Long TIPS are looking very cheap

The following commentary is by Scott Grannis, Chief Economist at Western Asset Management.

-- David M Gordon / The Deipnosophist

===============================

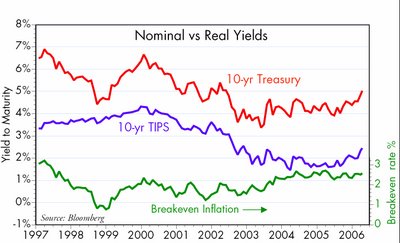

Both real and nominal 10-year yields are up to levels not seen since 2002. 10-year Treasury yields have broken through 5%, and 10-year TIPS yields are almost 2.5%, just shy of the 2.6% "Grannis Barrier" I postulated awhile back. My theory was that a real yield of 2.6% on long-maturity TIPS was the equivalent of a "true" real yield of 3.1% (since the CPI overstates inflation by 0.5% per year), and since 3.1% is the economy's long-term real growth potential, at that point TIPS become nominal GDP bonds. In other words, the return on a 10-year TIPS purchased today should be very close to the nominal growth rate of the economy over the next 10 years. That is a pretty attractive proposition, since it is also guaranteed by the U.S. government.

If real yields rise much further, then the long-term return potential of TIPS will rival the returns on equities, especially on a risk-adjusted basis, since the long-term growth of after-tax corporate profits is quite unlikely to exceed the long-term growth of nominal GDP. Demand for TIPS should therefore strengthen if real yields rise. For the past year, long-term TIPS yields have risen pretty much in line with the rise in nominal yields; both are up about 100 bps from last year's lows. But if 10-year nominal yields continue to rise from here, it is likely that real yields will rise by less, and potentially by much less. That is equivalent to saying that further rises in nominal interest rates from today's levels should be largely driven by rising inflation expectations.

What this means, in short, is that the downside risks to owning TIPS diminish the more real yields rise. This is quite different from nominal bonds, whose yields can rise without theoretical limit. Investors should thus find long-term TIPS increasingly attractive as real yields rise from today's levels, even if nominal bonds become increasingly less attractive.

TIPS should also find some support given the ongoing rise in commodity, real estate, gold and energy prices. That breakeven spreads on long-term TIPS have not budged over the past two years despite a 20% rise in industrial commodity prices, a 25% rise in housing prices, a 50% rise in gold, and a 100% rise in oil is interesting, to say the least.

Long-term TIPS are thus attractive from two perspectives: real yields are appealing at current levels, and TIPS do not appear to be pricing in any significant risk of inflation, despite the ongoing rise in the prices of most tangible assets.

-- David M Gordon / The Deipnosophist

===============================

Both real and nominal 10-year yields are up to levels not seen since 2002. 10-year Treasury yields have broken through 5%, and 10-year TIPS yields are almost 2.5%, just shy of the 2.6% "Grannis Barrier" I postulated awhile back. My theory was that a real yield of 2.6% on long-maturity TIPS was the equivalent of a "true" real yield of 3.1% (since the CPI overstates inflation by 0.5% per year), and since 3.1% is the economy's long-term real growth potential, at that point TIPS become nominal GDP bonds. In other words, the return on a 10-year TIPS purchased today should be very close to the nominal growth rate of the economy over the next 10 years. That is a pretty attractive proposition, since it is also guaranteed by the U.S. government.

If real yields rise much further, then the long-term return potential of TIPS will rival the returns on equities, especially on a risk-adjusted basis, since the long-term growth of after-tax corporate profits is quite unlikely to exceed the long-term growth of nominal GDP. Demand for TIPS should therefore strengthen if real yields rise. For the past year, long-term TIPS yields have risen pretty much in line with the rise in nominal yields; both are up about 100 bps from last year's lows. But if 10-year nominal yields continue to rise from here, it is likely that real yields will rise by less, and potentially by much less. That is equivalent to saying that further rises in nominal interest rates from today's levels should be largely driven by rising inflation expectations.

What this means, in short, is that the downside risks to owning TIPS diminish the more real yields rise. This is quite different from nominal bonds, whose yields can rise without theoretical limit. Investors should thus find long-term TIPS increasingly attractive as real yields rise from today's levels, even if nominal bonds become increasingly less attractive.

TIPS should also find some support given the ongoing rise in commodity, real estate, gold and energy prices. That breakeven spreads on long-term TIPS have not budged over the past two years despite a 20% rise in industrial commodity prices, a 25% rise in housing prices, a 50% rise in gold, and a 100% rise in oil is interesting, to say the least.

Long-term TIPS are thus attractive from two perspectives: real yields are appealing at current levels, and TIPS do not appear to be pricing in any significant risk of inflation, despite the ongoing rise in the prices of most tangible assets.

[click image to enlarge]

[click image to enlarge]

<< Home