Jobs market -- steady but unspectacular gains

The following comments are from Scott Grannis, the always-insightful Chief Economist at Western Asset management.

-- David M Gordon / The Deipnosophist

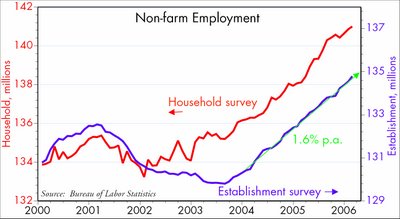

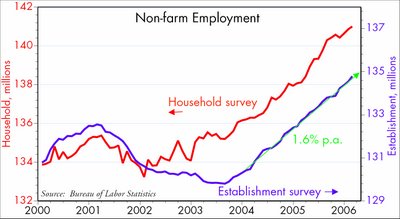

The U.S. economy has been creating jobs at about a 1.7% annual pace for more than two years, and there is no sign that things are changing. It's not as exciting as the late 1990s, when jobs grew by 2.5% per year for four years, but jobs today are growing a bit faster than the labor force, so the unemployment rate should inch down a bit further as the year progresses, despite the slight uptick from 4.7% to 4.8% in February.

It's reassurring that this growth in jobs has very little to do with government spending, since government payrolls have been rising by less than 1% a year for the past three years. This contrasts notably to the 2-3% annual growth in government payrolls in the 1999-2000 period.

As the labor market gradually tightens, hourly earnings have been rising a bit faster. Earnings were up 3.5% in the 12 months ended February, the fastest pace since 2001, and almost as fast as the 3.5-4% pace of the booming 1997-2000 period.

All this paints a picture of an economy that is healthy but not booming and a labor market that is very gradually tightening but not on fire. With the housing market gradually slowing down, the market is envisioning a "soft landing" scenario in which growth and labor market conditions settle into a somewhat slower, but steady-state pace by late summer, prompting the Fed to conclude that a 5% funds rate is sufficient to keep inflation and the economy under control for the foreseeable future. In short, from the looks of things today, we are only 50 bps away from Fed funds nirvana.

-- David M Gordon / The Deipnosophist

The U.S. economy has been creating jobs at about a 1.7% annual pace for more than two years, and there is no sign that things are changing. It's not as exciting as the late 1990s, when jobs grew by 2.5% per year for four years, but jobs today are growing a bit faster than the labor force, so the unemployment rate should inch down a bit further as the year progresses, despite the slight uptick from 4.7% to 4.8% in February.

It's reassurring that this growth in jobs has very little to do with government spending, since government payrolls have been rising by less than 1% a year for the past three years. This contrasts notably to the 2-3% annual growth in government payrolls in the 1999-2000 period.

As the labor market gradually tightens, hourly earnings have been rising a bit faster. Earnings were up 3.5% in the 12 months ended February, the fastest pace since 2001, and almost as fast as the 3.5-4% pace of the booming 1997-2000 period.

All this paints a picture of an economy that is healthy but not booming and a labor market that is very gradually tightening but not on fire. With the housing market gradually slowing down, the market is envisioning a "soft landing" scenario in which growth and labor market conditions settle into a somewhat slower, but steady-state pace by late summer, prompting the Fed to conclude that a 5% funds rate is sufficient to keep inflation and the economy under control for the foreseeable future. In short, from the looks of things today, we are only 50 bps away from Fed funds nirvana.

<< Home