Commodity update - prices still rising

-- David M Gordon / The Deipnosophist

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

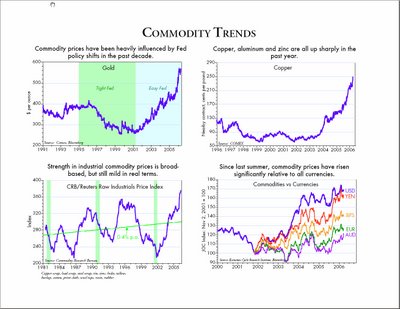

When the great majority of commodity prices moves in one direction or another, you have to suspect some underlying causal factor such as cyclical forces or monetary forces. From my perspective, monetary forces have been dominant for most of the past decade. Tight Fed policy pushed most commodity prices lower in the late 1990s, despite impressive growth in the U.S. and most global economies. Commodity prices began to rally in late 2001/early 2002 despite relatively sluggish global growth conditions, thanks largely to easy Fed policy. Today, money is no longer easy, but neither is it particularly tight: the real Fed funds rate today is close to its 2.3% average since 1960. With the notable exceptions of agricultural commodities and textiles, most commodity prices today continue to rise, with spectacular gains in copper, zinc and aluminum prices. The bottom right chart (below) suggests that recent commodity price gains have been driven mostly by rising demand/global growth, rather than by Fed policy, since commodity prices have increased significantly relative to all currencies since last summer.

In this context, $65 oil and $2.50 copper aren't burdens on the economy, they are a measure of just how healthy the economy is. These days, commodity prices are best seen as barometers of economic health. By that measure the global economy is doing very well. Today's FOMC announcement worried that "possible increases in resource utilization, in combination with elevated prices of energy and other commodities, have the potential to add to inflation pressures." If the Fed were to decide that it needs to tighten policy in order to slow the economy and avoid "overheating," the current strength of commodity prices suggests that they would be facing an uphill battle. That would present a serious challenge to the fixed-income market, which has adopted a strong consensus that the Fed will tighten only one, or possibly two more times, to 5 or 5.25%.

<< Home