Commodities update: still rising + Mixed news yesterday: housing softer, claims lower

The following comments are from Scott Grannis, Chief Economist at Western Asset Management...

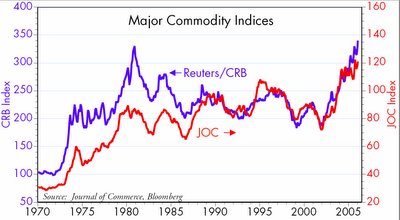

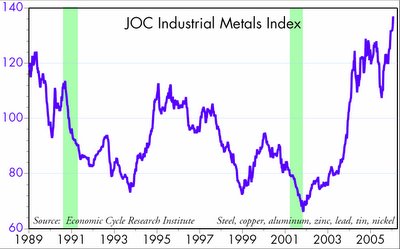

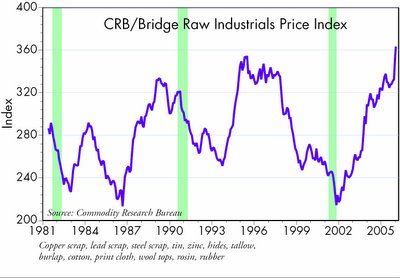

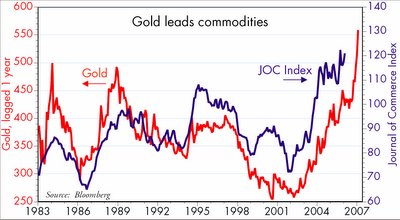

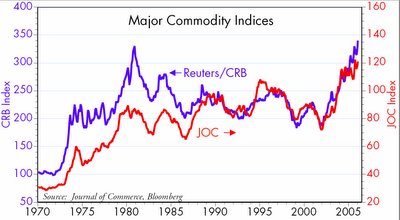

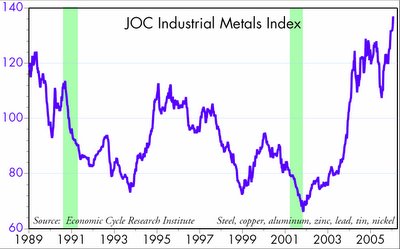

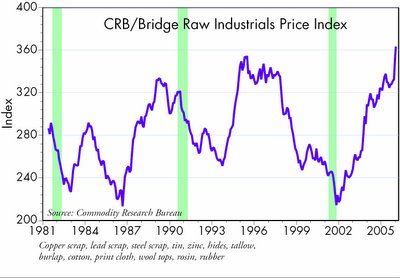

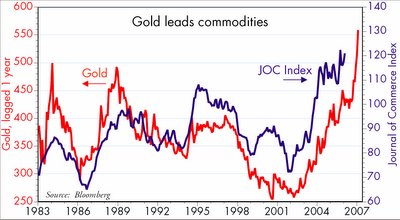

Oil is back up to $67, just shy of its $70 peak last August. Wholesale gasoline prices are up 25% from their November lows. At $9, natural gas is way down from its $15 peak last month, but remains 50% higher than a year ago. More importantly, perhaps, non-energy industrial commodity prices are at or near all-time highs. Gold typically leads other commodity prices by about one year, so gold's 33% jump since last summer to $560 suggests that the commodity rally is not yet over. All of this suggests that money is not tight (and is possibly still easy) and/or the global economy is very strong.

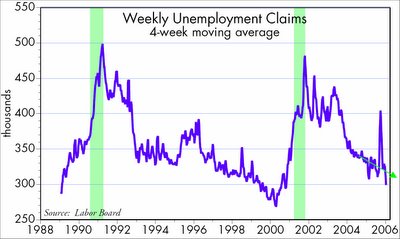

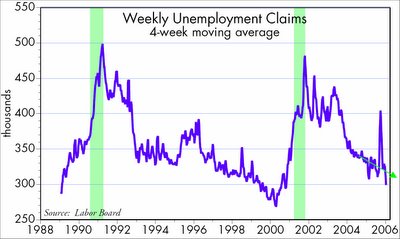

More evidence accumulates that the housing market is slowing down. Housing starts in December were way below expectations, but that could be because of bad weather. Nevertheless, starts on balance haven't increased much at all in the past year. Meanwhile, anecdotal evidence suggests prices are topping out in the overheated markets on the coasts. Separately, unemployment claims fell much more than expected, reinforcing the view that labor market conditions remain very healthy. It's quite possible for the overall economy to continue to do well even if housing weakens. Money flows that have fueled construction and home equity extraction can't just be turned off from one day to the next. The money is going to find somewhere else to go if the housing sector can't accommodate it. And there's plenty of money out there, as evidenced by the 14% rise in federal revenues last year, very strong corporate profits, and the fact that (according to Art Laffer) 43 of 50 states are enjoying budget surpluses--even California.

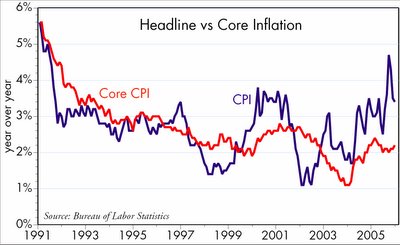

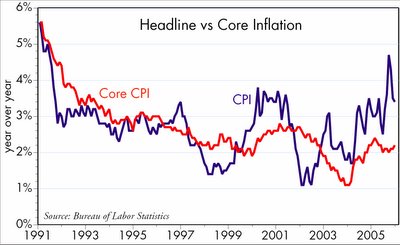

Yesterday, consumer prices were reported to have fallen a bit (-0.1%) in December, thanks to lower energy prices, but ex-food and energy, prices rose 0.2%. Energy prices are back up this month, so we're likely to see a strong CPI advance reported for January. Core inflation remains relatively low, but this is not exactly price stability; at the current rate of core inflation, prices will rise 25% over the next 10 years. At the current rate of headline inflation, prices will rise 40% in the next 10 years.

Oil is back up to $67, just shy of its $70 peak last August. Wholesale gasoline prices are up 25% from their November lows. At $9, natural gas is way down from its $15 peak last month, but remains 50% higher than a year ago. More importantly, perhaps, non-energy industrial commodity prices are at or near all-time highs. Gold typically leads other commodity prices by about one year, so gold's 33% jump since last summer to $560 suggests that the commodity rally is not yet over. All of this suggests that money is not tight (and is possibly still easy) and/or the global economy is very strong.

More evidence accumulates that the housing market is slowing down. Housing starts in December were way below expectations, but that could be because of bad weather. Nevertheless, starts on balance haven't increased much at all in the past year. Meanwhile, anecdotal evidence suggests prices are topping out in the overheated markets on the coasts. Separately, unemployment claims fell much more than expected, reinforcing the view that labor market conditions remain very healthy. It's quite possible for the overall economy to continue to do well even if housing weakens. Money flows that have fueled construction and home equity extraction can't just be turned off from one day to the next. The money is going to find somewhere else to go if the housing sector can't accommodate it. And there's plenty of money out there, as evidenced by the 14% rise in federal revenues last year, very strong corporate profits, and the fact that (according to Art Laffer) 43 of 50 states are enjoying budget surpluses--even California.

Yesterday, consumer prices were reported to have fallen a bit (-0.1%) in December, thanks to lower energy prices, but ex-food and energy, prices rose 0.2%. Energy prices are back up this month, so we're likely to see a strong CPI advance reported for January. Core inflation remains relatively low, but this is not exactly price stability; at the current rate of core inflation, prices will rise 25% over the next 10 years. At the current rate of headline inflation, prices will rise 40% in the next 10 years.

<< Home