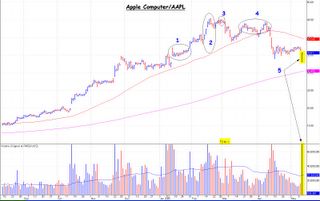

Apple Computer/AAPL

I said that based on its then-current setup (see area 1 in the chart above), one of two scenarios would unfold:

1) It would break down first, and then build a new intermediate term base in the mid- to upper-20s, or

2) It would continue to rise but unsustainably so, and soon thereafter would fail. This failure could prove to be either

a) another intermediate term base, or

b) a shelf before a more serious decline ensued.

Having taken the time to study the chart, I repeatedly issued warnings here (see archives, and areas 2, 3, and 4 above) based on the characteristics of those individual setups. It turns out that, in the end, #2 was AAPL's future.

Today's high volume reversal, however, augurs that scenario 2a will prevail. The low failed to achieve what I long ago perceived as the low of the base or shelf, ~$30. This failure to meet an objective, in addition to the nature of the reversal itself, has me kindly disposed to the shares as a new long side opportunity. However, I think sufficiently little of Apple/AAPL that it qualifies - for me - more as a trade than investment.

I do not recommend AAPL right here and right now at today's closing price - today's low area likely will be tested tomorrow, etc - so much as suggest you add it to your monitor as a bourgeoning upside opportunity. This pattern has more work to do and time to pass before it completes itself; especially now, in its new likely sideways trend, as it transitions from downside to upside. Of course, your perception of opportunities differs from mine. AAPL's high beta (volatility) equals to opportunities for all time frames, long or short -- for the nonce, at least.

<< Home