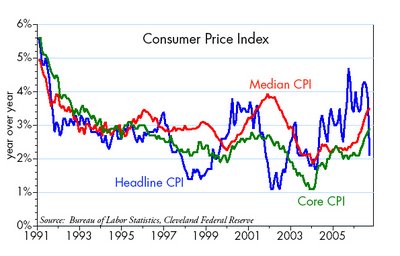

Headline and core inflation converging at 3%

-- David M Gordon / The Deipnosophist

================================

Due to huge declines in gasoline prices, the CPI fell 0.5% last month, while the core (ex food and energy) rate rose 0.24%. Since September '05 was dominated by a huge increase in energy costs in the wake of Katrina, the year over year rate of consumer price inflation tumbled from 3.8% in August to just 2.1% in September. The core CPI, however, has now accelerated to 2.9% in the past year (and has risen at a 3.2% pace in the past six months), from a year over year rate of 2.0% last year. The Cleveland Fed's Median CPI (which throws out those items that increased or decreased the most) has accelerated from 2.3% last year to 3.5% in September. Barring further significant declines in energy prices, I'm guessing that the headline CPI will rise about 3% this calendar year. That will put most measures of the CPI in the ballpark of 3% by December.

Interestingly, while many people might guess that soaring energy prices have been leading the inflation charge for the past four years, it is actually the case that energy prices have been bringing up the rear. The consumer price index rose about 6% less than the core CPI from early 1984 to February 2002, mainly because oil prices languished below $30 the whole time, while all other prices were (on average) steadily rising. Oil's price surge since then has brought the real price of oil back to roughly the same level as 1984 (thus more closely matching the average rise in all other prices), and that in turn has helped the headline CPI close the gap between the core and headline inflation indices to only about 2% today.

So maybe core inflation really is the thing to watch, as the Fed has been insisting, since core inflation has been out in front of oil prices for quite some time. Core inflation pressures bottomed in 2003 at about 1%, and core inflation is now running about 3%. Whether inflation turns down next year as the market expects (TIPS breakeven spreads project the CPI will average only 2% or so for the next few years) is the key question now. The bond market seems to be operating under the assumption that big declines in energy and housing prices, coupled with a significant slowing of economic growth, will pull core inflation down, but history suggests this is not necessarily going to happen. Big declines in inflation have traditionally occurred in the wake of recessions, and most recessions, in turn, were the result of a major tightening of monetary policy. With the exception of the flat/inverted yield curve, the sensitive monetary indicators of inflationary pressures that I consider most important to watch (e.g., gold, the dollar, swap spreads, the real Fed funds rate, commodity prices) are saying that monetary conditions today are not tight enough to result in any significant disinflationary pressures over the next year or so. Indeed, there is little to suggest that core inflation is unlikely to continue to drift higher.

Labels: Economics

<< Home