Corporate profits still very strong

-- David M Gordon / The Deipnosophist

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

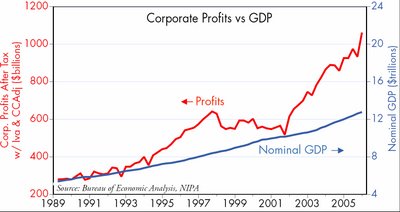

Along with the final revision to fourth quarter GDP (growth revised upwards slightly to 1.7%, inflation revised upwards to 3.5%), BEA today released their calculation of corporations' after-tax economic profits, and it was a barn-burner of a number. Profits rose 9.4% in 2005, compared to 2004, and fourth quarter profits soared to 8.3% of nominal GDP, the highest ratio on record. Profits have more than doubled from their 2001 low. Corporations' net cash flow was $1.4 trillion at an annualized rate in the fourth quarter (fully one-eighth of GDP!), up 18.5% from a year ago. Simply put, there's a heck of a lot of positive stuff goin' on out there.

Since NIPA profits typically lead GAAP profits, we can infer that reported earnings will remain very strong for at least the next 6-9 months. This further suggests that equities remain attractive. Using Laffer's capitalized profits model, equities continue to be a steal.

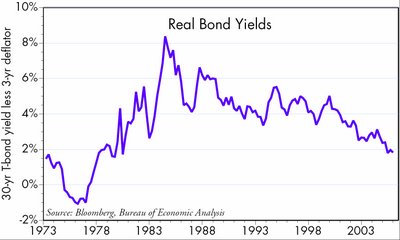

Bonds, meanwhile, do not look very attractive. The second chart subtracts a 3-year moving average of inflation, as measured by the GDP deflator, from current bond yields (arguably a better measure of inflation and inflation expectations than current core rates). Real yields by this measure haven't been so low since 1979-80.

<< Home