Jobs market still healthy

The following commentary is by Scott Grannis, Chief Economist at Western Asset Management.

-- David M Gordon / The Deipnosophist

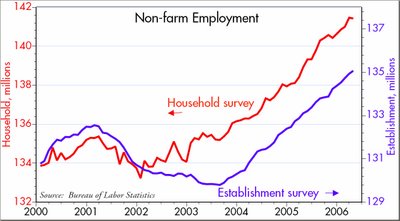

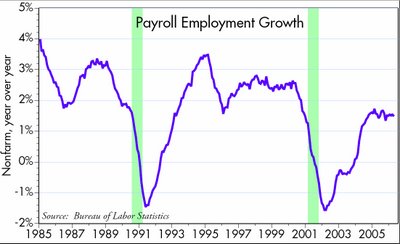

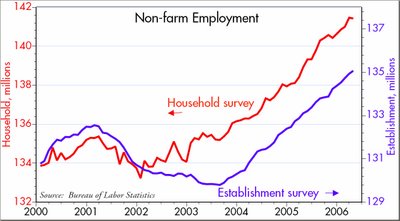

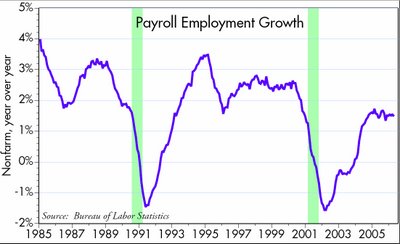

Bonds perked up this morning on news that payrolls rose only 138K instead of the expected 200K. But as the charts show, the April numbers were well within the range of normal fluctuations. The trends in place for jobs remain intact. Overall, jobs continue to grow by 1.5% per year, and private sector jobs continue to grow by 1.6% per year (government jobs are up only 0.6% in the past year). The 4-week average of weekly unemployment claims has risen a bit in the past few months, but from very low levels. Claims over the last six months are down at a 14% annual rate, about the same rate that prevailed through February. The labor force is growing a bit over 1% a year, so if current trends continue, the jobs market should tighten gradually and the unemployment rate should decline slowly. I see no sign yet of any slowdown in the jobs market, and the unemployment rate remains at a relatively low 4.7%.

[click on images to enlarge]

[click on images to enlarge]

-- David M Gordon / The Deipnosophist

Bonds perked up this morning on news that payrolls rose only 138K instead of the expected 200K. But as the charts show, the April numbers were well within the range of normal fluctuations. The trends in place for jobs remain intact. Overall, jobs continue to grow by 1.5% per year, and private sector jobs continue to grow by 1.6% per year (government jobs are up only 0.6% in the past year). The 4-week average of weekly unemployment claims has risen a bit in the past few months, but from very low levels. Claims over the last six months are down at a 14% annual rate, about the same rate that prevailed through February. The labor force is growing a bit over 1% a year, so if current trends continue, the jobs market should tighten gradually and the unemployment rate should decline slowly. I see no sign yet of any slowdown in the jobs market, and the unemployment rate remains at a relatively low 4.7%.

[click on images to enlarge]

[click on images to enlarge]

<< Home