Economy still OK + inflation still a concern = Fed on hold

=================================

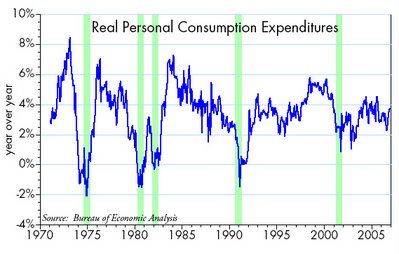

For the past six months the bond market has been been betting that the bursting of the housing bubble would slow the economy so much that the Fed would be forced to cut interest rates (3 cuts next year is the consensus forecast as of today). But so far the bet is not working out. The housing bubble began to burst over a year ago, housing starts have plunged 30%, and mortgage equity withdrawal has slowed sharply this year, but the consumer is still in good shape. Real personal consumption expenditures have actually accelerated in recent months, recording a respectable 3.7% gain over the past year. This is not surprising given the continued strength in state and federal tax revenues, the bouyant stock market, and ongoing jobs growth, not to mention a relatively low 4.5% unemployment rate.

[click on images to enlarge]

[click on images to enlarge]Manufacturing activity has slowed, however, and business capital spending has stalled over the past six months, so the economy is not exactly the picture of good health. (Why are businesses reluctant to invest at a time when profits are going gangbusters? That's puzzling, to say the least.)

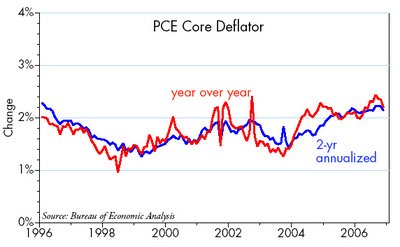

Real GDP growth was 3.2% in 2005, and it slowed to a 2.2% pace in the second and third quarters of this year. While this is unfortunate, the economy clearly has not deteriorated enough to provoke an easing response from the Fed, especially since inflation is not dead. The Fed's preferred measure of inflation, the core PCE deflator, is a bit over its presumed 2% target, and has been for almost three years now. Headline measures of inflation have dropped precipitously in the past several months due to a sharp drop in energy prices, but the inflation pipeline is not running dry just yet: nonenergy industrial commodity prices continue to hit new highs almost every day, and core crude materials prices are up almost 18% in the past year. The dollar is hovering very near its all-time lows, and gold is still trading north of $600/oz. At the very least, these indicators suggest that whatever problems the economy is having, it is not due to a shortage of liquidity; the Fed has not tightened enough to strangle economic activity. So it's likely that the economy can continue to expand at an unremarkable 2-3% pace.

In the unlikely event that the economy suddenly unravels or zooms ahead, or the inflation picture changes dramatically, it's hard to see a compelling reason for the Fed to do anything but just stand pat for the foreseeable future (3-6 months), as it has for the past four FOMC meetings.

Labels: Economics

<< Home