Mail Call

You are too funny, B. Thanks for the smile.I'm trying to correct a small hesitation problem. A few weeks ago I started watching AKAM - great weekly chart and interesting business. I bought at $17 before the breakout, sold at $19.70, bought back for fear of missing a big move, then sold that position at a small profit. So what's the hesitation problem? Back at $17, I considered telling you about the possible opportunity, but never had the confidence. So, I now have an appreciation of your trading skills AND, in a new way, your ability to stick your neck out there in public. Thanks for doing so. I'm still "on the qui vive" with AKAM.

In answering you, it might make sense that, via analogy, I am the fellow on the dance floor who lacks even a single iota of rhythm, and yet I go for it. I might look like a doofus, but never for a moment do I feel embarrassed; I am out there having fun. While those guys into looking bitchen' hang by themselves, next to the wall apart from the crowd that is busy having fun. Hmm, look cool and have no fun vs look stupid and have fun. The same 'logic' applies to the market: an investor might be correct or incorrect, make money or lose money, but he or she should at minimum have fun in the quest.

This mini-table (above) is an attempt to show that profits or losses can accrue to the investor whether he or she is correct or incorrect. Let's fill in the cells to see how this might work:

A) Correct and Profitable: Think Google/GOOG;

B) Incorrect yet profitable: Remember the apothegm, "It is better to be in the wrong stock at the right time than [to be] in the right stock at the wrong time";

C and D) Correct or incorrect, losses are endured: And just how often have you heard the comment, "I was right, in the end; I just ran out of time (patience, money" etc...)?

That column to the far right is problematic; losses could be either monetary or emotional (as in ‘saving face’), but they remain losses. Obviously, we each prefer to place checkmarks in the cell, correct + profits. This situation is akin to our sailing with the wind at our backs. Unfortunately, life rarely works in this way -- and we choose to complicate life unnecessarily. In my investing forays, I accept incorrect + profits. This acceptance is a critical hurdle to surmount that helps to facilitate consistent success when investing. My objective is not to be right, but make money; the prophet vs. profit syndrome.

For example (and not to embarrass anybody), one reader thought I would (should?) be embarrassed with the 'collapse' of IRIS, ("Ouch, what happened to IRIS today (Monday)? How does today's action affect your view/interest of that [former?] member of your winning list?") Perhaps this reader fails to understand I factor into my expectations such oscillations. Rest assured that I do. There is a rhyme to the reason; all is not random. Each set-up and pattern builds as it does, sudden sharp -- and seemingly random -- oscillations fit within the whole.

Thus, I willingly make public investment recommendations at the risk of being wrong because that effect -- wrongness or rightness fail to motivate me; only losing money, whether correct or incorrect, would achieve that effect. I am willing to be wrong, privately or publicly, in the quest to be correct, to make money.

I must add, however, that I see little in the weekly chart of AKAM that makes it appear “great” -- which does not mean that quality is not present. Please enlighten me as to what I miss... (As always, I miss a lot!)

The share price remains a fraction of its all time high of $345/share set six years ago...

The share price remains a fraction of its all time high of $345/share set six years ago...Another reader writes...

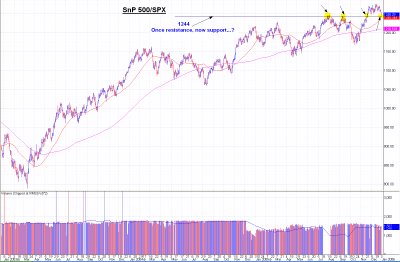

I was looking at the SPX chart and noticed that the previous resistance was about 1244 and that the index moved perilously close to breaking that yesterday. Would I be right in concluding that a break below that level would result in a short term decline in the index? I'm trying to get a feel for this charting stuff.

A glance at the chart above shows obvious points of resistance and support at the 1244 level. I note also the proximity of the rising 50 day sma, a dynamic measure of market change. Unfortunately, this chart reflects only ~18 months of data. A look at the same chart on a weekly basis is revealing...

... because the threshold line at 1244 has been crossed repeatedly, and in each direction. This says something important re trend lines: they serve to discern, identify, and circumscribe trends. The trend of the weekly basis chart is sideways; thus, this trend line is important (because some investors will use it) but not critical (because it is incorrectly identified). This is due to the limiting aspect of plotting only the x and y Cartesian coordinates. Most investors slice a bit of chart action into an epochal whole, never for a moment taking into consideration the subject's continuum.

In a post made 2+ weeks ago, I suggested the market was in for tough sledding; here is a snippet:

Of course, there is this post's subject header. Qui vive means "alert, lookout" -- I am on the lookout always for changes. Negative change occurs in the market now, as former bullish patterns creak under the weight of their up-trends... These declines represent warning shots over the bow, or so goes my interpretation. Thus, "I position my portfolio more defensively...

My expectation was for a chop higher into "the opening minutes of Tuesday, 3 January 2006, and then..." Well, here we are. I suspect the market will instead continue to chop higher beyond today's opening minutes. We shall know soon.

What this recognition (increasing market risk) meant to me then was to sell all stocks that had the following characteristics:

• less liquidity (as measured by average daily volume),

• short term bases assuming an appearance of convexity (vs concavity),

• any stock selling for more than 175% of its 200 day sma (simple moving average),

• etc

This portfolio sell-off of weeks ago had brought my portfolio holdings down to a double handful of opportunities. Remaining portfolio holdings include Apple/AAPL, Dress Barn/DBRN, HoLogic/HOLX, Matria HealthCare/MATR, Office Depot/ODP, Teva Pharmaceuticals/TEVA, and Whole Foods Markets/WFMI. Under Armour/UARM possibly hit its peak price on Thursday, so I sold it. Google/GOOG is the sole exception to the rules I explicate above, because I perceive the investment as a Singular Opportunity®; I thus am willing to hold it into and through its intermediate term bases. I note also the refusal of JW Nordstrom's/JWN to decline in line with the retailers as a group, and the market as a whole. The shares were a market leader in 2005, as this article attests and explains. Will its market leadership continue? Certainly, its lengthening (and thus strengthening) possible intermediate term base offers powerful upside potential, if actualized as such.

Which all is my way of saying that I prefer to manage market risk opportunity by opportunity rather than assign perceptual risk to the market, and then make monolithic portfolio decisions -- buy or sell everything; i.e., a form of bottom up vs top down investing. Manage the detail, manage the risk.

Nonetheless, the coming days and weeks should prove... interesting. I have my buy list at hand, ready to purchase on a moment's notice and be proved wrong re my expectations for the market. Because in the quest to make money (profits) from investing, who really cares how silly we each might appear, as long as the net result is positive? Certainly, my ego's need to be accorded accolades for being prophetic was satisfied long, long ago -- if not tamped down to a manageable level.

Yes, I acknowledge that this point (the profit vs prophet syndrome) is one I make repeatedly. Until we each check our egos at the door (prophet) we will find elusive the true goal, reliable and consistent profits.

I hope I answered the questions, and did not wander off on too many tangents or down too many rabbit holes. (As is my typical wont!) If I did, please ask again requesting clarity on whatever points I managed to muddy...

<< Home