"Capital spending, strong economy, and rising inflation pressures"

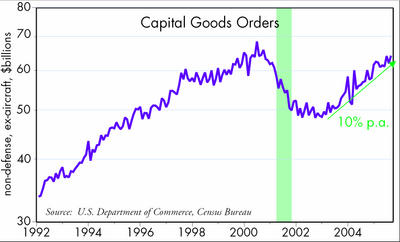

"Orders for new capital goods have been robust (growing at double-digit rates) since the second half of 2003, which not coincidentally was just after the Bush tax cuts that slashed taxes on capital. The tax on dividend income and capital gain is by far the lowest it has been in our lifetimes. As Art Laffer says, tax something less and you will get more of it.

"Capital spending provides the bedrock for increased productivity in the future, and that will contribute significantly to keep the economy growing. Strong capital spending also confirms that business profits are robust and business confidence in the future is fundamentally sound. This adds up to a solid reason for expecting the economy to continue to grow at reasonably healthy rates, despite high energy prices."

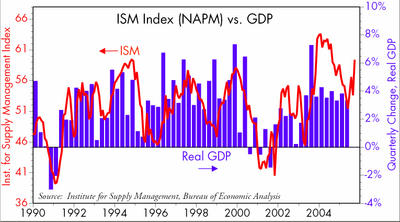

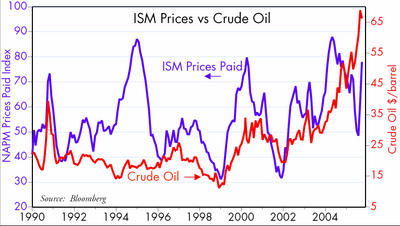

"The September reading on the Institute for Supply Management's manufacturing index was much stronger than the market expected (59.4 vs. 52) and robust overall despite the Katrina disaster. Strength was broad-based, and upward price pressures were significant. The bond market has been priced to a slowing economy and inflation that was "contained," but the ISM's numbers combined with the fact that prices for most non-energy commodities are rising suggest that higher energy costs are "spilling over" into the rest of the economy, thus increasing the risk that core inflation will exceed the Fed's tolerance band of 1-2%.

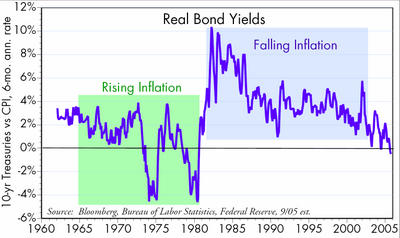

"In the market's output-gap view, the economy's surprising strength is the culprit behind inflationary pressures. In contrast, we have been concerned about rising inflation pressures for about two years now, in the belief that sensitive market-based indicators of monetary imbalances have been signalling that money was easy: the dollar has been generally weak, real yields have been low, gold prices have been rising, most commodity prices have been rising, and tangible assets in general have been rising. It is thus not surprising to see that higher energy prices are beginning to be passed on. If the Fed were tight, higher energy prices would force other prices to decline, but so far we have not seen any evidence of this outside of the auto sector."

<< Home