yohaku-no-bi

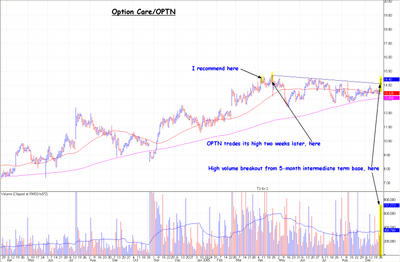

OPTN shares hit their high precisely two weeks later ("Way to go, David!"), and then proceeded to retreat into another intermediate term base. That base, however, ended today -- and with an exclamation mark.

Note on the weekly basis chart (below), OPTN shares build one base after another, and each on top of the one immediately prior. Also, each base lessens in duration.

Note on the weekly basis chart (below), OPTN shares build one base after another, and each on top of the one immediately prior. Also, each base lessens in duration.

For these and other reasons, this opportunity, for as far as it already has come, is far from completing its long term bullish move. Hmm, let me re-phrase that last statement: Option Care/OPTN has farther to rise in price but should require less time to achieve that objective. That is, there will be increasingly more bullish and fewer bearish days, and that the bases will continue to lessen in elapsed time -- all, until the final high. That reversal, when it occurs, should be exceedingly obvious.

I am still long those purchases from April 2005, and adding more yesterday and the immediate future.

On a different topic, general market action being what it (always) is, its recent action and direction tends to confuse many investors. I note a preponderance of bullish bases in individual stocks, despite the market's bearish tone and configuration. The leaders (Apple/AAPL, Altria/MO, Cameco/CCJ, Google/GOOG, et alii) already have spoken (up in trajectory), and as other stocks emerge from their base (such opportunities previously limned as Option Care/OPTN, Pan American Silver/PAAS, Telewest/TLWT, etc), the market broadens and deepens its strength. These breakouts and other lingering bases gather strength in the face of the "obvious" market weakness. Always do the hard thing. The choice is yours: make money investing in specific stocks or predict general market action. (Yes, I know I begin to sound like a broken record, but alas it seems this message still has yet to sink in.)

<< Home