Trawling for opportunity

Dress Barn/DBRN is a member of the Retail sector. This particular group is getting pretty oversold with its BP down to 42%. Underneath the surface, the sub-sector Retail Apparel still has its RS chart in X's; DBRN is a member of this sub-group. DBRN itself is in a strong uptrend with excellent RS; this is easily seen by its 5 for 5'er positive technical attribute reading. In fact, both of its RS charts gave buy signals (vs. Market and vs. Peers) just a few months ago, which suggests outperformance by DBRN for the next couple of years. The stock recently reversed up to make a higher bottom at 22, and now has the potential to complete a bullish catapult formation at 27. The upside price objective is 44.50, and the weekly momentum just turned back to positive this week after having been negative for 14 weeks. We also noticed that DBRN shows upward earnings revisions, too. All told, DBRN sets up as a good risk-reward trade here. Ok to buy the stock here (or calls as a stock substitute), and then use 21 as the initial stop/hedge point as that would break a double bottom.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

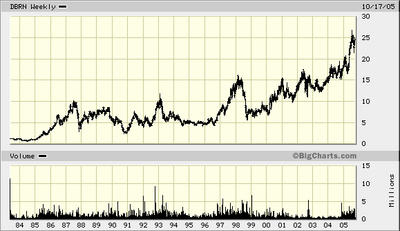

Okay, that's enough to get me going. The very next item I do is check the long term chart; if the shown history is more than 10 years, I consult Big Charts...(See chart below.)

Dress Barn/DBRN required 22 years to rise from ~$1 to $25, so other opportunities have been more dynamic; if however, you prefer dependable long term growth with little grief, DBRN would have been a fine addition to your portfolio. And the fact is, the chart does look good; moreover, I have always liked this sector and group (respectively, retail and specialty retail). The next thing I do is check out the competitors' shares -- do they trade bullish or bearish? As it happens, I am familiar with and especially like Urban Outfitters/URBN, Coach/COH, Joseph Bank/JOSB, etc; each has the appearance of building an intermediate term base.

Next I visit the company's website, and begin my due diligence re the company (not the shares). Assuming it passes muster (it does), I finally check the daily chart...

And now the opportunity begins to look especially tasty. It is building a base, likely 6 months in duration; thus, it is not quite midway through the process. Of course, the base might be of only 3 or 4 months in duration, so I do not drop it from my radar but instead add it to my monitor under budding set-ups.

I seek and would purchase:

1) A second decline toward $22-21 double support -- tested twice previously and the vicinity of the 200-day simple moving average (sma). (Also indicated as support by Dorsey Wright.);

2) A completion of the pattern based on time. This would occur during January/February.

Three caveats:

1) When buying retailers, you worsen the odds because you combine the whims of fashion with the vagaries of Wall Street. (I like those odds!)

2) Dress Barn/DBRN is not the leader of the specialty retailers; at this moment, that is likely Urban Outfitters/URBN.

3) Dress Barn/DBRN lacks liquidity (average daily volume) relative to others in the group, relative to the market, and relative to my (portfolio's) needs.

Thus, while I note the positive pattern abuilding for DBRN, I likely will purchase others as an investment. For example, Coach/COH, which is one of the few specialty retailers not subject to the whims of fashion because what they manufacture and retail is considered by many as timeless. (Arguable, I know.) While I might not invest in Dress Barn/DBRN, I will trade it, however. It weaves a pattern for future trading success!

A side comment about that pattern...

• During an intermediate term rally (trending up in price for 3 months or more), purchase pullbacks in price to the 50-day sma to capture future upside price momentum. When the pattern is an intermediate term base (trending sideways in price for 3 months or more), purchase tests of the 200-day sma.

• During an intermediate term price rally, the share price can approach or tag the 50-day sma many, many times; during an intermediate term base, the price should test the 200-day sma no more than twice.

In the former instance, you trade around the continuing uptrend (trade the trend's momentum). In the latter instance, you accumulate an investment position -- the first time down (test of the 200-day), should precede a bounce-back rally to a test and failure of the 50-day. The second time down is a test of the first test, thus building a double bottom within the intermediate term base. The pattern is near complete at this moment. The base typically is six (6) months because that is the difference in time between the two moving averages; when they converge (the Gordon Squeeze), the smart thing to do is close your eyes, hold your stomach, and buy the stock. (A third decline and test typically has bearish ramifications.)

I should mention this pattern is perhaps my favorite. It affords me the opportunity to invest in a long term winner (the market has already betrayed its proclivity) at a reasonable price, value, and substantially less risk. Other real time examples of this pattern include Corning/GLW, Genentech/DNA, Hansen/HANS, and the previously mentioned Joseph Bank/JOSB and Urban Outfitters/URBN, and many others including Google/GOOG (which is an especially shallow version of this base).

Questions...?

<< Home