Federal budget update - deficit shrinks to 1.6% of GDP

btw, consider these commentaries as an exclusive, as they are distributed only to a small roster of Scott's clients... and you. Thanks to Scott's generosity.

-- David M Gordon / The Deipnosophist

=================================

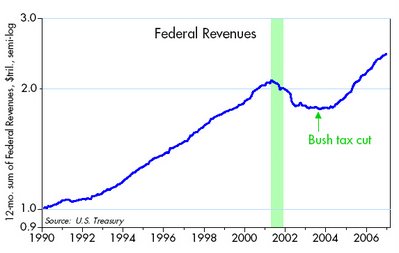

The dynamics of the Laffer Curve continue to dominate the federal budget. Lower tax rates, especially the 15% tax on capital gains and dividend income, helped fuel a strong economy that generated tax revenues that far exceeded even the optimists' expectations. Revenues are up at a 9% annual rate since the Bush tax cuts that took effect in the middle of 2003, and they have soared at a 12.8% annual rate over the past two years. And although the growth rate of revenues has slowed to a 7.8% pace in the past six months, that's still faster than the growth of nominal GDP, which has slowed as well.

[click on each graph to enlarge]

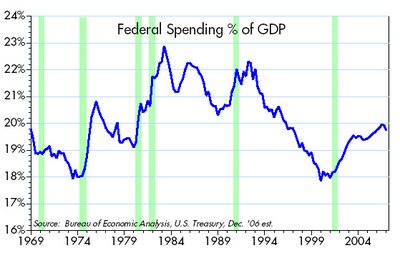

[click on each graph to enlarge]Meanwhile, contradicting the popular notion that Bush has allowed government spending to grow virtually unchecked, federal spending as a percent of GDP did not increase at all last year, and today it is approximately equal to the average of the past 40 years. That's not too bad, considering all the money that has been spent on the Iraq war and Congressional earmarks.

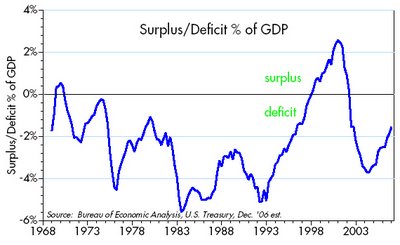

The combination of strong growth in revenues and moderate growth in spending has resulted in a deficit that has shrunk from what was projected to be more than 4% of GDP per year for as far as the eye could see, to a mere 1.6% of GDP in 2006. Instead of the $400-600 billion annual deficits that were initially projected by Bush's critics, last year's deficit was just $209 billion. That's approximately equal to the annual interest cost of the federal government's $4.9 trillion debt owed to the public, which means that the supply of Treasuries held by the public is no longer expanding. In fact, the supply of Treasuries has actually shrunk by $30 billion since the end of November, according to the Bureau of the Public Debt.

These impressive figures argue strongly for resisting any calls to increase taxes. It just ain't necessary, and higher tax rates could cause a painful reversal of the budget progress that has been made so far.

Labels: Economics

<< Home