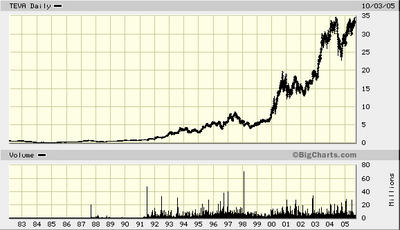

Lift-off

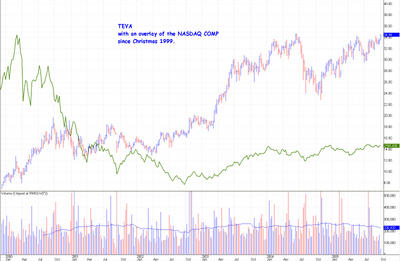

[chart courtesy of Big Charts.com]

This overlay chart (below) shows especially clearly how much stronger TEVA has been than the NASDAQ Composite...

Teva Pharmaceuticals/TEVA principal activities are the development, production, marketing and distribution of two types of products:

PHARMACEUTICALS - development, manufacturing and selling of medicines in various dosages and forms, disposable of hospital products and equipment for hospital use and veterinary products, and

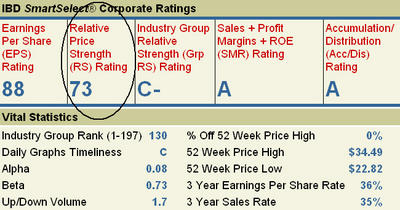

ACTIVE PHARMACEUTICAL INGREDIENTS (API) - development, manufacturing and selling of API for the pharmaceutical industry, including the Group's Pharmaceutical segment. That Relative Strength rating of (only) 73 (circled above) should improve as the stock breaks out above $35, and then trends higher.

That Relative Strength rating of (only) 73 (circled above) should improve as the stock breaks out above $35, and then trends higher.

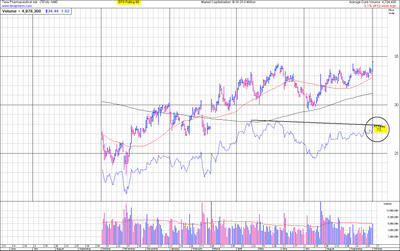

Q3 earnings release date could be as early as Halloween, Monday, 31 October. Based on the charts below, I suspect this report will be more treat than trick... A high EPS ranking and a middling RS ranking = nowhereland; at least until now. Both price and relative strength now appear set to move concurrently into all time highs.

A high EPS ranking and a middling RS ranking = nowhereland; at least until now. Both price and relative strength now appear set to move concurrently into all time highs.

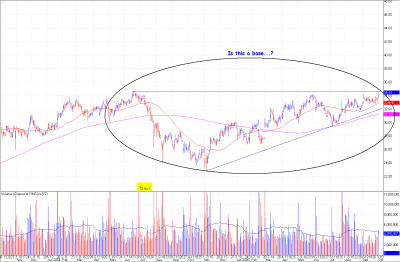

This base, if it is a base (and it looks like one to me!) counts to $50 as a minimum, initial objective... It also appears that the shares began to break out yesterday, albeit sans explosive volume. Therefore watch today for total volume, number of large blocks, a heightened state of trading activity, and a multiple breakout at $35, including PnF.

It also appears that the shares began to break out yesterday, albeit sans explosive volume. Therefore watch today for total volume, number of large blocks, a heightened state of trading activity, and a multiple breakout at $35, including PnF.

If the volume and type of activity I seek does appear, then I am a buyer today, or soon thereafter. TEVA has the appearance of "All systems GO!" for a successful lift-off.

<< Home