They shoot horses, don't they?

[click on image to enlarge]

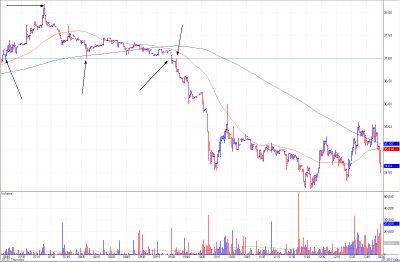

Remember, today's trading, including after hours trades (after the news release), qualified as an inflection point or seminal moment. I explained yesterday why that is. Thus, I was busy today watching the intra-day periodicities for subtle clues. And I got precisely that, with the reversal bar at $38+. I did not sell immediately, however, because what then followed might prove to be only intra-day volatility. So instead I drew a line in the sand at $37 -- the important albeit not crucial breakout level that should be support. As soon as that level failed, I entered market orders for clients and me. I filled between $36.75 and $36. Trading was sloppy (a rapid decline) immediately subsequent to breaching that level, as the chart above shows.

These sales proved to be the correct action, as the stock was annihilated in after hours action in response to comments from the conference call re future revenues. But an investor never knows that an oscillation is something more than mere intra-trend volatility; even a confirmed breakdown could retrace the breakdown. In the case of RACK, however, the breach was valid, true, and correct. Ouch! See chart below...

The chart above shows only after hours trading (well, it includes the final minutes of the regular session in the left margin). The trend lines circumscribe the former band of support between $34 and $32. Note the sudden plummet when $32 failed.

The truth of the matter is that, in re RACK's pattern, I am wrong. Horribly so. Nonetheless, traders and investors could have sold profitably (at $36+, as I did in anticipation of a breach), or breakeven (in after hours trading) when the breakdown was confirmed. The plummet is due to everyone scurrying for the exit at the same time. But waiting for the breach is just another quest for certainty.

By selling when I did, I was lucky. But only in retrospect. The shares could have gone the other way. When I saw the stock fail again at resistance (today's lower high), the reversal bar at that high trade, and the breach of important support, I sold. At that moment, I reasoned I would rather forego the opportunity for a profitable trade than lose money. I could always re-enter the position, although at a likely higher price. I figured that a breakdown would result in a plummet, whereas a breakout would result in more meandering albeit at higher prices while the base completed itself. Too, I struggle never to allow a profitable position to become instead a loss. This effort requires diligence -- or entering orders at pre-assigned levels.

This entire post, upon re-reading, seems like an elaborate defense of my stupidity. That is not my intent, however. What is my intent is to perform a necropsy of this 'dog' to show you what went wrong, how you could protect yourself, and how experience provides wisdom. At some point, science (charting, etc) leaves the scene and art enters. The art of interpretation, itself based upon experiential wisdom.

I was lucky to escape the wrath of an angry market. I hope you were as well.

-- David M Gordon / The Deipnosophist

<< Home