from the June 27, 2005 edition - http://www.csmonitor.com/2005/0627/p13s01-stin.html

The world's most intriguing company

By Gregory M. Lamb Staff writer of The Christian Science Monitor

MOUNTAIN VIEW, CALIF. - Impossible dream: Take all the books ever written, digitize them, and make them available to the world.

"We had all these cockamamie schemes for how we could get content," recalls Marissa Mayer, director of consumer Web products at Google. "We thought, well, could we just buy books? But then you don't get the old content. We thought maybe we should just buy one of every book, like from Amazon, and scan them all."

How long would it take to scan all the world's books? No one knew, so Ms. Mayer and Google cofounder Larry Page decided to experiment with a book, photographing each page so that it could be digitally scanned. "We had a metronome to keep us on rhythm for turning the pages. Larry's job was to click the shutter, and my job was to turn the pages," Mayer says. "It took us about 45 minutes to do a 300-page book."

With that ad hoc experiment, Google began its now controversial Digital Library project last December, signing agreements with the New York Public Library and the libraries of Stanford, Harvard, Oxford, and the University of Michigan to put their holdings online. Current projection: "Maybe inside of the next 10 years we'll have all the knowledge that's ever been published in book form available and searchable online," she says. "It's really a grand vision."

Grand vision seems to be the touchstone for the seven-year-old company, which earned more than $1.2 billion last quarter and is growing so fast and in so many directions that many observers are left scratching their heads. Just what is Google? Does the company itself even know? If it does, will its supersecret culture allow that vision to flourish?

Where the company's bread is buttered right now is clear: Nearly every one of its billions of dollars comes from selling advertising that appears when people search the Web using its ultrapopular search engine. With analysts saying more and more ads will be moving away from TV and print to online, Google would seem to have a bright future just doing what it's doing.

But Google has also become the world's biggest 'media' company, larger than TimeWarner, according to some, if a company can have that moniker without producing any original content. Others have their own ideas about what is, arguably, the most intriguing company on the planet.

"I think at its heart Google is a technology company," says David Edwards, an analyst at American Technology Research in San Francisco. "But it gets paid like a media company."

"They [Google] are a software company," proclaimed Microsoft's Bill Gates in a Fortune magazine article last month. "They are more like us than anyone else we have ever competed with."

"They're a little like a fetal stem cell," says Geoffrey Moore, a consultant to high-tech businesses and author of the popular management book "Crossing the Chasm," searching for a metaphor. "It could be an arm, it could be a head, it could be a leg." With a culture that stresses freedom and innovation, Google's "got lots and lots of possibilities" and may become "a lot of different businesses," he says.

The company's e-mail service, Gmail, and its new customized home page make Yahoo! a competitor. But as Google develops software, including a possible Web browser or a "thin client" that would allow more computing to take place on its servers instead of on individual desktops, it takes on Microsoft. Its new online payment service, which some have dubbed Google Wallet, would appear to rival eBay's successful PayPal, though Eric Schmidt, Google's chief executive officer, has denied that's the case. This week, a prominent eBay engineer starts work at Google.

"Google is in the position of being a lot of people's rivals, and that could be a potential problem for them," says Andy Beal, vice president of marketing at WebSourced, an Internet marketing firm in Morrisville, N.C., and editor of www.searchenginelowdown.com.

Developing a PayPal-type service could open up new opportunities and revenue sources, Mr. Beal says. The possibilities might include an auction service, a video-on-demand service, or even its own version of iTunes. Think about it, he says. "You'd use the world's best search engine to find music, and then use Google Wallet to pay for it."

Google's two guiding statements - "Do no evil" and "Organize all the world's information and make it universally accessible and useful" - say nothing overtly about computers, search engines, or ads.

But serving up advertising fits the mission because "we look at ads as information," says Tim Armstrong, vice president for advertising sales. Google believes it can target ads so specifically to each user that the ads will been seen as valuable content, not annoyances. After all, people like to read catalogs - collections of ads - points out Google cofounder Sergey Brin.

The more knowledge Google has about each user, the more it can make the online experience convenient and productive. But that also raises questions of privacy, and threatens to knock a leg out from under the company's "do no evil" edifice. To produce relevant ads, Google's computers must know what content is in the Web pages you visit and, in the case of Gmail, what's in your e-mail. A product to be launched shortly, Google Earth, will show detailed 3-D photos of much of the United States, right down to people's homes. Mr. Brin argues that these photos were previously available and not current, and don't provide enough resolution to threaten anyone's privacy.

Google's rush to put its brand on a slew of online services takes advantage of its "feel-good factor," Beal says. It already offers maps, a shopping guide, and specialized searches, such as news and images on the Web. The approach is similar to the way Richard Branson marketed his Virgin brand across a wide variety of products, he says.

But while it's busy pushing out products, the company doesn't seem to want to maximize its short-term financial gains. It regularly passes up opportunities to make money, Mr. Edwards says.

"Google is a very innovative company, but it's also managed in a very unconventional manner," he says. "We advise [investors] not to assume Google is going to launch any particular product [or try to make money from a product] until they do."

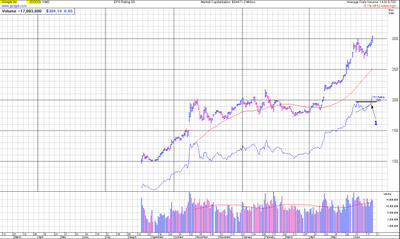

Among the company's quirks: not splitting its stock, which has soared from $85 to nearly $300 in less than a year, to make it more attractive, and not selling ads on its own ultrasimple home page (which contains what has been called the most valuable white space on the Internet). It also encourages employees to spend 20 percent of their time away from their usual work, experimenting with a project of their own choosing.

At a May "factory tour" for journalists and analysts, speakers were introduced with a "fun fact" about themselves. The job title for one employee, for example, is "Spam Cowboy and Porn Cookie Guy." Another, the visitors learned, is so obsessed with his job that he got married on his lunch hour.

The casual, fun-loving Silicon Valley image the company projects is hardly unique, Moore says. But it's combined, somewhat incongruously, with a tough attitude about its secrets - such as the algorithms it uses to index the Web.

"They do run a very tight ship," Beal says. "It's very difficult to get information out of anybody at Google."

But what's really remarkable about Google, Moore says, is how it's been able to stay in its protean "fetal state" much longer than most companies, which rush to define who they are and profit from it. "I think that's a testimony to its founding partners and to Eric Schmidt, who's doing everything he can to keep this freedom as long as he can."