GDP growth moderate, Fed on hold

-- David M Gordon / The Deipnosophist

================================

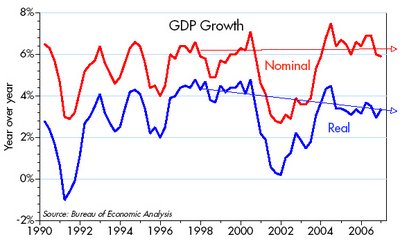

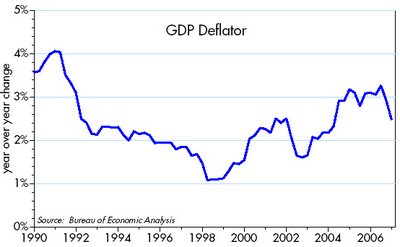

The economy grew at a 3.5% rate in the fourth quarter, a bit stronger than expected. Growth for the year was 3.4%, just a hair above the economy's long-term average growth rate of 3.1%. Thanks to a big decline in energy prices, all measures of inflation were low, with the GDP deflator registering only 1.5% for the quarter. Not too bad, overall, and much better than the market had feared just a few months ago.

But as the charts below suggest, if we abstract from the quarterly ups and downs in the data, and ignore the mild recession in 2001, there has been a modest but gradual increase in inflation in recent years, and a modest but gradual reduction in the economy's growth rate. Neither of these trends is significant enough to be alarming, however, which is one reason the FOMC today made no change to its funds rate target for the 5th consecutive meeting. In the Fed's view, the slowing trend in growth, if it continues, would likely contribute to lower inflation in the future, but in the meantime they worry that "resource utilization" rates are relatively high (e.g., the labor market is relatively tight with an unemployment rate of only 4.5%) and this could contribute to inflation. So for now they will most likely just stand pat and wait to see how things develop, and it could take at least another 3-6 months before anything changes by enough to make a difference.

[click on each chart to enlarge]

[click on each chart to enlarge]

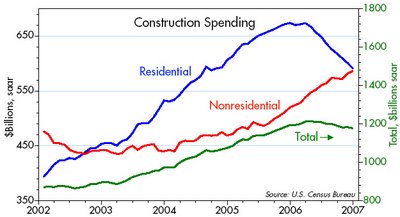

Residential construction was the only significant drag on growth, subtracting 1.2%, but as the next chart shows, much of the decline in the residential sector in the past year has been offset by strength in nonresidential construction. Today's FOMC statement noted, as we have also, "tentative signs of stabilization" in the housing market; if housing should indeed recover later this year, that could result in stronger growth and a more concerned Fed.

Bond bears thus have two things to watch for as the year progresses: a growth surprise and/or renewed signs of a gradual upcreep in inflation. Bulls, on the other hand, will be rooting for an economic slowdown and declining inflation.

Labels: Economics

<< Home