Jobs still growing at a moderate pace

-- David M Gordon / The Deipnosophist

================================

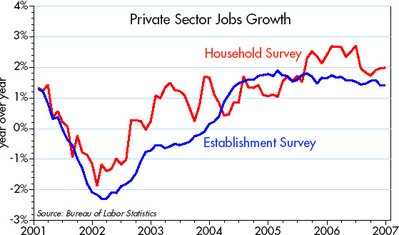

Today's jobs number was more than the bond market had been expecting (+167K vs +100K, plus a modest upward revision to prior months), but it doesn't reflect any change in the underlying dynamics of the labor market. Jobs are growing about 1.5-2% per year, as they have been for the past several years. The household survey continues to report stronger growth than the establishment survey, probably because it is better able to capture those who have left traditional businesses for more entrepreneurial ventures or to work for themselves. But in either case, jobs are growing at a fairly moderate but steady pace, and there is no sign of any deterioration or spillover from the still-weak residential construction sector. Jobs that are being shed in residential construction are being picked up by other sectors--the dynamic U.S. economy is managing to adjust fairly well, which shouldn't be too surprising.

[click on graphs to enlarge]

[click on graphs to enlarge]Although jobs growth is largely unchanged in recent years, economic growth has "downshifted" from the 3.5% pace of 2003-2005 to the 2-2.5% pace of recent quarters because labor productivity has declined. The decline in productivity may be due in part to the return of pricing power in certain sectors of the economy; some businesses find that it is easier to boost profits by raising prices than it is by investing in things which boost productivity. Labor is pretty productive as it is, though, since corporate profits are as strong relative to GDP as they have ever been.

With the unemployment rate down to 4.5%, the labor market is gradually tightening up, and average hourly earnings are growing at just about the fastest rate since the late 1970s/early 1980s. Is this incipient "wage inflation?" Or simply labor finally beginning to enjoy a bigger (and well-deserved) share of the profits pie? At the very least it's enough to give the Fed pause. Certainly there is no case for reducing rates at this point, and if current trends continue, the Fed would likely consider raising rates.

Labels: Economics

<< Home