Gone fishin'

Nonetheless, I return to this sector time and again, and note the market leadership the sector and group (in particular, medical technology) again provides. For example, and to list several, Celgene/CELG, Cutera/CUTR (get it?), Genentech/DNA, Gilead/GILD, HoLogic/HOLX, Iris/IRIS, Lifecell/LIFC, Nurometrix/NURO, Palomar Technology/PMTI, Quality Systems/QSII, Stericycle/SRCL, Varian Medical/VAR, and many, many others. As I am already long many of these mentioned, in all fairness (and as previously stipulated), I want to bring to your attention one I do not yet own.

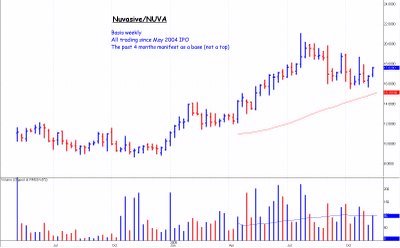

NuVasive/NUVA, a medical device company focused on developing products for minimally disruptive surgical treatments for the spine, announced today third quarter financial results for the period ended September 30, 2005.

Highlights:

* Generated revenues of $15.1 million - up 48.6% year-over-year

* Gross profit increased to $11.8 million - up 56.5% year-over-year

* Gross margin was 78.2% - up 400 basis points year-over-year

* Surgeons trained on MAS(TM) Platform totaled 99 - up 59.7% year-over-year

* Sales force exclusivity increased to 30%, up from 21% from the prior quarter

* Launched five new products within MAS Platform for a total of nine in 2005

* Acquired NeoDisc(TM) cervical disc replacement device

* Acquired dynamic stabilization technology and launched first product as ExtenSure(TM)

[click to enlarge]

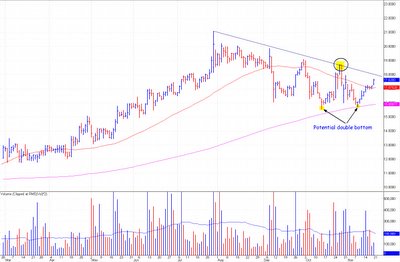

Let us examine more closely this presumed base...

1) Note the duration of the base - now ~4 months;

2) Note the separation of time between the high trade and the subsequent low trade - almost precisely 3 months;

3) Note the diminution of the downtrend during the past ~5 weeks, itself a transition from left side (decline) to middle (base) of this pattern;

4) Note the potential (and probable) double bottom, which would be confirmed at a trade -- and preferably a close -- above $18.70 (each highlighted in the chart);

5) Note the looming breakout above the correctly identified trend line of declining tops, at ~$18;

6) Note the low and reversal on 8 November, which likely represents the turn from intermediate term decline to intermediate term rally.

These items I denote above showcase a stock close to its moment of reversal -- in both time and price; moreover, this moment likely represents a low risk, high return entry point. However, as this stock trades more thinly (less average daily volume) than I typically prefer, I will downsize accordingly my position interest. I will, however, purchase one lot today.

Questions...?

<< Home