... On the other hand, part 2

A reader writes in reply to part 1 of this post...

An example of a former leader due for a setback (and previously warned) is favorite, Under Armour/UA. I note that Barron's 'non-bearishness' endures only so long before the magazine decides to take another of its typical (pot)shots...

And continuing where I left off in the part 1, I see I failed to reply to this question...

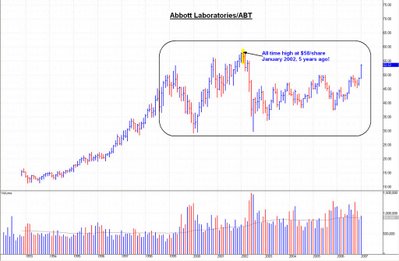

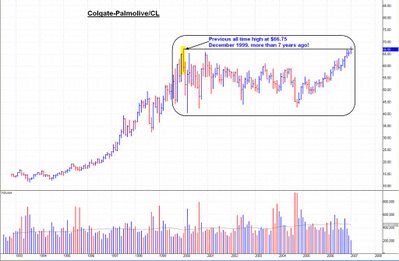

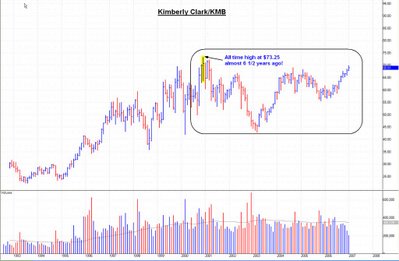

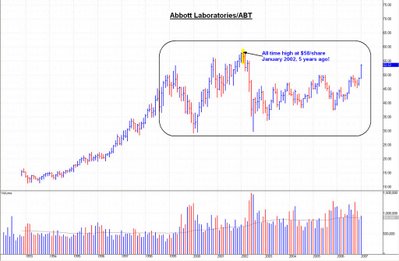

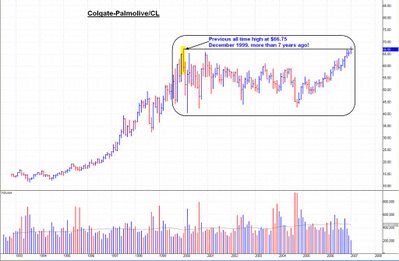

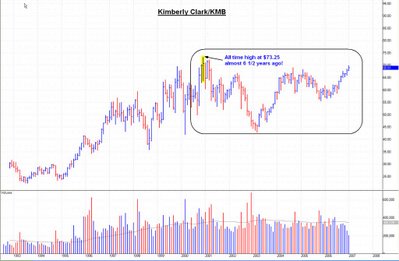

What follows are 13 stock charts of Tier 1 companies that I favor as investment opportunities right now -- of companies with earnings, increasing as their business increases and with high quality executives. Many of these companies will be familiar to regular readers. I selected 13 companies for the silly reason that each chart shows ~13 years of historical data. (Each bar = 1 month of trading activity.) Each picture speaks for itself; thus, each chart is lightly annotated, if at all. I prefer you to ignore the squiggles (short term oscillations), and instead see the big picture. As always, some moments manifest as better moments to purchase than others; nonetheless, each chart is very bullish long term. Most remain in massive bases (a high level consolidation, to be precise), but near their crucial breakouts. Some already have broken out to new all time highs (GIS, JNJ, PEP, etc). And some trade nearer the lows of their bases (KO). Colgate/CL, as only one example, looks especially promising -- yet to emerge from a profoundly bullish base but very near to doing so... (Click on each chart to view enlarged.)

JNJ qualifies as my poster child for the picture-perfect growth stock. Do not believe me, however; instead look for yourself at a chart that goes back even farther in time than merely 13 years.

Can you find others...? Please offer your favorite opportunities (specifically, large cap value trading in a high level consolidation of many years) and share here as a reply to this post.

-- David M Gordon / The Deipnosophist

Thought that was all very well stated. I share your concerns, as I did before. Just feels like there's a lot of complacency everywhere I turn. I was particularly struck by the fact that there was not one single bearish strategist in Barron's when it came to their forecast for '07. Not one. I think there's a reasonable chance that we will see a highly bifurcated market with high PE growth stocks getting hammered while more defensive big caps hold up reasonably well, but there's no guarantee of that either. I agree completely with your bottom line: Hold only investment positions.This second part is about the opportunities that keep cropping up, despite the markets' many oscillations of price. I note, and have mentioned, that institutional monies now move to large cap value opportunities. This becomes easily apparent when gazing at the truly long term charts. See charts below for some examples of what appear to me to be the market's newest new leaders. That is, as the former leaders lead the market down, the new leaders will lead it up, ending in a wash. Well, almost. The coming correction, after a scary initial decline, should settle into basing mode, as institional money continues its transition to these new leaders.

An example of a former leader due for a setback (and previously warned) is favorite, Under Armour/UA. I note that Barron's 'non-bearishness' endures only so long before the magazine decides to take another of its typical (pot)shots...

Barron's reports based on almost every valuation metric, investors are paying too much for Under Armour/UA. The stock is selling for more than 80 times its earnings of the past 12 months, and 53 times the 96 cents a share analysts are projecting for this year. That p-e ratio is 2.76 times the rate of earnings growth. In contrast, Nike/NKE, with a market value 14 times Under Armour's, is selling for 17 times this year's earnings and at just 1.16 times earnings growth. There's a good case that the stock ought to be no higher than the low 40s, about 12% below current levels. And if the still-young co stumbles in managing its growth, the shares conceivably could fall much further. Under Armour, for its part, has been diversifying into athletic footwear, including football cleats, to ward off competition. But that's a famously crowded arena, one likely to crimp margins. Concludes Brady Lemos, an analyst at Morningstar: "We believe the market's rich valuation of Under Armour is based on lofty revenue and profit-growth projections that will be difficult to sustain as the business matures."Yes... perhaps. I suppose the stock will get spanked on the opening; the question remains whether it breaches support at ~$48. Should it do so, a decline toward $43-41 would offer a tremendous opportunity. But then this possible and potential decline is nothing new. Those with cash waiting for this opportunity could receive a gift within the coming days and weeks.

And continuing where I left off in the part 1, I see I failed to reply to this question...

I notice that the earnings aren't so historically good with Isis Pharmaceuticals/ISIS, and occasionally some other stocks that you mention. How big of a part does that play in your evaluations?What can I say...? An excellent question, but predicated on a horrible misunderstanding of my methodology re investing. So my reply is simply that, yes, earnings are important. By the time positive earnings (surprises) or negative earnings (surprises) are announced, however, the stock has already made a good portion of the move in anticipation.

What follows are 13 stock charts of Tier 1 companies that I favor as investment opportunities right now -- of companies with earnings, increasing as their business increases and with high quality executives. Many of these companies will be familiar to regular readers. I selected 13 companies for the silly reason that each chart shows ~13 years of historical data. (Each bar = 1 month of trading activity.) Each picture speaks for itself; thus, each chart is lightly annotated, if at all. I prefer you to ignore the squiggles (short term oscillations), and instead see the big picture. As always, some moments manifest as better moments to purchase than others; nonetheless, each chart is very bullish long term. Most remain in massive bases (a high level consolidation, to be precise), but near their crucial breakouts. Some already have broken out to new all time highs (GIS, JNJ, PEP, etc). And some trade nearer the lows of their bases (KO). Colgate/CL, as only one example, looks especially promising -- yet to emerge from a profoundly bullish base but very near to doing so... (Click on each chart to view enlarged.)

JNJ qualifies as my poster child for the picture-perfect growth stock. Do not believe me, however; instead look for yourself at a chart that goes back even farther in time than merely 13 years.

Can you find others...? Please offer your favorite opportunities (specifically, large cap value trading in a high level consolidation of many years) and share here as a reply to this post.

-- David M Gordon / The Deipnosophist

Labels: Market analyses

<< Home