Consumer price inflation still elevated

-- David M Gordon / The Deipnosophist

================================

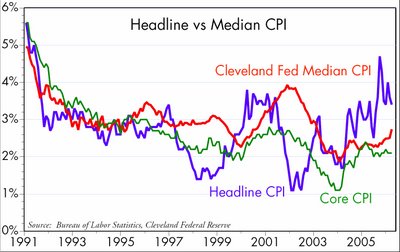

Since inflation pressures started rising in mid-2003, there have been two consistent themes: headline inflation has been in the 3-4% range, while core inflation has been hugging 2%. The difference is almost completely explained by oil prices, which have more than tripled over the past four years. The Fed has insisted that the core measure of inflation is the only thing that matters, and since core inflation hasn't moved higher, both the Fed and the market have breathed a sigh of relief. Energy prices are apparently not being passed along to other prices. Once oil stops going up, headline inflation should head back down and everything should be fine.

But will it? The attached chart adds the "median CPI," as calculated by the Cleveland Fed, to the mix. The "core" measure of inflation takes energy and food prices out of the calculation, since they are the most volatile components of the CPI on a month-to-month basis. The "median" CPI takes all of the things that have either gone up a lot or down a lot out of the mix, and focuses on what those in the middle are doing. This is supposed to do a better job of picking up underlying trends than either the core or the headline measure, but nothing's perfect. Whatever the case, the median CPI has moved up of late, suggesting that maybe higher energy prices are finding their way into other things.

[click image to enlarge]

[click image to enlarge]One of the more interesting features of the commodity price landscape in recent years has been the very strong and positive correlation between energy prices and non-energy industrial commodity prices. All prices have gone up, and they continue to rise. Higher energy prices are not crowding out prices for industrial metals, for example; indeed, copper has more than doubled in just the past year. This contrasts to the negative correlation that existed between these price groups in the late 1990s, when monetary policy was restrictive. If monetary policy is still accommodative, as the rising prices of gold, energy and most industrial commodities suggest, then a cessation of energy price inflation might provide more leeway for non-energy prices to rise in the future.

<< Home