The Fed, the yield curve, and the economy - no recession signal

The comments that follow are from Scott Grannis, Chief Economist at Western Asset Management...

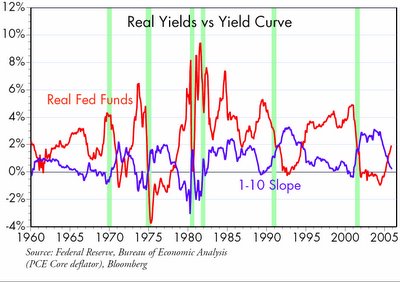

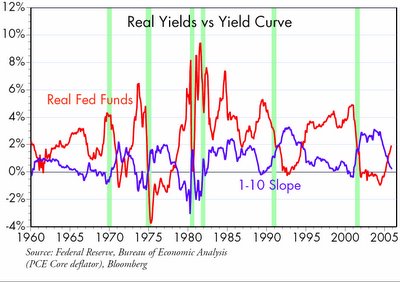

There has been much hand-wringing among analysts over the flatness of the yield curve and what this portends for the economy. Since every one of the past six recessions going back to 1970 has been preceded by an inversion of the yield curve, today's very flat curve is thought to signal that at the very least the economy is likely to slow meaningfully in the next year or so. As the chart shows, however, it probably takes more than an inverted yield curve to hurt the economy: it also takes very tight monetary policy in the form of a real Fed funds rate that is 4% or higher. Today's 2% real funds rate doesn't qualify. The Fed is not very tight today, and the curve is not inverted, so there's no reason to expect anything like a recession (at least by this method) in the near future.

Note: I am using the spread from 1-year to 10-year Treasuries to measure the slope of the yield curve, and the Core PCE deflator to measure inflation. Using the headline PCE deflator would give the same result, but the real Fed funds rate today by that measure is less than 1%, and that would suggest that any significant economic slowdown is even further out on the horizon. If we assume that the PCE deflator (core and headline) is likely to be somewhere in the range of 1.7 - 3% for the near future, it would take a nominal Fed funds rate of 5.75 - 7%, plus an actual inversion of the curve, to signal that a recession was likely within the next year.

There has been much hand-wringing among analysts over the flatness of the yield curve and what this portends for the economy. Since every one of the past six recessions going back to 1970 has been preceded by an inversion of the yield curve, today's very flat curve is thought to signal that at the very least the economy is likely to slow meaningfully in the next year or so. As the chart shows, however, it probably takes more than an inverted yield curve to hurt the economy: it also takes very tight monetary policy in the form of a real Fed funds rate that is 4% or higher. Today's 2% real funds rate doesn't qualify. The Fed is not very tight today, and the curve is not inverted, so there's no reason to expect anything like a recession (at least by this method) in the near future.

Note: I am using the spread from 1-year to 10-year Treasuries to measure the slope of the yield curve, and the Core PCE deflator to measure inflation. Using the headline PCE deflator would give the same result, but the real Fed funds rate today by that measure is less than 1%, and that would suggest that any significant economic slowdown is even further out on the horizon. If we assume that the PCE deflator (core and headline) is likely to be somewhere in the range of 1.7 - 3% for the near future, it would take a nominal Fed funds rate of 5.75 - 7%, plus an actual inversion of the curve, to signal that a recession was likely within the next year.

<< Home