Whoa!

"Well, gosh, David, that seems not only obvious but self-evident as well!"

Yes, it is, which is why I limit comments re the markets' general direction to infrequent updates such as the recent, "At 4 months old, it (this recent uptrend) is getting long in the tooth."

So, okay, yesterday ushered in a return of downside volatility. But what does it mean? Well, it means that markets are not one-way bets, and risk is always present. However, this go-round, things could be different; yesterday's decline could include trend-changing dynamics. For one, the US$ trends down, and nears a breakdown from a crucial long term level of support. $ moves almost always presage something big in the equity and credit markets; recall 1987 as only one example. Which leads to another cliche: Tighten your stops.

My apologies for the brevity of this post. Suddenly, my mouse does not work, and I am crucially dependent upon it. It moves about the page, but does not click on the items I point to. How, then, do I click on my portfolio items? Slamming it on the desk helps, but for how long? So I have just lost 1 hour attempting to isolate the problem (achieved), and correct it (no such luck). All suggestions welcomed.

Continued several hours later...

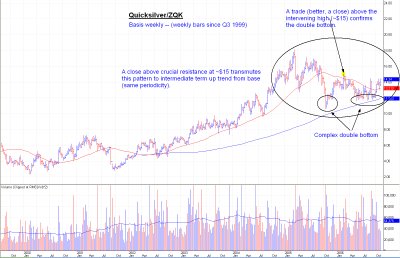

So these sudden squalls of price volatility come about seemingly at random, but are anything but random. In fact, so regular do they occur, that they should be expected. Technical analysis is all about this effort: to discern changes in price based upon pattern recognition, trend lines, etc.

Anyway, these squalls occur, and rarely endure. Due to changes in the backdrop, this decline could be different, although unlikely. Count time: these squalls typically endure 2-4 days. And even if the high for this move is 'in', some testing (of the recent high) is in order so that a top could form. Simple peak & trough analysis will help you discern the difference between landmines and goldmines.

-- David M Gordon / The Deipnosophist