Productivity continues to weaken

The following comments are from Scott Grannis, Chief Economist at Western Asset Management...

-- David M Gordon / The Deipnosophist

--------------------------------------------------

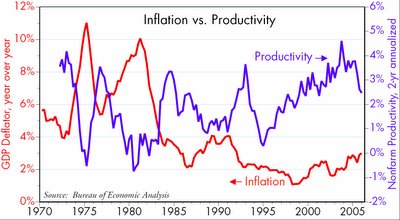

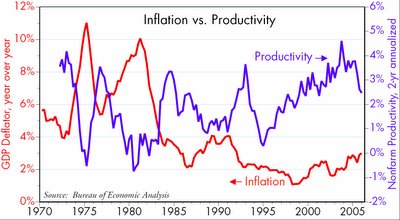

Productivity in the fourth quarter plunged to -0.6%, driven largely by the fact that the economy grew at a 1.1% rate while the number of people working grew at a 1.7% rate. But just as 1.1% likely overstates the weakness of the economy, a negative productivity rate most likely understates the underlying productivity trend. Productivity for all of last year was 2.3%, down from the 2.6% pace of 2004. The chart (below) gives a broader picture, showing productivity declining from the 4% rate of a few years ago to a 2 - 2.5% rate today. With the labor force likely to grow at least 1% this year, real GDP growth is thus quite likely to be in a 3-4% range.

As the chart suggests, and as I have been arguing for several years, one reason for declining productivity is rising inflation. (Most observers are saying just the opposite, however, noting that declining productivity could put upward pressure on inflation.) I think that the reemergence of pricing power has reduced the incentives of firms to seek out productivity gains. Productivity doesn't just happen, it requires effort and expense, and therefore it should be responsive to changing incentives. It's much easier to raise prices than it is to reduce costs, so cost cutting is strongest when monetary policy (and the ability to raise prices) is most restrictive. The Fed's accommodative policy stance in recent years has made it easier for some firms to raise prices, so productivity has suffered.

One could also argue that the productivity-enhancing impact of technology and the internet has finally faded. These factors can't result in a permanent increase in productivity, but rather a one-time increase that could have been spread out over the past 10 years or so and is finally running its course. Whatever the case, productivity is now returning to its long-term average of 2+%, and I see no reason for it to decline meaningfully from these levels.

-- David M Gordon / The Deipnosophist

--------------------------------------------------

Productivity in the fourth quarter plunged to -0.6%, driven largely by the fact that the economy grew at a 1.1% rate while the number of people working grew at a 1.7% rate. But just as 1.1% likely overstates the weakness of the economy, a negative productivity rate most likely understates the underlying productivity trend. Productivity for all of last year was 2.3%, down from the 2.6% pace of 2004. The chart (below) gives a broader picture, showing productivity declining from the 4% rate of a few years ago to a 2 - 2.5% rate today. With the labor force likely to grow at least 1% this year, real GDP growth is thus quite likely to be in a 3-4% range.

As the chart suggests, and as I have been arguing for several years, one reason for declining productivity is rising inflation. (Most observers are saying just the opposite, however, noting that declining productivity could put upward pressure on inflation.) I think that the reemergence of pricing power has reduced the incentives of firms to seek out productivity gains. Productivity doesn't just happen, it requires effort and expense, and therefore it should be responsive to changing incentives. It's much easier to raise prices than it is to reduce costs, so cost cutting is strongest when monetary policy (and the ability to raise prices) is most restrictive. The Fed's accommodative policy stance in recent years has made it easier for some firms to raise prices, so productivity has suffered.

One could also argue that the productivity-enhancing impact of technology and the internet has finally faded. These factors can't result in a permanent increase in productivity, but rather a one-time increase that could have been spread out over the past 10 years or so and is finally running its course. Whatever the case, productivity is now returning to its long-term average of 2+%, and I see no reason for it to decline meaningfully from these levels.

<< Home