Getting Out Just In Time

-- David M Gordon / The Deipnosophist

================================

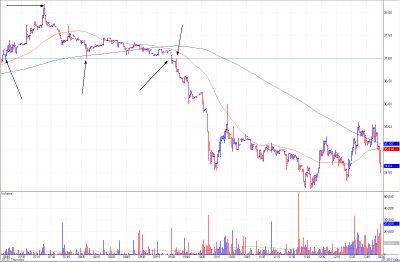

What is your tolerance for pain? Consider the following scenario. You have 10% of your account balance on the line. For the past two days, the stock has been going in the direction you had anticipated, but today, it was announced that materials for the company’s biggest selling product are now in short supply. The media has been covering the shortage, and the stock price has started to drop. All your profits were wiped out in an hour. What will you do? Sell? See if the price will recover? At times like these, it is useful to have a clearly defined trading plan with a specific exit strategy.

Trading is inherently uncertain. You never know exactly what will happen next. That’s what makes the business exciting to some traders but nerve wracking to others. How you handle adverse events that make a stock fall hard depends on your personality. The best way to protect your capital is to use protective stops. When formulating your trading plan, you must decide how much pain you can tolerate. How much money can you lose before you have to exit the trade? You can set this exit point as a formal stop loss, you can use the automatic settings on your trading platform to set a stop, or you can use a mental stop.

The problem with a formal stop loss procedure, whether it is a formal order or an automatic setting on your trading platform, is that a transitory change in price can “stop you out” if the placement of your stop loss does not adequately account for volatility. It’s hard to know how far a stock may move and a temporary drop can ruin your trading plan when a protective stop is not set properly. Mental stops may be more useful. You can decide how far a stock price must fall before you will sell. When the stock price reaches the exit point, you can decide whether the low price is transitory or represents a significant change in trend. You can then exit the trade.

This all sounds good in theory, but depending on your personality, you may not be able to carry out this strategy. If you have trouble controlling your emotions and you use a mental stop, for example, you may have trouble closing the trade when it reaches your exit point. Some people panic and out of fear don’t close their position when their mental stop is reached. These people may need to impose the proper amount of discipline on their trading actions by using an electronic stop or a formal stop-loss order.

Minimizing trading losses is the hallmark of successful trading, but not all traders are equal when it comes to their ability to trade decisively under strain. If you want to trade profitably, it is vital to work around your personality. If you are cool headed and disciplined even under the most stressful conditions, you can use mental stops to protect your capital. But if you are easily shaken by choppy market action, you might want to use electronic, automatic stops to protect yourself. Whatever you do, however, minimize losses as much as possible. It’s the only way to trade profitably in the long run.