Fed policy -- strange bedfellows

-- David M Gordon / The Deipnosophist

=================================

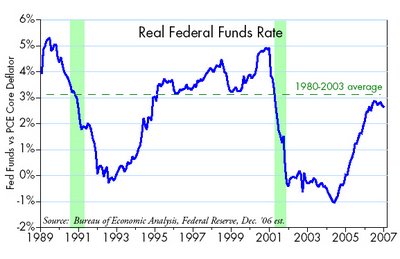

The effective stance of Fed policy arguably is best measured by the level of the real Fed funds rate. High real borrowing costs tend to discourage borrowing, encourage saving, and increase the demand for money, and thus tend to be disinflationary, while low real rates tend to be reinflationary. By this measure, Fed policy has been relatively stable for most of 2006; even though the nominal funds rate has risen from 4.25% to 5.25%, inflation has been moving higher for most of the year, resulting in little change in the real rate. By my estimation, the real Fed funds rate will average about 2.7% this year, and that is a bit less than the 3.1% average during the disinflationary 1980-2003 period, during which time inflation fell from a high of almost 10% to a low of 1%. (I'm using the core PCE deflator in these calculations, which is the Fed's preferred measure of inflation.)

The FOMC statement today suggested that the Fed is prepared to wait at least several months, and possibly several quarters, to see how inflation pressures, which they currently classify as "elevated," respond to past tightening actions, a slower-growing economy, a weak housing market, and lower energy prices, all of which are thought to be disinflationary. The bond market has already decided on the outcome, betting on moderate growth, falling inflation, and a reduction in the funds rate target to 4.25-4.5% by the end of 2007.

Arguing against a cooling of inflation, however, is the behavior of certain key market prices that respond to monetary imbalances. So far this year the dollar has lost almost 10% of its value against other major currencies, and about 20% of its value against gold and nonenergy industrial commodity prices. This suggests that although a 2.7% real funds rate might well be "average" and close to a level which in the past has been disinflationary, in the current climate it may not be high enough.

The yin and the yang of monetary policy is a complex interaction of supply and demand dynamics that can take many months or even years to manifest itself in the general price level. It's part art and part science, with a dose of politics thrown in, all taking place in a global setting with few absolutes. Treasury Secretary Paulson later this week will urge the Chinese government to continue revaluing its currency against the dollar, a move which would likely result in the dollar losing even more of its value relative to most Asian currencies. Paulson will essentially be arguing for a reduction in Asian demand for dollars, at the same time his fellow traveller, Fed Chairman Bernanke, will presumably be reassuring the market that the Fed will be vigilant in safeguarding the dollar's value, something that is hugely important to a region of the world that holds a sizeable quantity of dollar-denominated bonds. Strange bedfellows indeed, working at cross purposes in an oriental setting. Paulson's success would only complicate Bernanke's job, making it less likely that the Fed could ease policy as much as the market is now expecting.

Labels: Economics

<< Home