"As far as your short term trading, how do you deal with being stopped out on a regular basis? Personally, I found it very frustating and one of the reasons I gravitated to a longer time horizon."

Because you are not specific, Ron, I must assume you refer to the always-present emotional anguish of trading. Of course, I understand your preference for the long term perspective: the greater the time frame = fewer bars on the chart = less signals = less noise = less frustration... Which, in the end, means less likelihood to make wrong decisions.

However, to me, no decision still = a decision. It does not matter whether you buy and are wrong, sell and are wrong, or stop out and are wrong. What does matter is whether you adhere to your guidelines. Otherwise your portfolio, and you, amount to little more than a weather vane...

The following comments are from Price Headley: If you identify that you are not yet performing at a level necessary to reach your trading goal, then you must take a "No Excuses" attitude to solve the problem. Once you tackle the issue, an immense growth and self-satisfaction tends to occur.

When you go through a trading slump, do you ever find yourself blaming something outside yourself? One of my favorites used to be blaming "the system" - "the system is rigged against me: the brokers are the only ones getting rich, the market makers are killing me on these bid/asked spreads, the guys getting in pre-IPO are getting the best prices," etc. When you blame an external situation, you give up control, and instead let yourself be controlled by outside events. This converts you from a proactive trader into a reactive trader. If you are reacting after the fact in the markets, you are in turn letting your emotions start to rule you, instead of planning how you will react to any set of circumstances. You know how letting emotions control you typically turns out in the markets -- badly.

Justifications and excuses are the hallmark of traders who consistently lose. Excuses seek to diminish the trader's responsibility for a losing trade, creating what psychologists call an "External Locus of Control." This means that the trader believes he is acted upon by events beyond his control. In comparison, a trader with a strong "Internal Locus of Control" believes he is responsible for every reaction that happens to each action he takes. When the trader feels external circumstances control his results, he will not tend to set goals (why should he? - the market will create the result for him), and the controlled trader will not apply as much effort to prepare or trade. This makes it nearly impossible for a trader to build self-confidence. How can you believe that your actions will succeed when events are totally out of your control?

Great traders take total responsibility for each action they take. They do not carelessly take actions to buy or sell. Such impulsive moves can destroy the trader's confidence. The successful trader knows that every action taken will produce a reaction, and actions taken with the probabilities on the trader's side will increase the odds of favorable reactions over time. You must believe that you control your own destiny. If you are not getting the results you expect of yourself, look inside yourself. Start analyzing your actions and behaviors: are you hanging on to losers too long? Are you cutting profits too soon? Are you not able to pull the trigger and then you watch helplessly as the stock roars on without you? These or other frustrations should clue you in that you need to fix some element of your trading plan, and you should make decisions and act immediately to find a proactive solution after evaluating your situation.

I do not suggest that you, or anyone, fails at these specific items, or any others. But these items apply in general because we each are human. So how do I deal with the exigencies of trading?

1) I acknowledge in advance that no matter the action I take, I will be wrong;

2) I take ownership for all [of] my decisions.

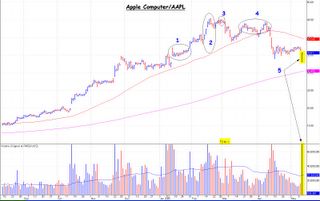

I shared previously a variation of this chart study:

[click to enlarge]

It is an overlay of the US$, NASDAQ COMP, and S&P 500. Note that the typical relationship changed in late-February 2003; as the US$ continued its decline, stocks instead traded up! This move was not limited to only the multi-national companies that would profit from the weaker $; perhaps it was a result of the horrendous broad market sell-off for the three years prior to Feb 2003. Whatever the prior relationship, I point out both the recent surprising strength in the US$ of late (well, a surprise to all but a handful of market seers) and the new intermarket dynamics. As the US$ gathers upside momentum, especially last week, the SnP trades down -- expected -- but now the NASDAQ trades up! Unexpected by most, there does exist a handful of market participants for whom seemingly random oscillations are anything but that, as these few recognize the market's continuum. This activity is part and parcel with a transitioning phase, something I have been alerting you to for months...

The understanding I share is manifold:

1) The market's dynamics always change;

2) That viewing a specific stock's chart in isolation of the market's continuum is limiting;

3) That the market's own trend can add wind to the sails of your individual stock selection;

4) To bolster your trading efforts requires the work of strategizing your trades; trades do not succeed in a vacuum

5) Always keep in mind the Holy Trinity of investing: vision, strategy, and tactics.

If, as occurs now in at least several specific periodicities, the market trends sideways to down, then the failure to include the market's trend in your trading efforts will lead to trading activity (or portfolio) failure. Consider, for example, Radiation Therapy/RTSX, a chart that I perceive as quite comely...

[click to enlarge]

The breakout above resistance at $20 (4 April) resulted in a quick move up to $25. Subsequent to this powerful breakout was the concomitant test of the breakout, followed by the expected test of the high, etc. (See area 1 in chart.) This testing in each direction results in a congestion pattern, or another base, and is to be expected. In fact, it builds as a particularly powerful ascending triangle -- note the higher high and higher low within the pattern. (See area 2.) This pattern builds because the market itself restrains RTSX from making bigger, quicker moves up in price. Depending upon your time frame, risk tolerances, and objectives, you can trade the pattern as it oscillates between ~$20 and ~$25; I do. It is helpful to know area patterns so as to know when to enter and exit, etc. (BTW, I purchased more RTSX this week at $21, because the data points are now in for a breakout from this pattern to... say, ~$30.)

In this same mode, I sold this week my shares in Telewest/TLWT. (And others; see this week's Portfolio Update.) Can you examine the chart below, and determine at what price I sold, and at what I price I will re-enter...?

[click to enlarge]

Successful trading represents an admixture of external and internal understanding. An understanding of market forces without an understanding of the internal ensures ultimate failure. Vice versa ensures limited success. The two together represent excelsior.

I hope this answer proves helpful. Please know that, as much as I welcome compliments, I thrive on questions, as they prove of particular help in achieving the objectives of this blog.