Gold up, dollar up, bonds up?

The comments that follow are from Scott Grannis, Chief Economist at Western Asset Management...

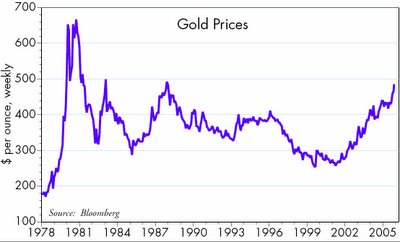

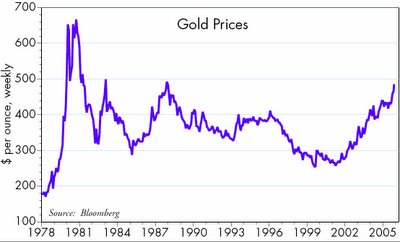

Lots of contradictory signals of late. So far this month, gold is up 5% vs the dollar, reaching an 18-year high of $490; the dollar is up 2% vs. a basket of major currencies; and bond prices are higher across the board. In addition, the breakeven spread on 10-year TIPS has narrowed from 2.57% to 2.41%, and the S&P500 is up 3.5%. Rising gold prices are typically symptomatic of rising inflationary pressures, but that is contradicted by lower bond yields, lower breakeven spreads, and a stronger dollar. Rising gold prices in recent years have typically been associated with a weaker dollar, but the dollar has been strengthening all year long. Larry Kudlow theorizes that gold is up because of heightened global risk stemming from Iran's resumption of its uranium enrichment program, while higher bond prices and lower breakeven spreads simply reflect a stronger economy and Fed policy gaining traction. However, higher equity prices (the Nikkei is up a whopping 7.5% this month) don't really jibe with increased global tensions. Which one of these indicators is the odd man out?

Implicit in Kudlow's view of the world is the assumption that the TIPS breakeven spread is a better indicator of inflation pressures than gold. I'm going to disagree with one of my favorite mentors (our relationship goes back to 1980), however, and stick with gold. Gold has been in a rising trend almost from the day the Fed started lowering interest rates in early 2001. During this period the Fed has vowed to boost inflation from levels they considered to be too low, and they have succeeded. Consistent with this, gold has correctly forecast rising inflation pressures and rising bond yields (10-year yields are up 150 basis points since mid-2003, at the same time that core inflation has risen from 1% to 2%, and breakeven spreads are up 100 bps over this same period). Gold correctly predicted the rising inflation of the 1970s, and the rising inflation from 1987-1990. Meanwhile, the bond market's record of forecasting inflation remains dismal. Bonds chronically underestimated inflation throughout the 1965-1981 period, and they have chronically underestimated inflation for the past five years. That's why TIPS have been among the best-performing financial assets in the world. To bolster my case for inflation, I note that the JOC Metals index is within inches of an all-time high, and the CRB Raw Industrials Index is within 2% of its all-time high, and neither of these contain a drop of petroleum. If monetary policy were indeed tight, then higher oil prices would be pressuring other sensitive prices lower (as happened in 1999-2000), but that is not the case today.

How would I explain the stronger dollar, given that I think U.S. monetary policy is still accommodative? Since almost all currencies are falling against gold, the best that can be said about the dollar is that it is among the strongest in a weak field. The dollar has a lot going for it, in relative terms: It is undervalued on a purchasing power parity basis. The U.S. economy is demonstrably resilient and chronically dynamic, and it has become a magnet for capital. U.S. interest rates may not be low enough to contain inflation pressures, but they are among the highest of the industrialized world. The Fed is moving (albeit slowly) to address our inflation problem, while most other central banks are content to sit back and watch.

Lots of contradictory signals of late. So far this month, gold is up 5% vs the dollar, reaching an 18-year high of $490; the dollar is up 2% vs. a basket of major currencies; and bond prices are higher across the board. In addition, the breakeven spread on 10-year TIPS has narrowed from 2.57% to 2.41%, and the S&P500 is up 3.5%. Rising gold prices are typically symptomatic of rising inflationary pressures, but that is contradicted by lower bond yields, lower breakeven spreads, and a stronger dollar. Rising gold prices in recent years have typically been associated with a weaker dollar, but the dollar has been strengthening all year long. Larry Kudlow theorizes that gold is up because of heightened global risk stemming from Iran's resumption of its uranium enrichment program, while higher bond prices and lower breakeven spreads simply reflect a stronger economy and Fed policy gaining traction. However, higher equity prices (the Nikkei is up a whopping 7.5% this month) don't really jibe with increased global tensions. Which one of these indicators is the odd man out?

Implicit in Kudlow's view of the world is the assumption that the TIPS breakeven spread is a better indicator of inflation pressures than gold. I'm going to disagree with one of my favorite mentors (our relationship goes back to 1980), however, and stick with gold. Gold has been in a rising trend almost from the day the Fed started lowering interest rates in early 2001. During this period the Fed has vowed to boost inflation from levels they considered to be too low, and they have succeeded. Consistent with this, gold has correctly forecast rising inflation pressures and rising bond yields (10-year yields are up 150 basis points since mid-2003, at the same time that core inflation has risen from 1% to 2%, and breakeven spreads are up 100 bps over this same period). Gold correctly predicted the rising inflation of the 1970s, and the rising inflation from 1987-1990. Meanwhile, the bond market's record of forecasting inflation remains dismal. Bonds chronically underestimated inflation throughout the 1965-1981 period, and they have chronically underestimated inflation for the past five years. That's why TIPS have been among the best-performing financial assets in the world. To bolster my case for inflation, I note that the JOC Metals index is within inches of an all-time high, and the CRB Raw Industrials Index is within 2% of its all-time high, and neither of these contain a drop of petroleum. If monetary policy were indeed tight, then higher oil prices would be pressuring other sensitive prices lower (as happened in 1999-2000), but that is not the case today.

How would I explain the stronger dollar, given that I think U.S. monetary policy is still accommodative? Since almost all currencies are falling against gold, the best that can be said about the dollar is that it is among the strongest in a weak field. The dollar has a lot going for it, in relative terms: It is undervalued on a purchasing power parity basis. The U.S. economy is demonstrably resilient and chronically dynamic, and it has become a magnet for capital. U.S. interest rates may not be low enough to contain inflation pressures, but they are among the highest of the industrialized world. The Fed is moving (albeit slowly) to address our inflation problem, while most other central banks are content to sit back and watch.

<< Home