The Deipnosophist

Where the science of investing becomes an art of living

About Me

- Name: David M Gordon

- Location: Summerlin, Nevada, United States

A private investor for 20+ years, I manage private portfolios and write about investing. You can read my market musings on three different sites: 1) The Deipnosophist, dedicated to teaching the market's processes and mechanics; 2) Investment Poetry, a subscription site dedicated to real time investment recommendations; and 3) Seeking Alpha, a combination of the other two sites with a mix of reprints from this site and all-original content. See you here, there, or the other site!

30 April 2005

28 April 2005

The ECONOMIST discovers Google

David

Internet advertising

The online ad attack

Apr 28th 2005 From The Economist print edition

Google's new advertising service could make the internet an even more valuable marketing medium

THIS year the combined advertising revenues of Google and Yahoo! will rival the combined prime-time ad revenues of America's three big television networks, ABC, CBS and NBC, predicts Advertising Age. It will, says the trade magazine, represent a “watershed moment” in the evolution of the internet as an advertising medium. A 30-second prime-time TV ad was once considered the most effective form of advertising. But that was before the internet got going. This week, online advertising made another leap forward.

This latest innovation comes from Google, which has begun testing a new auction-based service for the more sophisticated advertising of brands, rather than of just individual products. Both Google and Yahoo! make most of their money from advertising. Auctioning keyword search-terms, which deliver, along with their own search results, sponsored links to advertisers' websites, has proved to be very lucrative. Advertisers like these links because, unlike with TV ads, they pay only for directly measurable results. They are charged when someone clicks through to their own website.

Both Google and Yahoo!, along with search-site rivals such as Microsoft's MSN and Ask Jeeves (recently bought by Barry Diller's InterActiveCorp), are developing much broader ranges of marketing services. Google, for instance, already provides a service called AdSense. This works rather like an advertising agency, automatically placing sponsored links and other ads on third-party websites. Google then splits the revenue with the owners of those websites, who can range from multinationals to individuals publishing blogs, as online journals are known.

Google's new service extends AdSense in three ways. Instead of Google's software analysing third-party websites to determine from their content what relevant ads to place on them, advertisers will instead be able to select the specific sites where they want their ads to appear. This provides both more flexibility and more precision, says Patrick Keane, Google's head of sales strategy. Firms trying to raise awareness of a brand often want a high level of control over where their ads appear.

The second change involves pricing. Potential advertisers must bid for their ad to appear on a “cost-per-thousand” (known as CPM) basis. This is similar to TV commercials, where advertisers pay according to the number of people who are supposed to see the ad. But the Google system delivers a twist: CPM bids will also have to compete against rival bids for the same ad space from those wanting to pay on a “cost-per-click” basis, the way search terms are presently sold. Google already calculates likely CPM values for the ads that it places on other people's websites.

Advertisers promoting a brand sometimes only want to get a name and an image in front of consumers, and not necessarily have them click through to a website. Moreover, click-through marketing tends to be aimed at people who already know they want to buy something and are searching for product and price information. Brand, or “display”, advertising is more often used to persuade people to buy things in the first instance.

The third change is that Google will now offer animated ads—but nothing too flashy or annoying, insists Mr Keane. Google has long been extremely conservative about the use of advertising; it still plans to use only small, text-based ads on its own search sites. But many of its AdSense partners might well be tempted by the prospect of earning a share of revenue for display and animated ads too, especially as such ads are likely to be more appealing to some of the big-brand advertisers.

With the spread of broadband providing faster connections, so called “rich-media” ads, which can contain animation, video and sound, are already becoming more widespread. And these are just the sort of ads favoured by companies trying to build their brands.

This could fuel online ad growth even further. As overall advertising spending continues to recover from the slump that began in 2001 after the bursting of the technology bubble, the internet has become the fastest growing advertising medium. Worldwide ad revenue on the internet grew by 21% in 2004 to $13.4 billion, and it is expected to continue at that pace for the next few years, says ZenithOptimedia, a research firm (see chart). Google and Yahoo!, the two most widely visited sites, are reaping many of the rewards. Google recently announced a net profit of $369m in its first quarter from revenue that soared to $1.3 billion, up 93% compared with the same period a year earlier. Yahoo!'s first-quarter net profits more than doubled to $205m on revenue of $1.2 billion, up 55% from a year earlier.

Terry Semel, Yahoo!'s boss, believes there is a lot more growth to come as firms become even more familiar with online advertising. He happily points out that many big firms still allocate only 2-4% of their marketing budgets to the internet, although it represents about 15% of consumers' media consumption—and is growing. Many young people already spend more time online than they do watching TV.

If Google can prove that bidding for display ads works, then its rivals are bound to follow with similar services. This could shake the industry up even more. DoubleClick, an online-marketing specialist which helped pioneer the delivery of simple banner ads to websites, was sold this week in a deal worth more than $1 billion to a private-equity firm, Hellman & Friedman. Even though its prospects recently brightened, DoubleClick put itself up for sale after facing fierce competition.

Other innovations in online marketing are said to be in the pipeline. Local search and its associated advertising opportunities are one huge growth area. Sites such as eBay, the leading online auctioneer, and Craigslist, which hosts local sites, are soaking up large amounts of classified advertising for everything from used cars to job vacancies that once might have gone to newspapers. Yahoo! is expanding rapidly into entertainment, with film and video clips providing another avenue of advertising. This week, Yahoo! appointed another top executive to its media group, fuelling speculation that the website may start to produce its own entertainment content. That should seriously worry TV broadcasters, who are already losing viewers and ad revenue to the internet.

27 April 2005

OLYMPOS

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Hi, ****,

I have completed reading OLYMPOS. Throughout both novels, Dan Simmons employs a deft hand in creating people and even settings that we, as readers, care about. Dan also displays an almost pixieish playfulness with the novel form itself: his creation of Thomas Hockenberry (who deigns to defy GB Shaw’s maxim), his characters’ discourses re Shakespeare and Proust et alii, his re-imagining of the Trojan War, etc all speak of a creative and (very) bold author. The true extent of Dan's playfulness, however, knows no boundaries, as he provides new meaning (and shading) to the term, deux ex machina.

Thank you very much for sharing the galley for OLYMPOS. I enjoyed very much the experience of reading all ~1300 pages in one sitting (well, kindasorta one sitting). Doing so revealed authorial flourishes I otherwise likely would have missed.

Problems

Hi, Allan,

Thank you for your kind compliments.

I have viewed Curb Your Enthusiasm, and really, really like its (his) very droll sense of humor. As much as I enjoy this show, it fails at least one critical litmus test: production values. The show, as with most TV shows, is about talking heads in which the viewer must pay attention only to the two people speaking. Nonetheless, the show is funny. (LOST fills the screen from margin to margin. At any moment, some important item or clue will flit across the screen or a line of dialogue will be uttered by a character out on the margin... If your attention flags, you miss it.)

BTW, I hope you continue to visit and share your comments re anything. We all welcome your insights and wit.

Best wishes,

David

DW re AMHC...

Trader Dan (someone I speak with several times throughout each trading day because of his markets savvy) asked me yesterday whether then was a good moment to execute a scale-in purchase of AMHC; I said "no, not yet, wait until tomorrow's likely downside opening, and then purchase as close as possible to $36-35."

Which is precisely what just occurred. So while the markets do their thing (decline) and you wait for the "indicators to turn up", this stock quite possibly just saw its low. Acknowledge that oscillations occur, and then make them your friend rather than your foe.

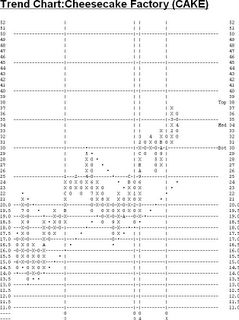

...and re CAKE

What was that I just now noted re oscillations...?

25 April 2005

LOST

Its qualities are too numerous to list but its writing, directing, and acting are brilliant, its imagination top flight. Because its story line is convoluted (to say the least), the producers have assembled a one hour special that will air this Wednesday, and serve to bring everyone who has seen nary an episode quickly up to speed. Then come the final four episodes of the season, in which secrets will be revealed. View these final episodes, and see whether you too become hooked!

24 April 2005

Two articles re Google/GOOG

Investors Business Daily

BY PETE BARLAS

Google/GOOG stock is acting like it's 1999 — and that's because its balance sheet is acting nothing like 1999.

Shares in the No. 1 search engine jumped 5.7% on Friday, a down day for the market in general, to end at an all-time closing high of 215.81. It went public in August at $85.

The hike marked the first trading day after Google late Thursday reported sales and profit figures for its first quarter that far exceeded even the most optimistic estimates.

While one-day stock gains of 5%, 7%, 10% or more were not unusual during the dot-boom, profits and huge profit growth most decidedly were. But Google reported a net profit of $1.29 a share, up nearly six times from the 24 cents it reported in first-quarter 2004. Revenue rose 93% to more than $1.2 billion. The company gets some 95% of its revenue from the sale of ads placed on targeted search results pages, a fast-emerging method of advertising used by more and more companies.

And analysts see no end in immediate sight.

Google is an Internet boom unto itself, says Mark Mahaney, an analyst for American Technology Research. "The fact is, of all Internet companies, Google right now has the best fundamentals," he said. "They have the strongest revenue growth, the highest profit margins."

Indeed, no other tech company with quarterly sales of more than $500 million enjoyed a 90% sales hike in its most recent quarter.

Scott Kessler, Internet analyst for Standard & Poor's, upped his target price on Google shares to 300 from 260 after the latest earnings report. "The company is just knocking the cover off the ball," he said. "It's just mind-boggling."

Six years ago, most Internet companies were happy with mild revenue growth, as they continued to log quarters in the red. The Internet of yesteryear was mostly hype and false promises, says Troy Mastin, an analyst for investment bank William Blair & Co. "Back then valuations were based upon eyeballs (gains in Web site visitors) or press releases," he said. "A meaningless press release would come out and the stock would shoot up 40 bucks in a day."

Google's success stems from developing secret sauce software algorithms that provide what many observers say are the most concise and relevant search results on the Web. Handling more than 2 million U.S. search queries in March alone, Google has more than twice the market share of its two closest rivals, Yahoo (YHOO) and Microsoft's (MSFT) MSN, says tracker Nielsen/NetRatings. Yahoo also has paid search. On Tuesday it, too, reported numbers that handily beat analyst expectations for its first quarter.

More advertisers are jumping online, where paid search links their ads with generally good sales prospects, says Mastin. "The fundamentals that are driving the business are real companies and real customers," he said. "They are buying (the service) because it works, not for any other reason."

Most of Google's success has come from selling to midsize and small advertisers, electronically. "The joke was that if you didn't do at least $10,000 a month in ads, you never talked to Google personally," said Martin Pyykkonen, analyst for investment bank Janco Partners. "You just dealt with the Web site." That keeps costs down.

In paid search, often advertisers bid to place their ads with the results of specific keywords or phrases. The bid typically is a set amount of money for each time a Web surfer actually clicks on an ad. Advertisers that pay the most, say $1 or $10 per click, get the best placement on a search results page.

Google, like Yahoo and others, is working on plans to reach more large advertisers. Most of the biggest companies have not advertised online, Google Chief Executive Eric Schmidt said Thursday during the earnings conference call. "It's become clear that that is a vastly underpenetrated space," he said.

Google has challenges. Yahoo and Microsoft loom large. The ad market could repeat its nose dive of four years ago. And analysts could place such high expectations — Google is the rare public company that does not provide sales and/or earnings guidance — that it will be easy for future Google quarters to disappoint. "One or more of those factors probably will be a source of a disappointment," Kessler said. "When? Heck if I know."

For now, advertiser demand will keep driving Google, says David Garrity, analyst for Caris & Co. "The evidence is pretty clear that you have got traditional advertisers stepping up, and that's something that is likely to continue over the course of 2005," he said. "If there's an end to it, I can't see it from here."

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Living by Google Rules

By Steven Levy

NEWSWEEK/Senior Editor

Mining the Web is only part of it. The search giant faces growing pains and fierce competition.

April 11 issue - A couple of weeks ago, a prominent dot-com warrior gave me a hot tip about Google: the next big move of the search phenom would be an assault on eBay. Think about it. Millions visit the Google site daily; why not let them search for items offered by sellers? The company already knows auctions, since it uses a bidding process for ads that accompany its search results. And eBay might be vulnerable, since it recently angered its sellers by raising commissions. The move would be straight out of the "Art of War" playbook apparently distributed by venture capitalists to all ambitious entrepreneurs.

But when I floated this theory to Google's CEO, Eric Schmidt, the Valley veteran who joined the company in 2001, he just laughed. "It's a perfectly reasonable question, but it doesn't compute here," he says. "If I said at a meeting, 'Are we going to enter eBay's space?' everyone would look at me and say, 'Why? They do a fine job.' The genius of Google is that we find new ways to solve problems that were never solved before."

Welcome to Google-think, the mind-set by which Sergey Brin and Larry Page, the brainy Stanford dudes who founded the company in 1998, hope to change our world while incidentally redefining the way corporations should be run. We've learned the mission of the company: to make all the world's information readily available to everybody. But in the past year we've begun to see the quirky management style by which this might be accomplished. The founders first outlined their views in a colloquial "owner's manual" included in the prospectus for the initial public offering that would make Brin and Page multibillionaires. It warned shareholders that Google would not be overly concerned with quarterly results, but focused on the long term. It stated that while Google actively sought profits, it also believed in higher principles, notably the Google version of the Boy Scout Pledge, "Don't be evil."

The IPO, run by an unconventional auction process and plagued by embarrassments like an untimely Playboy interview that piqued the SEC, was somewhat of an ordeal. The company took a battering in the press, and the final price to bidders for the opening stock was $85 a share, much less than the $108-to-$135 range originally sought. On the day Google went public, while Page and Schmidt went to NASDAQ to ring the opening bell, Brin came to work as usual. "I was tired; I didn't want to take a red-eye. It was a very productive day." In fact, that day kicked off a period of intense productivity, with Google introducing a slew of new features and improvements including desktop search, a mapping product and a scheme to put the entire contents of five major libraries online.

"The IPO was work and, yeah, it was a distraction," says Brin. "But now that it's over with I actually see us executing really well."

"I would disagree a little with that," Page says. "I actually think we executed well during that whole time. We always crossed our fingers that we'd be able to continue to operate in the way we wanted to as a public company, and I think that's been largely true."

Certainly by the numbers, Google's results have been awesome. In the last quarter, the company took in more than a billion dollars, twice as much as the previous year. Profits more than tripled. "They haven't missed a quarter," says John Battelle, author of the upcoming book "The Search." And the share price? About $180. All this while sticking to the promise that the company won't kowtow to Wall Street's demands for financial guidance on a quarterly basis. Indeed, when Google hosted a daylong analysts' briefing in February, the chief financial officer, usually the star of such confabs, spoke for less than four minutes, with literally no comment on the numbers.

But Google-think is under big-time pressure, as the company tries to handle dramatic growth—from under 10 employees to more than 3,000 in just a few years—and much tougher competition. Yahoo has undertaken a massive attempt to rebuild its search efforts, and is in a position to lead in the next step in search—personalization, where the search engine gets better results because it knows what you like. "We can leverage our base of 165 million users," says VP Jeff Weiner. Microsoft, on a mandate from Bill Gates to overtake the Google guys, has also launched a huge effort, backed by a $150 million ad campaign. "In 10 years from now, what you see in search today will be like looking at an eight-track tape," says MSN's Bob Visse. And last month the lagging but technology-rich contender Ask Jeeves became revitalized when Barry Diller added it to his Internet portfolio. "The 44 million visitors [to his sites like Expedia and LendingTree] will help Ask Jeeves," says Diller.

The Google-chasers take heart in recent surveys, which indicate that competitors are catching up both in technology and in market share. "A couple of years ago we were talking of Google and only Google, but that's changed," says Danny Sullivan of Search Engine Watch.

All this has led some critics to wonder whether Google's let-'em-loose theory of planning can withstand these challenges. Google's execs say the critics just don't get it. "Let me tell you why we look so scattered," says head of Web products Marissa Mayer. She draws a big circle on a whiteboard, with a bunch of smaller circles around it. Outside those orbits, she makes a few X's. "We operate on a model of 70-20-10." (This is a formula concocted by mathematician Brin.) The big circle represents the 70 percent of effort Google puts into its core business: Web search and the targeted ads that accompany the results. Included in that category are the things deeply integrated into search, like Google News. The loops outside are search-related products like Gmail (which displays the targeted ads Google sells). (Some of those are the results of Google's policy of letting its engineers use one fifth of their time to work on projects of their own choosing.) The X's are less-integral products like the Weblog tool Blogger, the Picasa photo organizer and Keyhole, a 2004 Google acquisition that uses satellite imagery to provide photographic maps.

While the discrete new products outside the core get attention, Mayer says that the bulk of Google's work is quietly improving the bread-and-butter of search. "We don't put out a press release saying that we got rid of 5 percent of search spam, but that stuff happens all the time. We definitely have a grand plan," she says. Indeed, just this week Google is integrating the Keyhole service into its local search product.

Nonetheless, the evolutionary process by which such products rise and sometimes fall underlines the fact that Google is sort of scattered—by design. "Larry and Sergey's vision, which I think is absolutely brilliant, is, 'Let's get these systems to prove themselves.' It's very Darwinian," says Schmidt. In order to let the products develop organically, sometimes Google forgoes revenues in the short term. "It takes years to become profitable in terms of total dollars invested, but we don't even think about it," he adds. "When we started Google News, we forgot to put ads in it. It's not deliberate. We actually forgot."

If your takeaway from that story is that Google is sloppily leaving money on the table, don't bother applying to work there. Page and Brin both believe that moving forward, fast, will work better in the long run. "With Larry, it's all about big impact," says Google exec Sukhinder Singh.

This year it will be Brin's turn to write the shareholder letter. He's focusing on things like new compensation plans to keep employees motivated now that the IPO is over. (He's already announced a "Founders' Award," with grants that can total more than $1 million to star performers.) "This one's less interesting," he says. "There's not going to be anything terribly shocking in it."

"Well, one thing," Page prompts him. "There's a certain amount of ... humor." Brin smiles. "Maybe I made it a little more entertaining." But no matter how outrageous his quips may be, they won't be half as entertaining as Google's larger quest to remake search—and business—by its own rules.

22 April 2005

The Ouroboros

This lack of perception is why technical analysis -- which is a tool for when to buy, and certainly not what to buy -- becomes instead a crutch. It becomes a siren song for those investors who want to crash on the rocks and shoals of investing, even though they believe their goal is to make money.

AMHC is a small (short term) base that nests on top of a large (intermediate term) base, which itself nests on top of a massive (long term) base. The critical breakout -- which I believe already has occurred -- will represent not only more of the same (higher highs and higher lows), but also an acceleration in the pace of the advance...

And this next chart is a Daily Graph that betrays that the relative strength (not RSI) for AMHC achieves new high ground ahead of price, a critical tell.

To explain who and what AMHC is and does, I share this article from Investors Business Daily (from the 10/25/2004 edition)...

Disease Management Catches On With Its Clients

GLORIA LAUGiven the continuing rise in health care costs, employers and insurers will try almost anything to keep costs down.

One option is disease management. The idea is that if patients with expensive ailments such as diabetes and heart disease get regular preventative care, they're less likely to need costly hospitalizations. Most major health insurers offer disease management programs. Medicare is about to run pilot tests of it on 10% of its members.

American Healthways/AMHC is the country's biggest disease management provider. Its health-plan clients boast 50 million members. Health plans make up 95% of the firm's revenue. The rest of its contracts are with hospitals. While the company works to grow its disease-management business with clients, there's a chance some of those clients will develop programs of their own. "There's always that risk," said Chief Executive Ben Leedle. "It's the age-old build-or-buy scenario. Our job is to make sure the customer sees the value of our relationships and . that we continue to produce results."

THE COMPANY

American Healthways wins clients by spelling out the potential upside of its programs. In 95% of cases, it can promise a certain level of financial savings and that patients will reach some health benchmarks. It usually can forecast the annual savings five years out, Leedle says. "Say you have 100 patients and they cost (the health plan) $400 per patient per month," he said. "And say that we put our program in and we save you 10%. Next year each patient will cost $360, a $40 savings per patient per month."

American Healthways offers a 2-to-1 return on investment. If the savings are $40 per patient per month, the health plan pays American Healthways $20 and keeps $20. Disease management has its critics, however. Some argue that spending inevitably will rise because it costs more to provide regular tests, medicine and doctor visits. And the longer patients live, the more they'll cost. Other studies suggest disease management works. One such study involves Cigna, which has a contract with American Healthways. Cigna's first-year results, recently published in policy journal Health Affairs, show that with disease management, the cost to care for a diabetic dropped nearly 25% to $417 a month. Drug costs dipped 7.6%, while hospital admissions fell 30%. Almost 43,500 diabetics were studied.

LOOKING AHEAD

From the beginning, American Healthways lobbied for and advised Medicare on how to structure a chronic care program. Analysts expect it to win some of these Medicare pilot contracts. "My guess is that the programs American Healthways offers will look attractive to the people making the decisions," said analyst Andrew May of Jefferies & Co., which has a banking relationship with American Healthways. "I'd say it's significantly better than a 50-50 chance that they'll get some of this business."

© 2005 Investor's Business Daily

In for a penny, in for a pound. The following data is again from IBD...

I had previously muttered the name of American Healthways/AMHC. I believe it is a "buy", preferably closer to $35 but a buy nonetheless.

21 April 2005

What Ray sees...

"... Folks who have been focusing on the perceived H&S top are missing a lot. Awesome relative strength in a weak market, nice tight daily bars in it's first true base, the three weeks tight pattern in March on the weekly chart with it's RS line getting set to hit all time highs before the share price does..."

especially re GOOG's relative strength leading the price to higher highs is a classic tell in this Daily Graph (from William O'Neill). BTW, GOOG shares last traded in after hours (AH) activity at ~$222.

... and Rich and Rick share

From Briefing comes this roundup of today's earnings report and conference call summary:

CNBC headline from Jim Cramer's show:Company's profit jumped six-fold thanks to higher online ad sales outside the U.S. GOOG doesn't provide guidance to analysts. Movie show time and map features (offered in Feb) as well as more customization features have been very successful. Company lowered price of GOOG Mini to attract more customers, and they have. 2005 off to healthy start coming over seasonally strong Q4 period. Q1 and Q4 strongest for advertising and Q2 and Q3 seasonably weaker. Full quarter with AOL Europe partnership has helped company boost growth in Europe. GOOG's relationship with ASKJ runs through 2007, and GOOG sees no changes to alliance after IACI completes buyout. Company remains cautious that operating margins may decline due to rapid expansion. Sees tax rate in 30% range for full year of 2005, but hopeful it could see a lower future rate. Company no longer shows multiple ads on a given URL search, so they can add more search listings for a better customer experience; notes this is only the beginning of the kind of penetration for this type of online ad market -- saturation is nowhere to be found. Company is not dependent on any one category for revenues (something some analysts have expressed concern about in the past). Company does not have intention of instituting buyback program anytime soon, rather wants to continue building cash. (Without giving away too much, consider carefully this last statement... --dmg)

"Jim Cramer Now Sees GOOG at $318" Cramer says "real company, real earnings" gotta give it the same multiple as eBay... says this may be one of the most under-owned growth stocks... says tomorrow all these institutions that have been stuck in no-growers (CSCO, MSFT), they are going to swap into GOOG... Mr. Cramer is issuing a "Buy, Buy, Buy -- Triple Buy."

Thank you, Richard and Rick, and everyone else who shares information that is of interest to us all. Please continue doing so...!

Webcast

Were You Aware...?

"Roughly two-thirds of the way through April, which is historically the best performing month of the year for the Dow Jones Industrial Average, we haven't yet seen that historical performance transcend the present. Since 1950 the Dow Industrials average a positive return of 1.9% for the month of April, thus far the Dow is down 7.1% (month-to-date) with seven trading sessions still remaining."

20 April 2005

THE WEEK

19 April 2005

A Head & Shoulders Top...

Present and accounted for are the critical signifiers:

1) The price pattern

2) The appropriate volume:price relationship

Pattern recognition, however, is akin to a Rorschach Test -- each of us perceives only that which we want to see; thus, we misperceive all too easily. Studying the same pattern, one person might view it as bullish whereas another views it as bearish, one sees risk and another opportunity. Let's look again at this chart, sans studies...

Let's tame the seemingly wild oscillations in price via dropping the lagging zero (moving the decimal point one slot to the left); this results in an alltime high of $21.68 and a subsequent low of $17.25. No longer so terrifying, eh? In fact, this stock has held up especially well in the face of an ugly market. Note, for example, the higher low at a time the market concurrently made a lower low.

Yes, this is yet another 'loving' gaze upon Google/GOOG, which will report Q1 earnings after the close this Thursday. I bet that between the close today and that of Friday, the share price will be higher than now (~$192). And yet the bearish talk ("Watch out below!") echoes in the canyons of Wall St.

The bears are wrong. And when a widely-recognized pattern such as a H&S top fails, then I cry out, "Watch out above!" I previously have exhorted you to recognize Google/GOOG as a singular investment opportunity, worthy of the attention of all investors irrespective of time frame. After all, the insights of that great trader, Burton Pugh resonate for me, as they should for you...

"To the professional short-turn trader who can spend all his time at the exchange, it is, of course, permissible and expected that he will try to secure frequent fragmentary profits in an effort to compound them into larger funds, but this is not investment. Few are the ones who can afford to become 'professionals' and, in the final wind-up of a financial campaign, the outright investor following [a] plan will far exceed the results achieved by the less patient in-and-out trader."

In a nutshell

P.F. Chang's China Bistro/PFCB is a member of the still-favored Restaurant sector. This particular group has been very steady despite the market weakness, showing near term RS as well. (Imagine that... I suppose a perception such as this one represents 'news' to most investors! - dmg) PFCB is one of the better-looking stock charts in the sector, as evidenced by its overall positive trend and excellent Relative Strength. This is summarized by its 5 for 5'er positive technical attribute reading. PFCB is currently on a bullish catapult formation, and was able recently to go to new highs. The bullish price objective is 73-77, so this recent pullback to the 58 area improves the risk-reward for PFCB as a long play. Initial support lies at 57, which is also the middle of the ten week trading band. Below that is even more substantial support around the 53-54 range. Those looking for a new long idea after this recent market pullback can consider buying PFCB here (57-59 range). A first breakdown (double bottom) would come at 56, so those traders very short term oriented could consider this as their stop loss point, but ideally we prefer to give PFCB a little room and would use 51 as the initial stop loss point, as that would break the January-March support and violate the bullish support line.

18 April 2005

Google/GOOG

Analysts at BofA and Bear Stearns now believe that Google (and Yahoo/YHOO) will report Q1 above consensus. (Imagine that! -dmg) Bear Stearns comments on Google/GOOG saying their channel checks with marketers and tracking of keyword volumes and pricing data reveals that Google should report a stronger than expected quarter. As such, they increase Q105 revenues estimates for the company from $721M to $731M and increase pro forma EPS estimate from $0.88 to $0.96 (Reuters consensus $0.91). The Bear Stearns analyst believes that the number of advertisers on Google increased meaningfully during the quarter, as more advertisers embrace the paid search platform as part of budgeting goals for the year."

So this is a good moment to delve more deeply into Google's advertising model. The comments that follow are from Jeff Neal...

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Google/GOOG has come up with an advertising service that helps websites generate revenues. The service, called AdSense, is a very expedient and easy way for website owners to display Google advertisements on their site's content pages and earn money. In addition, website owners can provide Google Web and site search to their visitors and earn money by displaying Google ads on the search results page. Basically the website owner gets paid when one of their visitors click on these links.

Many different types of websites are profiting from this approach. For example, the gamut of website publishers runs from the very small and specialized e-tailers to big-time companies like Amazon/AMZN and the New York Times/NYT. However, there are some critics of this approach claiming that the overabundance of advertisements is hurting the integrity of that particular website, and they even go on to say it is like a new form of spam that is turning the Internet into a billboard for Google ads.

The actual revenue being generated ranges from a few hundred dollars a month to more than $50,000 a year for some sites. The amount of money is closely tied to the traffic volume and how long per day the website can be up and running. The AdSense program has worked particularly well for Web publishers by providing them with more opportunities to make money.

For example, one Web publisher stated that he used to have a tough time sleeping because he was constantly worried about his very high monthly printing bill. However, now he has more than 70 websites that cover a variety of different subjects like vehicles, music, video games and much more. Google's AdSense program allows him to earn revenue without paying the high cost associated with print advertising and other marketing expenses.

The online search advertising business is projected to surge to more than $5 billion by 2008 up from $2.7 billion in 2004 according to e-commerce experts. Currently both Google and Yahoo/YHOO dominate this business with Google more than doubling its search advertising revenue in 2004.

The AdSense program has text ads that appear next to search results and operates on a pay-pe-click model. In other words, advertisers only pay if someone clicks on an ad. Advertisers can purchase keywords anywhere from 10 cents to $20-plus per word. These are the terms people enter into query lines when they are searching. AdSense essentially is part of that keyword model and is really just a different branch of Google's AdWords program.

AdSense is potentially a very powerful approach for companies marketing their products because beyond Google's homepage you can reach more than 200,000 participating websites. Small website owners have been attracted to AdSense as a very efficient way of attracting advertising dollars. The procedure is really quite straightforward. The customer only needs to sign up at Google and then some computer code is embedded on the accepted website. Google does all the work from there by matching advertising links from its inventory of customers to the appropriate sites. To get the most out of the AdSense program the advertisements need to be very targeted and that closely related products have their ads grouped and linked together.

As of now Yahoo does not go after small publishers, so in this particular market Google's only AdSense competition comes from a small, privately owned company called Kanoodle. They not only work with small publishers but very large ones as well like USA Today and MSNBC. Kanoodle also sees search advertising as a very lucrative market going forward.

The recent IPO of Google showed that there is indeed growth and investor interest in search engines and search advertising as the stock soared from the original open of $85 per share to a high of $216 per share. Shares of Google have retraced some to currently trading around $185 per share.

According to the market research firm Forrester, look for the paid search market to start to slow down a little bit even though it still has room for more growth. For example, Forrester has indicated they see overall search advertising revenue growth declining almost 15 percent in 2005 compared to 2004. To regain momentum there are issues the industry still must resolve, such as click fraud. There are some crafty Webmasters out there that have set up automated clicking models which clicks away all day and cost the advertiser. Once these types of issues are effectively addressed, look for the search advertising market to resume its phenomenal growth rate.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

But Google/GOOG is by no means done innovating. The company announced several weeks ago a wrinkle to their online maps software...

A bird's-eye view

Have you ever wished you could see what someplace looked like before you got there? A house? A hotel? A freeway exit? We thought you might find it useful, so we've incorporated Keyhole technology into Google Maps and Google Local. Now when you type an address into Google Maps, you can click the 'Satellite' link and see a view of the area. You can zoom, move the view by dragging, and even resize the window just like the normal 'Maps' view. Looking for a new apartment or house? Type in an address you're considering, get a view from the air and, with a quick local search, find out if you can walk to your favorite Saturday morning cup of coffee. Thinking about spending time at the shore this summer? Search for hotels with Google Local and check out the "beach" in "beachfront." You can even see driving directions with real images. We can't promise you'll never miss another freeway exit, but we do think that Google Maps + Keyhole gives you a great way to see and explore your world. But take a look for yourself...

17 April 2005

What a gift!

A couple had a pool and bbq party yesterday at their new home in Anthem, an upscale development in Las Vegas. Of course, I had to take my new camera. This proves to have been a wonderful notion, as their house, furnishings, and art, and several of the people proved to be quite photogenic. I had a blast pushing the limits of the camera. For example, with this first photo (below) I wanted to utilize the macro mode albeit with a 'normal' lens rather than a telephoto...

The second photo was an attempt to freeze the motion of the falling water but at a relativity different from most standard, pre-set action modes. (BTW, this waterfall is only one of several in their backyard swimming pool -- what a pool, what a home...!)

16 April 2005

Why Literature Matters

Important editorial that deserves your attention, thought, and action.

15 April 2005

Groet'jes!, to my Nederlands visitor

Ondertussen, pas het woord aan all U vrienden en familie about the Deipnosophist.

Tot ziens,

David

14 April 2005

Dorian Gray

Each informed person is entitled to his or her opinion, but I believe this relationship to be not good. IF the US$ does in fact breakout (at ~86), thus ending its multi-years decline (at least for the comparative nonce), then foreign investors must purchase something to close the loop on that particular transaction. But what -- stocks? No, they are declining. Real estate? Hmm, problematic. Bonds? Even more problematic. Gold, titanium, oil, steel? Each declines in its own 'sudden' downdraft.

This specific mirror image bears close scrutiny. It is textbook intermarket analysis. Watch the equity markets, yes. Watch the currencies, yes. But watch also how they react to each other. I have no doubts that the markets send a message, but alas I lack the necessary Rosetta Stone to decipher it.

Comments?

Monarch/MCRI - the news

The City Council members, including the Mayor, all expressed their desire to gather additional information and hold more public discussions on the issue. No timetable was given on future discussions. Officially, the vote was 6 to 1 against changing the master plan to allow gaming in the area; however, nearly all of the council members seemed to be (or in fact stated they were) 'on the fence' when reaching their conclusion.

Such nothing news results in such a dramatic response in the stock? Methinks opportunities are made from 'stuff' such as this... albeit not necessarily this one.

A watched pot...

But this market action is nothing new; in fact, it is more typical than atypical. This is so despite the markets' unwillingness to follow the script of typical seasonal patterns: strength from (approximately) mid-October to mid-April and weakness from mid-April to mid-October. The markets did begin to follow this pattern with the various indices commencing upward moves in late-October/early-November. But then came that reversal on the first trading day of the year (3 January) -- and the markets have since trended sideways to down. The past ~6 weeks certainly have been no picnic in the park!

To confound further the typical seasonal pattern, if the markets continue to sell off for the coming 1-2 weeks, then a good low likely could be put in. The markets could then rally - strongly, broadly, enduringly - from May until... (Lacking this near-term capitulative sell-off would mean more of this frustrating chop.)

A declining market environment provides an excellent opportunity to find new investments. For example, I seek stocks that, as the markets decline they decline begrudgingly, and as the selling pressure for the markets abates these stocks rise with alacrity. Imagine what those stocks will do when the markets turn and rally...

This understanding of market opportunities is only one reason of several why I never play the short side. Certainly it is not for lack of apprehending opportunities; even a long-side sale arguably qualifies as a short candidate. Market moves have been measured: in general, bull trends endure twice as long as bear trends (2/3, 1/3); thus, I can focus on one side or the other. Stated rather simplistically, either I make a lot of money in a comparatively small amount of time (bear) or I make a lot of money over greater amounts of time (bull). I choose to play the long side, but that decision is not necessarily apropriate for you. During bearish market environments (such as the past ~4 months), I seek new investment opportunities (as limned above). Or I do things other than investing, in a quest for balance in my life, such as travel.

As I strategize the markets' oscillations - i.e., fit each daily price bar into the larger pattern - I buy and sell everything I have recommended on this blog. I seek those opportunities that betray the likelihood of greater, and easier, gains to come. So the DNRs, XTOs, PKDs, and CBIs of the world are long gone (and quickly so), whereas I add to positions in RTSX, MW, RRGB, AMHC, and GOOG (to name a handful) albeit during pullbacks. Understand that, if the person is a long-side investor only, then he or she recognizes the market environment for what it is, and thus downsizes his typical investment position because declines in the general market should be mirrored in his or her specific long side opportunities; that is, they too will decline in price. However, their declines also should be perceived as part of a budding larger pattern, perhaps a short term base within an intermediate term uptrend, etc.

Consider, for example, Radiation Therapy/RTSX: I perceive the breakout above $20 as coming from a completed intermediate term cup & handle pattern. Now while the general market declines, RTSX:

1) Bides its time as it consolidates that breakout,

2) Waits for the pressure on the general market to abate, and

3) For the moving averages (primarily, the 50-day sma) to catch up.

In other words, the greater pattern is apprehendable to anyone who cares to see it: a continuing up trend into the future. I choose to purchase the light volume tests of the $20 breakout area. (Once resistance, now support.) As I mentioned in "Snap Decisions", things change, and even the best pattern can become (quickly) despoiled. So I allow the markets to tell me what to do, not perceive the market as a square peg and attempt to fit it into a circular opening.

Things change. This (market environment) too shall pass.

13 April 2005

Apple/AAPL

Well, it now appears the inflection point is baked into the cake, especially in light of the reversal day, Monday (2 days ago). Because earnings will be released before the markets open tomorrow, it will be no surprise to see the shares gap big on that news, in one direction or the other.

My bet, however, is a big move down. A breach of critical support (~$38) could usher in tests of $35, and then $30... Wait; I now realize I repeat myself. So I will stop prattling.

What it Takes to Succeed

David

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

By Jay Kaeppel

Many different individuals have enjoyed investment and trading success over the years, and the variety of trading strategies used by these individuals covers a very wide spectrum. Yet despite this diversity of personalities and methods, there are a few common elements which virtually all successful traders and investors share. In the broadest stroke possible these elements can be categorized as Mindset, Technique and Discipline. Any one or two of these elements alone does not assure success. It is only through the painstaking implementation of all three of these three critical elements that long-term success is achieved. So let's explore just what is involved in these three key elements of trading success.

MINDSET

As with most everything else in life, success or failure in trading comes down primarily to what goes on between the ears. What you think about certain things, how you interpret them, how you react to them, and how much past experience empowers or hinders you in the future all play a part. Anyone who trades long enough will eventually experience the entire spectrum of trading related emotions. There will be the thrill of a great winning trade. And that trade will instill great confidence. And for many people, that great wining trade will instill too much confidence and that will lead to trouble down the road. There will be winning trades that we feel badly about ("I should have stayed in longer," or "I should have gotten out sooner."). There will be losing trades that we feel good about ("Thank goodness I was smart enough to cut my loss when I did!"). And of course there will be those losing trades that cut to the very bone and make us wonder why we got into this racket in the first place ("I can't believe that 15 minutes after I bought it the stock gapped down 30%!").

All of our past experiences simmer somewhere under the surface and can exert a great deal of influence over our future. This influence can be positive or negative. This is especially true for trading, where we have our hard-earned money on the line. The big profit that we let slip away can cause us to take the next 10 profits far too soon and ultimately cause us to leave a lot of money on the table. Or we might strengthen our resolve to follow our preferred trading method and say to heck with that one bad memory. The choice is ours. Obviously, the unexpected big loss can throw us for a loop also. We may become "gun shy" and find ourselves talking ourselves out of a lot of trades that we should be taking. Or, once again, we can write that bad experience off as "the cost of doing business" and stay on the straight and narrow in terms of following our trading method.

It seems that the most successful traders are the ones who can most easily put yesterday behind them.

And in something of an irony, while a short memory appears to be a positive, ultimately, in order to be successful you must have a long-term mindset. This is not the same as saying that you have to hold positions for a long time. What this means is that in order to successfully utilize any technique you must feel as though you are committed to using it for a long time. Too many traders make the mistake of jumping from system to system, invariably jumping ship at exactly the wrong time – after a string of losses and right before the next run of good trades. As a result, it is imperative to develop the utmost confidence in whatever trading method or methods you employ, so that you will have the courage to stick with them when things get rough (as they invariably do from time to time). There are many aspects involved in getting to that point. The real key is to determine the type of trading you are most comfortable with. There are those who trade using monthly bar charts, and adjust their portfolios once a month or even less often, and seem to do pretty well. At the far end of the spectrum there are traders who work off of one-minute bar charts day in and day out. And then of course there is everything else in between.

Choosing the type of trading that works best for you is a critical step towards success. To fully understand this, consider what would likely happen if the "once a month portfolio adjuster" suddenly started trading using one minute bar charts. This person would likely be overwhelmed by the amount of information coming at him and would quickly lose whatever edge he held from carefully and deliberately analyzing monthly bar charts. Likewise, consider the poor "one minute bar chart day trader" who attempted to trade only once a month. There are few things more painful to watch than a hyperactive trader trying not to trade. It's kind of like watching an alcoholic trying not to drink, or the office coffee hound trying to remain calm when the coffee machine breaks. In any case, a person who is predisposed to be a longer-term trader will invariably enjoy greater success pursuing that approach than if he tried to reinvent himself as a day trader. Likewise, an active (successful) daytrader who tries to wean himself of his active ways is likely to do himself more harm than good.

Complicating all of this is that for those starting out, it may take some time to determine what type of trading he or she is most comfortable with. So while ideally you want to settle on a trading approach and commit yourself to following it for a long time, the fact is you may have to do the opposite of that until you make the critical determination as to what type of trading style works best for you. Is this fun, or what?

TECHNIQUE

Some traders adopt an entirely systematic approach to trading. At the other end of the spectrum others traders essentially make it up as they go along. Everybody else falls somewhere in between. Within each of these groups there are winners and losers. For the systematic traders, the likelihood of success rests heavily on the quality of the system or systems that they are using. If they utilize a sound system that is based on sound principles and which has held up well over time, then they stand to reap substantial rewards. However, if a systematic trader jumps from one systematic approach to another every time a particular system suffers a drawdown, he will almost certainly end up a day late and many dollars short. Discretionary traders essentially face much the same situation. Whatever criteria they use to select and manage trades must be based on sound principles or else they will fail in the long run. Whether a trader uses a purely systematic approach, an entirely discretionary approach, or something in between, ultimately there are several key questions that must be asked and answered. Most notable among these are:

How much capital will I risk on each trade?

What criteria will I use to determine when to enter a trade?

What criteria will I use to determine when to exit a trade with a profit?

What criteria will I use to determine when to exit a trade with a loss?

The potential number of answers to these questions are countless. Still, when you boil it all down, any effective trading method must – at a minimum – answer these four questions. Obviously, this is true when starting out, however, it is also true even for those who have been trading for a long time. It is an extremely useful exercise every once in awhile to review your trading method or methods in terms of the questions posed above. If you cannot give specific, clear-cut answers to these questions, you may be slipping off the path to success.

DISCIPLINE

Discipline – as it relates to trading – essentially revolves around developing a successful technique, developing the mindset to apply that technique for a long enough period of time to do you some good, and then following through on the plan. For the purely systematic trader, discipline simply means following the signals generated by his or her system and sticking with it even when things get rough. For the purely discretionary trader, discipline means sticking to one's guiding principles and not allowing a rough patch to cause them to deviate from those principles. In either case, it can all be very tricky. The pain of losing more money than one expected to – whether on a single given trade, or on a series of trades or over a period of weeks or even month – can be extremely debilitating, even to the most seasoned and successful of investors. Generally speaking, big profits tend to accumulate over a period of time. Big losses on the other hand, seem to hit like an air raid out of nowhere. Just as you are admiring your ability and the number of zeroes in your trading account, like a bolt from the blue, a chunk of those hard-earned profits vanish.

Bottom line: it hurts. No one likes pain so the first natural reaction is to try to avoid future pain whenever possible. The easiest way to do that in trading is to "cut back". In other words, after a significant loss or series of losses, a trader may decide to trade smaller size or to start skipping certain trades altogether. Invariably, he ends up missing out on some winners that would have easily earned back what was lost during "the big hit". Then having realized that he has just cost himself a chance to recoup his losses, he may decide to suddenly increase his trading size to compensate. And what do you suppose happens next?

The only way to avoid this vicious little cycle is to employ your chosen trading approach with as much discipline as possible, day in and day out, trade after trade. In a nutshell, when you find yourself saying things to yourself like "well maybe I'll just cut back for a while and see what happens", or "well I guess my approach just doesn't work anymore" (even though you've been doing it for years), or "maybe I'll double up on the next trade to recoup my losses more quickly", and so on and so forth – then it's time to stop and take a good look in the mirror and ask yourself who is fooling whom.

The irony is that it is almost always possible to tell when you are putting aside your discipline in trading, it's just that inside of one's own mind it is extremely easy to rationalize things. One good idea is to find a friend or spouse or whomever to act as a sounding board. Keep them up-to-date about what you are doing and how you are doing it (but be careful not to go into overly great detail, lest they get that glassy-eyed, "Oh God, he's talking about it again" look in their eye). If that person one day say's to you "hmmm, that's different," or "that doesn't sound like what you normally do," or "why did you make that change," or well, you get the idea, chances are good that you need to get back yourself on track.

SUMMARY

The real secret to trading success is to recognize that there really are no secrets. A world-beater system will end up costing you money if you don't have the discipline to follow it. Pursuing a career as a day trader will be a costly mistake if you lack the wherewithal to pull the trigger in rapid-fire succession day after day. The best advice involves a very old adage, that being "treat trading like a business." If you were planning to start a business you would meticulously develop a plan as to what you need to do in order to be successful. You would then carefully assess your likelihood of actually achieving success based on your plan. And then you would execute your plan as closely as possible. Your approach to trading should be no different.

If you are just starting out remember these thoughts. If you have been trading for a while, take the time now and then to review and reflect on your entire approach to your "trading business." I guarantee you that it will be time well spent.

12 April 2005

Snap decisions

Although decisions to buy or sell might appear to be snap decisions, they are anything but that. Note the subsequent failures of EBAY, FLIR, and SBUX to highlight (lowlight?) three examples. (There are many other examples that were warned about here, in advance of their horrific declines. These seemingly snap decisions no longer appear as particularly hasty, eh?) A real time example could be Nike/NKE, as the shares might break down from what I previously had perceived as a base, but suddenly (possibly, probably) manifest as a top. We shall see.

Things change; s**t happens. Keep abreast of the market, or suffer the consequences. No matter how lengthy your investing time frame, what once was superlative could, in a heartbeat, become merely comparative. And perhaps even less.

Where she stops...

As shown in the chart (above), the shares broke out to a new all time high this past Thursday -- and seem particularly well set up for higher highs, perhaps as early as today's opening trades.

In a research comment released early this morning, the analyst at Morgan Stanley, "upgrades TLWT to Overweight from Equal Weight. We (this firm) believe the company will deliver consistent operating results over the next 2 years as it balances customer growth with margin improvement. We raise our price target to $23 (from $19) and EPS estimates for 2005-2007 to $4.12, $17.04 and $31.39. We further believe that TLWT can achieve its 1Q05 and long-term customer growth targets and, by keeping flat its SG&A, drive 7-9% EBITDA growth for 2005-06E."

Positive comments of this type should result with a likewise positive response from the shares, manifesting most likely as a gap higher on the opening. I already purchased one lot on Thursday and a second lot yesterday. I would like to buy more today. If TLWT shares do gap higher at the opening, then I will bide my time for the likely inevitable decline and subsequent intra-day base from the early-AM high, for another opportunity to purchase. As always, volume is critical: how many shares trade during the push to higher highs (in the assumed opening gap higher) vs. the number of shares traded during the assumed intra-day decline and base. And the number of shares traded en toto. Of course, the action of the general market will have something to say about all this.

This seeming inactivity (biding one's time) frustrates some investors and traders, albeit not me. I seek to profit from price oscillations, not gnash my teeth over them!

08 April 2005

Atlantis

[click to enlarge]

The trading activity yesterday represents a high volume breakout above a line of resistance that, honestly, is drawn quite liberally. (It could be placed closer to $21 rather than $22.) Nonetheless, this is a clean breakout. I am buying the shares today.

PS: This post should have been uploaded before the markets opened, but alas problems once again with eBlogger. Frustrating, that.

07 April 2005

Change happens - watch for it!

For example, Starbucks/SBUX. I fretted whether this recent activity would prove to be a base or top. Now, with today's possible breakaway gap beneath the 200-day sma, it seems to be a top. (Final critical support lies at $49-48.) The close for today and tomorrow (weekly basis) are important.

Contrary to SBUX, however, is Google/GOOG. I previously have sung hosannas to it, perhaps ad nauseum. But its dynamics changed abruptly two days ago (Tuesday) when the shares enjoyed a minor, but important gap above its 50 day sma. This particular change is a bullish augury. (Recall the caveat expressed in the "Raindrops" post.)

More anon re Google/GOOG...

Miracles can and do occur

[click to enlarge]

Yes, I realize I should have said something about these shares 6 1/2 years ago, but I didn't even know you then, leave alone this company. And anyway, who is to say the shares will not continue higher, even from this seemingly elevated price? That certainly appears to me to be the case in this instance...

Option Care provides infusion therapy and other ancillary home healthcare services through its owned locations and through its supporting franchise network. These activities are very similar to another company I owned in the early 90s (RoTech Medical/ROTC;since bought out), and that made me lots of money. As a result of that investment, I know and understand well the field of home infusion therapy. Needless to say, it is a money-maker -- within the confines of medicare reimbursement, etc.

I will not dwell on this specific opportunity because it is not for every investor. But it does serve as an example of a type of opportunity I buy for both trades and investments. OPTN trends higher, and declines such as last Friday's reversal -- caused solely by the reversal in the market-at-large -- represent buying opportunities. I bought shares on Monday, and more on Tuesday. At some point, the shares will reverse and begin anew (most likely) another intermediate term base. But having only recently emerged from its last intermediate term (6 months) base at ~$12.50, it is unlikely to do so from the current price.

Brief Update

This means that in the example of Radiation Therapy/RTSX, in which volume explodes higher with price, I quickly scratch the trading objective in favor of an investment objective. (One measure of the difference between trades and investments is that of time; the other, of course, is price.) Contrary to RTSX is Parker Drilling/PKD: when the originally perceived breakout is achieved by price alone -- not acccompanied by an explosive increase in volume -- then I know most likely that my original analysis is faulty, even incorrect. In situations such as this, I choose to tweak the line. What I do not do is buy the supposed breakout. Without volume, (it goes) without me.

Meanwhile, bebe/BEBE and Men's Wearhouse/MW promise to open significantly higher today, while Urban Outfitters/URBN nears a major breakout. And of course, PF Changs/PFCB performed yesterday as expected and on schedule. Red Robin Gourmet/RRGBE performs well, too. These breakouts occur masked by the weakness in the Retail Holders/RTH index, which is heavily weighted to and weighted down by WalMart/WMT and Home Depot/HD. (Of course, the restaurants are not part of the RTH index.) The homebuilders, the market's erstwhile leadership, teeter and even begin to break down; the critical question, however, is whether they break down from tops or are declines prefatory to another intermediate term base. I hope to post a lengthier update sometime this weekend.