Volatility is extremely low

Scott Grannis re stocks and bonds volatility...

The economy has been growing at a moderate pace for 10 quarters. The Fed has been tightening in a well-publicized and nonthreatening manner for the first time ever. The labor market has been growing at a steady, moderate pace for two years and tightening ever so gradually. The economy has weathered $65 oil, $3 gasoline, and $14 natural gas without skipping a beat. The bond market has enjoyed the longest period of relatively stable bond yields since the early 1960s. Corporate profits have been very strong for over four years. The global economy has been in good shape for years, emerging market economies are once again prosperous, and Japan has finally broken out of its deflationary funk. Outside of GM and Ford, there have been no nasty surprises to rock the markets since 2002. On balance, the economy has been stronger than expected, the news has been better than expected, and a "soft landing" scenario seems plausible and within reach.

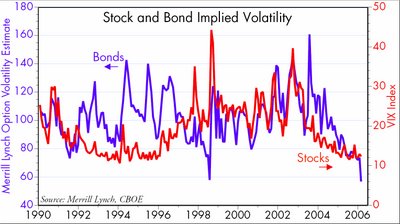

The flat yield curve says that the Fed will stop tightening soon and interest rates will be just south of 5% for as far as the eye can see. And the fact that implied volatility in bond options is as low as it has ever been in recorded history (which, by the measure used in the chart, goes back to 1988) means that the market is very confident that not much is ever going to happen to any of the major economic and financial market variables.

The economy has been growing at a moderate pace for 10 quarters. The Fed has been tightening in a well-publicized and nonthreatening manner for the first time ever. The labor market has been growing at a steady, moderate pace for two years and tightening ever so gradually. The economy has weathered $65 oil, $3 gasoline, and $14 natural gas without skipping a beat. The bond market has enjoyed the longest period of relatively stable bond yields since the early 1960s. Corporate profits have been very strong for over four years. The global economy has been in good shape for years, emerging market economies are once again prosperous, and Japan has finally broken out of its deflationary funk. Outside of GM and Ford, there have been no nasty surprises to rock the markets since 2002. On balance, the economy has been stronger than expected, the news has been better than expected, and a "soft landing" scenario seems plausible and within reach.

The flat yield curve says that the Fed will stop tightening soon and interest rates will be just south of 5% for as far as the eye can see. And the fact that implied volatility in bond options is as low as it has ever been in recorded history (which, by the measure used in the chart, goes back to 1988) means that the market is very confident that not much is ever going to happen to any of the major economic and financial market variables.

[click image to enlarge]The last time volatility was this low in the bond market was just before the Russia/LTCM crisis in the summer of 1998. Low volatility and high confidence lead some to take riskier and riskier positions. If the future doesn't turn out to be as placid as expected, these positions can cause much pain and suffering, and unwinding them can cause prices to gyrate as volatility spikes. Recall the bloodbath in the second half of 1998. Whether another such unpleasant event is just around the corner is hard to say, but the market is exceptionally vulnerable to the unexpected at this juncture. (Italics mine -- dmg)

[click image to enlarge]The last time volatility was this low in the bond market was just before the Russia/LTCM crisis in the summer of 1998. Low volatility and high confidence lead some to take riskier and riskier positions. If the future doesn't turn out to be as placid as expected, these positions can cause much pain and suffering, and unwinding them can cause prices to gyrate as volatility spikes. Recall the bloodbath in the second half of 1998. Whether another such unpleasant event is just around the corner is hard to say, but the market is exceptionally vulnerable to the unexpected at this juncture. (Italics mine -- dmg)What could go wrong? The housing market could unwind too fast, pulling the economy down with it. Or the economy might just keep barrelling along, spooking the Fed into raising rates by much more than expected. Core inflation might start picking up. A weaker housing market, and weaker economy, and rising inflation might go hand in hand, since lower home prices could result in rising rental prices, and rents comprise almost one-third of the the CPI. This would be a particularly troubling combination of events, since the Fed would be in a very tough position: should they ease to cushion the economy, or should they tighten to arrest inflation? Whatever the case, when markets are as relaxed as they are now, it's time to start getting nervous.

<< Home