Inflation -- rising or stable? + Capex continues strong

The following comments are from Scott Grannis, Chief Economist at Western Asset Management...

-- David M Gordon / The Deipnosophist

~~~~~~~~~~~~~~~~~~~~~

Inflation -- rising or stable?

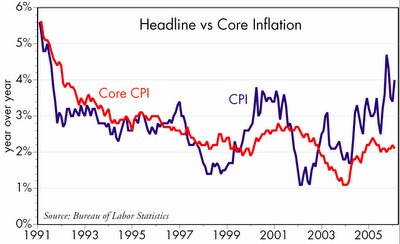

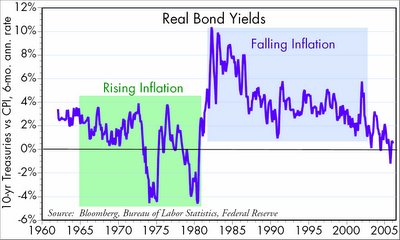

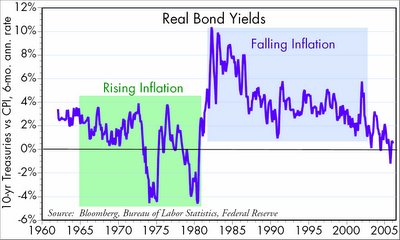

Despite the outsized 0.7% gain in the headline consumer price index in January, which raised the year over year level of inflation to 4%, the bond market breathed a sigh of relief since the "core" CPI was only up 0.2% and 2.1%, respectively. The Fed has decreed that core measures of inflation are preferred, and so the fact that core inflation has remained around the upper bounds of the Fed's comfort zone for 8 years or so is a source of comfort to the bond market. But as the second chart shows, bond valuation (measured as the difference between 10-year Treasury yields and current headline inflation) has rarely been as unattractive as it is today.

I note that energy prices today are roughly the same in real terms as they were in the early 1980s. This means that the recent 4-year sustained rise in energy prices has not really been an outlier occurrence, and energy prices are not exaggeratedly high. It means that energy prices have simply caught up to the rise in all other prices that has occurred over the past 25 years. In that sense, energy prices today are not at unsustainable levels, and therefore it is difficult to dismiss them out of hand. We have not suffered an energy shock, we've simply seen energy prices normalize relative to other prices. If energy prices hold these levels, then headline inflation is indeed 4%, and not 2%. Energy can only be dismissed if one believes strongly that energy is responding purely to supply/demand factors that are confined solely to the energy sector. If energy is up because of the monetary inflation that has existed over the past 25 years, then this is not an energy shock, and core inflation is not the thing to watch.

Capex continues strong

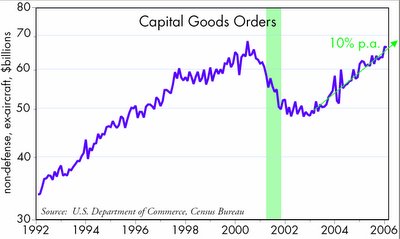

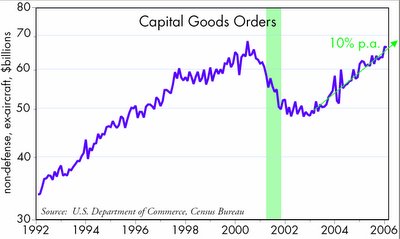

Durable goods orders plunged in January, falling over 10%, but this was all due to volatile aircraft orders. As the attached chart shows, non-defense, non-aircraft capital goods orders are still growing at a 10% annual rate. This reflects strong corporate profits and business confidence in the future, and suggests that the economy continues to have healthy underpinnings.

-- David M Gordon / The Deipnosophist

~~~~~~~~~~~~~~~~~~~~~

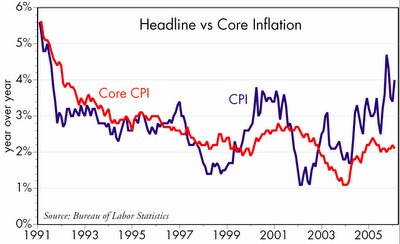

Inflation -- rising or stable?

Despite the outsized 0.7% gain in the headline consumer price index in January, which raised the year over year level of inflation to 4%, the bond market breathed a sigh of relief since the "core" CPI was only up 0.2% and 2.1%, respectively. The Fed has decreed that core measures of inflation are preferred, and so the fact that core inflation has remained around the upper bounds of the Fed's comfort zone for 8 years or so is a source of comfort to the bond market. But as the second chart shows, bond valuation (measured as the difference between 10-year Treasury yields and current headline inflation) has rarely been as unattractive as it is today.

I note that energy prices today are roughly the same in real terms as they were in the early 1980s. This means that the recent 4-year sustained rise in energy prices has not really been an outlier occurrence, and energy prices are not exaggeratedly high. It means that energy prices have simply caught up to the rise in all other prices that has occurred over the past 25 years. In that sense, energy prices today are not at unsustainable levels, and therefore it is difficult to dismiss them out of hand. We have not suffered an energy shock, we've simply seen energy prices normalize relative to other prices. If energy prices hold these levels, then headline inflation is indeed 4%, and not 2%. Energy can only be dismissed if one believes strongly that energy is responding purely to supply/demand factors that are confined solely to the energy sector. If energy is up because of the monetary inflation that has existed over the past 25 years, then this is not an energy shock, and core inflation is not the thing to watch.

Capex continues strong

Durable goods orders plunged in January, falling over 10%, but this was all due to volatile aircraft orders. As the attached chart shows, non-defense, non-aircraft capital goods orders are still growing at a 10% annual rate. This reflects strong corporate profits and business confidence in the future, and suggests that the economy continues to have healthy underpinnings.

<< Home