Energy prices -- still a concern

The following commentary (with charts) is from Scott Grannis, Chief Economist at Western Asset Management...

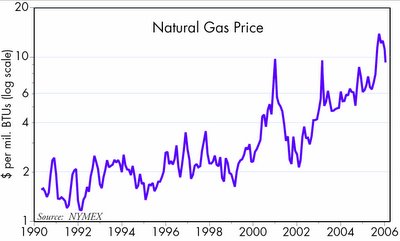

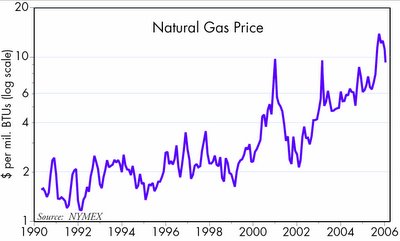

The energy story isn't over yet. As the charts show...

energy prices still look to be in a rising trend, with no sign yet of any significant price declines. Even though natural gas prices have dropped almost 40% from their recent December high, they are still up by over 500% since their 1998 lows. The fact that energy prices have moved up in the last month or so means that headline inflation is likely to pick up again. Wholesale gasoline prices are now 24% higher than their November lows, so that could add 1% or so to the CPI over the next two reports.

The fourth chart (above) poses an important question: what is a "normal" price of oil these days? In inflation-adjusted terms, should oil today be considered expensive because it is double the level which prevailed from the mid 1980s until the late 1990s? Or is it more accurate to say that oil today has simply returned to the "normal" levels that prevailed from the mid-1970s to the mid-1980s? This latter question might be rephrased to say that oil prices today have finally caught up to the rise in all other prices that has occurred since the early 1980s. The CPI has about doubled since 1982, and now so have oil prices. So maybe oil at $60/barrel or even $70 is not a big deal. If oil were any less, it would be cheap relative to other things.

This has implications for core inflation, which the Fed has deemed to be the thing to watch. If energy prices have simply caught up to the rise that has already occurred in other prices, then maybe there's little reason to worry about higher energy prices getting passed through to other prices. Instead, we might say that the rise in non-energy prices is finally getting passed through to energy prices.

The more important thing would be whether there is a monetary impulse sufficient to move all prices higher, at a faster rate, in coming years. On that score, I would fall back to my favorites: gold, the dollar, commodity prices, real estate, and real yields. Gold at $540 is saying that money is still too easy. Almost all non-energy manufacturing and industrial prices are rising, and several indices are at all-time highs. Real estate prices are high in most parts of the world. The dollar has stabilized over the past six months, but is still down 25% from its 2002 highs, and is undervalued relative to most major currencies. Real yields are generally low, and low real yields help provide the monetary fuel for rising inflation by not discouraging the impulse to borrow money and buy things. So the monetary tea leaves still point on balance in the direction of higher inflation, and not the falling inflation that is priced into the bond market (TIPS breakeven spreads are predicting the CPI will rise only 2.1% or so in the next 12 reports, as compared to the 3.5% rise in the 12 months ending Nov. 2005).

A further consideration: if energy prices have only returned to more normal levels, then maybe all the talk about an oil shortage and rampant energy demand in China is misplaced. After all, China didn't all of a sudden start growing and burning oil. China has been growing by leaps and bounds for over a decade. If there's a common denominator to globally rising prices for energy, commodities, and real estate, it's more likely easy money than it is a voracious China. I've been frustrated by the muted response of core inflation in recent years, but I think it's just a matter of time before core inflation picks up.

The energy story isn't over yet. As the charts show...

energy prices still look to be in a rising trend, with no sign yet of any significant price declines. Even though natural gas prices have dropped almost 40% from their recent December high, they are still up by over 500% since their 1998 lows. The fact that energy prices have moved up in the last month or so means that headline inflation is likely to pick up again. Wholesale gasoline prices are now 24% higher than their November lows, so that could add 1% or so to the CPI over the next two reports.

The fourth chart (above) poses an important question: what is a "normal" price of oil these days? In inflation-adjusted terms, should oil today be considered expensive because it is double the level which prevailed from the mid 1980s until the late 1990s? Or is it more accurate to say that oil today has simply returned to the "normal" levels that prevailed from the mid-1970s to the mid-1980s? This latter question might be rephrased to say that oil prices today have finally caught up to the rise in all other prices that has occurred since the early 1980s. The CPI has about doubled since 1982, and now so have oil prices. So maybe oil at $60/barrel or even $70 is not a big deal. If oil were any less, it would be cheap relative to other things.

This has implications for core inflation, which the Fed has deemed to be the thing to watch. If energy prices have simply caught up to the rise that has already occurred in other prices, then maybe there's little reason to worry about higher energy prices getting passed through to other prices. Instead, we might say that the rise in non-energy prices is finally getting passed through to energy prices.

The more important thing would be whether there is a monetary impulse sufficient to move all prices higher, at a faster rate, in coming years. On that score, I would fall back to my favorites: gold, the dollar, commodity prices, real estate, and real yields. Gold at $540 is saying that money is still too easy. Almost all non-energy manufacturing and industrial prices are rising, and several indices are at all-time highs. Real estate prices are high in most parts of the world. The dollar has stabilized over the past six months, but is still down 25% from its 2002 highs, and is undervalued relative to most major currencies. Real yields are generally low, and low real yields help provide the monetary fuel for rising inflation by not discouraging the impulse to borrow money and buy things. So the monetary tea leaves still point on balance in the direction of higher inflation, and not the falling inflation that is priced into the bond market (TIPS breakeven spreads are predicting the CPI will rise only 2.1% or so in the next 12 reports, as compared to the 3.5% rise in the 12 months ending Nov. 2005).

A further consideration: if energy prices have only returned to more normal levels, then maybe all the talk about an oil shortage and rampant energy demand in China is misplaced. After all, China didn't all of a sudden start growing and burning oil. China has been growing by leaps and bounds for over a decade. If there's a common denominator to globally rising prices for energy, commodities, and real estate, it's more likely easy money than it is a voracious China. I've been frustrated by the muted response of core inflation in recent years, but I think it's just a matter of time before core inflation picks up.

<< Home