Federal revenues still robust, but Fed looking for a slowdown

-- David M Gordon / The Deipnosophist

===============================

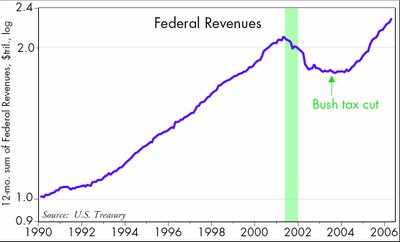

Federal revenues continued to surprise on the upside last month. Indeed, the surge in taxes paid to the Treasury has no historical equal. Revenues have soared almost 10% in inflation-adjusted terms for fully two years now. As a result, the deficit over the past 12 months has fallen to $265 billion, down sharply from its high of $455 billion two years ago, and it now represents a mere 2% of GDP. The Bush tax cuts were likely contributors to this outstanding performance, so it is a great relief to know that Congress has finally agreed to extend the cuts for another two years (through 2010). Fantastic growth in corporate profits, personal incomes, and capital gains are the drivers behind this revenue gusher. Not surprisingly, the Dow Industrials index is within inches of reaching a new all-time high, and the Dow Transports index is well into record-high territory. Reflecting robust demand conditions globally, commodities continue to move broadly higher. (Sugar has tripled in the past two years, copper has tripled, oil has almost doubled.)

What is perhaps surprising is that despite all this good news on the economy, both the bond market and the Fed are expecting the economy to slow down. The FOMC made its case explicitly today, citing as reasons for a slowdown a "cooling" of the housing market (which has indeed been slowing for almost one year now), the drag of expensive energy, and the lagged effects of higher interest rates. A relatively flat yield curve is the bond market's way of predicting a slowdown, since it assumes that the Fed will not need to raise rates much further if the economy slows. The slowdown that is supposedly just around the corner is very important, because it is assumed that a slower economy will reduce the inflation pressures that are being signalled by $700 gold and a weaker dollar.

Thus we have the makings of a double bank shot in the bond market. Not only is the economy expected to slow, but that slowing is expected to reduce inflation pressures. Both assumptions need to be right, but both assumptions run counter to current evidence. If either assumption is wrong, the Fed is likely to continue to raise rates.

<< Home