Capex still strong, weekly claims also reflect strength

The following comments are from Scott Grannis, Chief Economist at Western Asset Management...

Strong gains in capital goods orders in December plus upward revisions to November numbers put capex growth back on its 10% annual growth track. Things were beginning to look soft a month ago, but now these concerns have been put to rest. The broader category of durable goods orders also continues strong, up 12.7% in the past year.

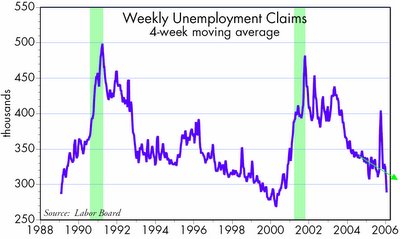

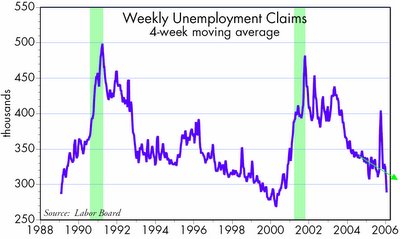

Weekly unemployment claims have fallen at a pretty impressive rate in recent months, now that the Katrina disruption is clearly in the past. The labor market is now looking almost as 'tight' as it was in 1999-2000, when the economy was booming and the Fed was desperate to slow it down.

Weekly unemployment claims have fallen at a pretty impressive rate in recent months, now that the Katrina disruption is clearly in the past. The labor market is now looking almost as 'tight' as it was in 1999-2000, when the economy was booming and the Fed was desperate to slow it down.

Strong profits, surging government tax revenues, strong investment spending, a healthy labor market, low tax burdens -- it doesn't get much better. This economy is not about to slow down in any meaningful fashion, even if it does increasingly look like the housing market has peaked, and even though the yield curve is flat (and slightly inverted out to 5 years).

Strong profits, surging government tax revenues, strong investment spending, a healthy labor market, low tax burdens -- it doesn't get much better. This economy is not about to slow down in any meaningful fashion, even if it does increasingly look like the housing market has peaked, and even though the yield curve is flat (and slightly inverted out to 5 years).

Strong gains in capital goods orders in December plus upward revisions to November numbers put capex growth back on its 10% annual growth track. Things were beginning to look soft a month ago, but now these concerns have been put to rest. The broader category of durable goods orders also continues strong, up 12.7% in the past year.

Weekly unemployment claims have fallen at a pretty impressive rate in recent months, now that the Katrina disruption is clearly in the past. The labor market is now looking almost as 'tight' as it was in 1999-2000, when the economy was booming and the Fed was desperate to slow it down.

Weekly unemployment claims have fallen at a pretty impressive rate in recent months, now that the Katrina disruption is clearly in the past. The labor market is now looking almost as 'tight' as it was in 1999-2000, when the economy was booming and the Fed was desperate to slow it down. Strong profits, surging government tax revenues, strong investment spending, a healthy labor market, low tax burdens -- it doesn't get much better. This economy is not about to slow down in any meaningful fashion, even if it does increasingly look like the housing market has peaked, and even though the yield curve is flat (and slightly inverted out to 5 years).

Strong profits, surging government tax revenues, strong investment spending, a healthy labor market, low tax burdens -- it doesn't get much better. This economy is not about to slow down in any meaningful fashion, even if it does increasingly look like the housing market has peaked, and even though the yield curve is flat (and slightly inverted out to 5 years).

<< Home