Quark, Strangeness, and Charm

Yesterday was such a day [of change], and thus an intriguing day for the markets. I had noted only days ago the preponderance of bases; yesterday brought with it reversals of declining trends, which likely equal an end to each correction (left side of the chart) and entry into the base (middle of the chart). For example...

• eBay/EBAY: Failed to achieve even the higher of two bearish objectives, ~$35. (The second, lower objective was ~$30.) Failure to achieve targets is a critical tell; a failure to achieve a bearish objective therefore is bullish. eBay/EBAY also reversed higher yesterday on 150% of average daily volume (adv). This likely means that all the activity this year qualifies as a base rather than a top.

• Starbucks/SBUX: Whew, how bearish could investors become on a stock that has declined less than $20 from its $65 all time high? Now it too ends its secondary test, and confirms the action of 2005 as a base.

• The homebuilders got into the bullish act, at least temporarily, rising when they instead should have declined.

I trade for a living, which means I also buy and sell stocks that I will own for only a short time. (Investments increase the net worth, whereas swing profits pay the bills.) So during the 3rd quarter, while everyone else moaned their fears for a summer decline, or a "September Swoon", or a "Fall fall" in the equity markets, I bought. And kept on buying. With the strength yesterday, and the follow-on strength today, that appears to have been a wise decision. I had the opportunity to purchase weakness rather than chase strength; this means, contrary to misperception, that my risk was lessened and my reward increased.

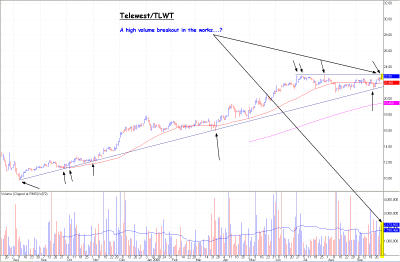

I prefer not to chase stocks, so I monitor the shares of companies I have interest in owning. When the market creates an opportunity to buy with comparatively little (or lessened) risk, then I purchase. Sometimes, an opportunity comes along wherein the decline and base are so shallow that I might as well purchase the high volume breakout, as seems to be transpiring today for Telewest/TLWT (at $23). In truth, I could not care less about this company or its business, but I do see the setup and pattern in the stock. Buying this high volume breakout will pay lots of bills after it hits its bullish objective... and I sell.

Charts have a language all their own, but I find they sing their song to me. I really cannot understand comments from investors who state they have no interest in learning technical analysis. Gosh, that is akin to a cardiologist who dismisses the importance of an EKG in his or her practice. Thank you, but I will consult another doctor!

Each day is a challenge, personally as well as professionally, but I embrace these challenges. And am paid handsomely for my efforts. So, too, could you!

<< Home