Federal finances still healthy

The following analysis is by Scott Grannis, Chief Economist at Western Asset Management.

-- David M Gordon/The Deipnosophist

~~~~~~~~~~~~~~

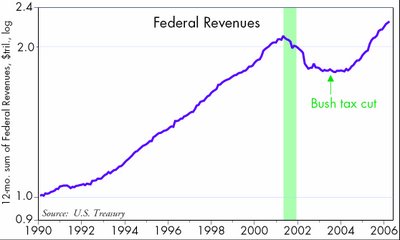

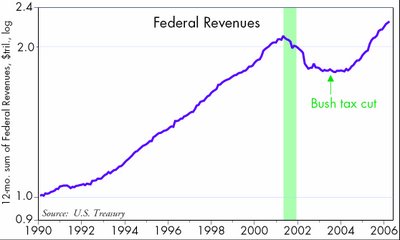

One of the most bullish indicators of the economy's health, federal tax revenues, continued to expand at a 14% annual pace in March.

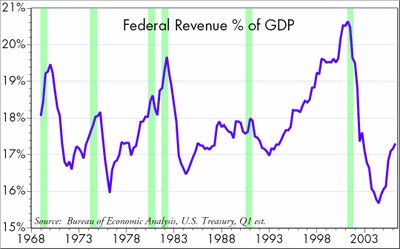

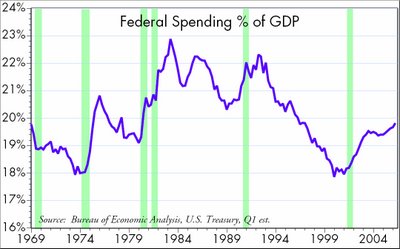

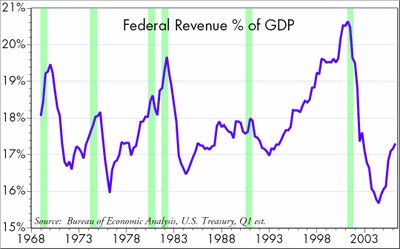

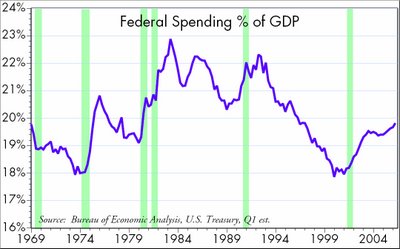

In real terms, this is the fastest pace of growth that we have seen in many decades. It reflects very strong growth in corporate profits, personal incomes, and capital gains. It is not subject to distortion, revision, or bias, as it represents cold hard cash flowing into Treasury coffers. Tax burdens (taxes divided by GDP) have recovered from very low levels as a result, and are now almost at their average level for the past 40 years. Government spending, meanwhile, has been growing at a 7-8% pace, lifting spending relative to GDP also back to average levels. Bush hasn't vetoed any spending bills yet, but he can't be accused of expanding government with reckless abandon, at least in an historical context. The budget deficit is a relatively modest 2.5% of GDP, down from 3.7% two years ago (and down sharply from where it was projected to be), and net federal debt held by the public has been just under 40% of GDP for the past 5 years or so.

It's hard to get exercised about numbers like these.

-- David M Gordon/The Deipnosophist

~~~~~~~~~~~~~~

One of the most bullish indicators of the economy's health, federal tax revenues, continued to expand at a 14% annual pace in March.

In real terms, this is the fastest pace of growth that we have seen in many decades. It reflects very strong growth in corporate profits, personal incomes, and capital gains. It is not subject to distortion, revision, or bias, as it represents cold hard cash flowing into Treasury coffers. Tax burdens (taxes divided by GDP) have recovered from very low levels as a result, and are now almost at their average level for the past 40 years. Government spending, meanwhile, has been growing at a 7-8% pace, lifting spending relative to GDP also back to average levels. Bush hasn't vetoed any spending bills yet, but he can't be accused of expanding government with reckless abandon, at least in an historical context. The budget deficit is a relatively modest 2.5% of GDP, down from 3.7% two years ago (and down sharply from where it was projected to be), and net federal debt held by the public has been just under 40% of GDP for the past 5 years or so.

It's hard to get exercised about numbers like these.

[click on images to enlarge]

<< Home