Mad Tea Party

It should, as it is the cup & handle. Note that the shares broke out above handle resistance (only) yesterday...

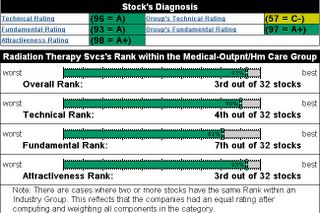

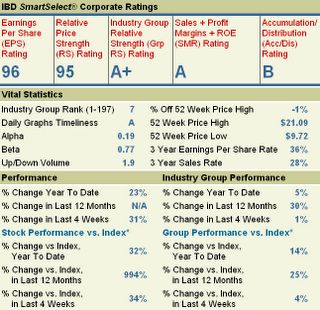

If I am going to seek out O'Neill's c&h pattern, then I should use his CANSLIM method, as well. This next graphic is from IBD.

Radiation Therapy Services/RTSX, a provider of radiation therapy services to cancer patients, owns, operates, and manages treatment centers focused exclusively on providing comprehensive radiation treatment alternatives. Which kinda lacks detail, eh? So might as well go whole-hog: the article below is from Investor's Business Daily (IBD) 1/23/05 edition...

Working On Chain Gang Can Pay Off

AMY REEVES

It seems as though everything's being taken over by chains these days. The field of radiology is no different.

Radiation Therapy Services/RTSX owns 52 radiology centers in eight states targeted to treat cancer. It offers standard chemotherapy as well as high-tech options such as implanted radioactive "seeds" for prostate cancer, 3D conformal treatment planning and Intensity Modulated Radiation Therapy.

If the name doesn't ring familiar, you might have heard of the brand under which most of its centers operate: 21st Century Oncology.

Radiation Therapy Chief Executive Daniel Dosoretz says patients can reap benefits by turning to a big chain with deep pockets instead of the local community clinic. "In the last 10 years there's been significant technological improvement (in radiology)," he said. "So you not only have to provide great service; you have to have the technology to provide that service. That combination is what we provide."

The company grows by buying existing clinics and building new ones. It typically aims to move into one or two new markets a year. Its centers are scattered around the South, the Atlantic seaboard, Nevada and California. Radiation Therapy looks for markets that have a large and growing elderly segment, Dosoretz says. The company targets retirement hot spots. It has 13 clinics in Florida, for instance, and its lone California outpost is in Palm Springs.

The firm also looks at the regulatory environment, competition and health care payer mix when considering a new market.

THE FINANCIALS

Unlike many other companies in this column, Radiation Therapy has been around a while and has built steady earnings growth. Profit and revenue have grown every year since the firm started publicly reporting in 1999. In the third quarter it earned 13 cents a share, up 18% from the prior year. Revenue gained 27% to $40.7 million.

Analysts polled by First Call expect full-year 2004 earnings to come in at 86 cents a share, up 30% from 2003. This year they see profit rising 12% to 96 cents.

THE COMPANY

Radiation Therapy's story started 22 years ago, with a single clinic in Florida. Over time it grew to include 13 centers in that state. In 1997 the group incorporated as a business and made its first buyout. That was also when it decided to go outside its home state.

Radiation Therapy went public in June at 13. The stock peaked at 19.70 on Jan. 10, but has since fallen back to near 16.

Dosoretz sounds proud of the fact that the company never had to raise any venture capital for the project. "That has a lot to do with our philosophy," he said. "It created a discipline in our minds."

LOOKING AHEAD

Chief Financial Officer David Koeninger hints that the company might be able to "accelerate the pace" of its existing growth strategy because of the money gained from going public.

Just don't expect the company to go too hog wild. "We grow at a rate that we can manage, and comply with our obligations to (patients)," CEO Dosoretz said.

How would I 'play' this opportunity, especially because it broke out yesterday? Well, the breakout was at ~$19.75, which I will round up to $20 (for ease of arithmetic). I typically seek to buy within ~5% of the breakout, or in this instance ~$21, dependent upon today's opening trades (I would flex with the flux). My initial stop would be $17.5, which is immediately beneath the $17.60 low of the handle and above the current placement of the 50 day sma. Initial swing trading objective is ~$27.

<< Home