any signs of above-average systemic risk, and few signs that the market is concerned about unforseen events.

In addition to all the benign signals from key financial market indicators, we have the lowest taxes on capital in our lifetimes. Corporate profit margins are at or near all-time highs. Household net worth is $51 trillion, up over 20% from the levels of five years ago. Inflation is generally low, inflation expectations are low, and the economy has been growing at an above-average and relatively stable pace for the past 30 months. The unemployment rate, at 5%, has rarely been lower. There hasn't been a terrorist attack on our shores in over four years. If it weren't for the problems at GM and Ford, and the fact that gold is over $500/oz., you could call this financial and economic nirvana.

One big problem these days is that the rewards to taking on risk in the bond market have rarely been so low. There may well be some further upside to bonds, but the downside risks have become potentially huge. Gold's rise in recent years suggests that monetary policy continues to be somewhat accommodative, and this could show up in the years to come in the form of a continued, albeit modest rise in core inflation. That in turn would most likely result in a funds rate higher than the market is currently expecting, and that is something to worry about, even though it is not likely an imminent threat, but rather one that could develop as 2006 unfolds.

Bottom line: things look pretty good right now, but we can't let down our guard.

<< Home