Some holiday revelry

Happy New Year to All!

-- David M Gordon / The Deipnosophist

Labels: Humanities

Where the science of investing becomes an art of living

A private investor for 20+ years, I manage private portfolios and write about investing. You can read my market musings on three different sites: 1) The Deipnosophist, dedicated to teaching the market's processes and mechanics; 2) Investment Poetry, a subscription site dedicated to real time investment recommendations; and 3) Seeking Alpha, a combination of the other two sites with a mix of reprints from this site and all-original content. See you here, there, or the other site!

Labels: Humanities

Labels: Company analyses

[click on image to enlarge]

[click on image to enlarge]Labels: Market analyses

If sex - or rather, the lack of sex - in marriages and long-term relationships isn't a hot topic, it's because no one dares talk about it. On a personal level, we don't do it out of loyalty to our partners, or embarrassment because we feel on some level that we're failing (although we understand that almost all of us are failing in the same way), or because we believe that our sex lives are a barometer of our relationship as a whole. On a wider cultural level, it's just not considered sufficiently - sexy. And yet, we are surrounded by sex. By our single friends' rampantness, but also by the latest Durex report, which insists that the average Brit had sex 118 times - or a little over three times a week - last year. We know about - have even entered into - the debate surrounding Shortbus, the allegedly most graphic non-porn film ever made, which focuses on 'a polysexual New York salon', and features fellatio and threeways and gay sex - none of which is simulated. We know that British teenagers are having huge amounts of sex - unprotected and feckless sex - and that it's a problem. We are bombarded by highly sexualised imagery every moment of every day. But none of it seems to apply to us any more.The article is laced with racy terms, facts, and 'bad' words' -- if you offend easily, please skip this post. It so happens I learned a lot from reading it, and thus share it with you. Of course, I seek your thoughts, comments, and opinions.

Labels: Humanities

[click on images to enlarge]

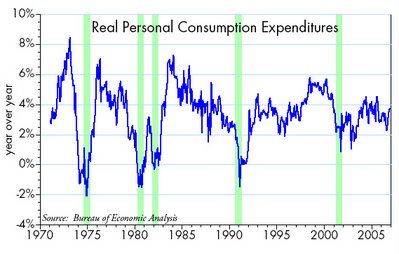

[click on images to enlarge]Manufacturing activity has slowed, however, and business capital spending has stalled over the past six months, so the economy is not exactly the picture of good health. (Why are businesses reluctant to invest at a time when profits are going gangbusters? That's puzzling, to say the least.)

Labels: Economics

Well stated; I agree with your insights. I, too, note the emerging up trend in what typically is called large cap value stocks. The small cap growth stocks I prefer slowly and incrementally begin to under-perform both relatively (to the large caps) and absolutely (to themselves). So my warning, if you prefer to view it as such, is as much to scan for new opportunities in areas not typically explored by me. Large cap stocks fail to excite me because we all know their names, their products; as a class, they tend to be over-followed, over-researched, and over-owned. None of which argues profits cannot be had in this market sector.I think you've done a very good job of summarizing the potential state of play. I don't pretend to have any idea how things will play out, but your analysis is cogent and inciteful (sic). It is always a worry when leaders start acting badly. (For example, I was just looking at GOOG. This is nothing but an instinct, but for some reason it looks like a set-up for an island reversal. I don't follow it like you do, and I really have no particular opionions, but it just looks that way to me. My opinions on this subject are worth what you pay for them, if not less.)

And it's a big worry when all the market strategists are as unanimously bullish as they now are. However, I have also been observing the divergence between the way that this year's big winners (aka leaders) have been acting of late, versus the way some of the laggards have been acting. I have a gut feeling that there is a lot of year-end profit taking going on with managers who want to lock-in their year ('s return). Hence, the selling of winners and the accumulation of the beaten-down. I would not be surprised to see that pattern reverse after the first of the year. However, you are quite right: Prudence certainly dictates caution for those whose time horizons are not truly Long Term.

[I] am trying to make money in a very short term time frame on this trade. LVLT could indeed be a long term winner, in fact I hope it is. But the short term trend looks down to me. I did consider the top 8 months prior but didn't think it fit the trendline properly.If I draw an ascending triangle, it has already violated that pattern to the down side. If it only declines to it's 50 day moving average soon enough I should make 100-300% profit on my options, if it trades down to the $5 support level with some time value left, I make even more, if it trades down to it's 200 day moving average I make 500% or better profit on the options. It fits my risk/reward goals.That all sounds good to me, although I must admit you include many "if" statements in your thesis. Interestingly, the Wall Street Journal reports today that there are reasons to be wary of Level 3 Communications/LVLT.

The co remains saddled with debt, it is in a business that still has excess capacity, and it has reported a quarterly profit just once in its more than 20-year history. With the stock and bonds at lofty levels, it could be that any future possible good news already is priced in. Even bullish analysts acknowledge that to keep the stock climbing, demand for video and voice over the Internet will have to be strong enough to allow Level 3 to increase what it charges big telecommunications, cable and other businesses for access to its fiber network, one of the world's largest. Level 3 also will have to demonstrate that it can skillfully integrate a series of recent acquisitions. The co will also have to show that it is getting closer to pulling more cash out of its business than it is putting in. By one measure, Level 3 stock and bonds are a bit pricey. Its enterprise value is about 13 times the co's Ebitda for 2009. And prices for access to networks have fallen about 15% this year. While much slower than the 50% rate of 2004, that still is a troubling sign in a market where demand for network capacity has increased at a rate of about 60% a year in the past two years. The capacity glut is so huge that it could take years before it is filled up.Okay, so much for the bear's thesis. But we already know all this stuff. Sheesh. Instead of derogating a stock that likely builds a massive, long term bottom, look for the reasons why the market slowly but surely turns increasingly bullish. Reiterating yesterday's news will not help that effort.

I don't know why, maybe a psychological flaw, but my adrenaline always races when I see a post like this from you. Chaos begets opportunity?Yes, absolutely correct. Investing never has been nor will it ever be a one-way street. Risk is the yang to the yin of reward. Accept each, embrace each, and factor into your analyses the continuum and you will see... truth. (Whew, did I really write that?) No longer will you invest with your eye cast backwards to what the stock has done, but forward to what it has yet to do.

Labels: Market analyses

When Google/GOOG introduced Checkout in June, it was seen as a formidable rival to PayPal. And with Google aggressively promoting Checkout during the holiday season and beyond, its use with some merchants has already surpassed PayPal's. But Google's plan for Checkout has always been about more than online payments. The service is a calculated effort to expand Google's base of advertisers, which provide the bulk of the company's revenues. And Google has made a substantial financial commitment to the service's success. Goldman Sachs estimates that Checkout promotions will cost Google about $20 mln in the current quarter. The campaign to promote Checkout also says something else about Google: As rivals Yahoo (YHOO) and Microsoft (MSFT) are working on getting the basics right in their search and advertising systems, Google is racing ahead to consolidate its lead. "I believe that Google's advantage is widening with time and this is one example," said Scott Devitt, an analyst with Stifel Nicolaus. "Checkout could be a game changer, and the competitors are doing nothing of the sort." Google has not released figures on the number of Checkout users. Still, there are signs that with the heavy promotions, the service is making significant inroads.-- David M Gordon / The Deipnosophist

Labels: Company analyses

Labels: Humanities

"However, this go-round, things could be different; yesterday's decline could include trend-changing dynamics. For one, the US$ trends down, and nears a breakdown from a crucial long term level of support. $ moves almost always presage something big in the equity and credit markets; recall 1987 as only one example. Which leads to another cliche: Tighten your stops... [And]even if the high for this move is 'in', some testing (of the recent high) is in order so that a top could form."Well, yesterday's market action, examined apart from other factors, concerned me enough that I began to hedge -- and even to sell some -- of my portfolio's positions. There are several items of alarm to note; I list only two:

[click on chart to enlarge] © Daily Graphs

[click on chart to enlarge] © Daily Graphs

When examined in a vacuum, yesterday's price reversal (see highlighted price area) -- from a new all time high to a negative change on the day and very close to its intra-day low -- is not especial cause for concern. Such a reversal typically would set up the chart action for several weeks of meandering as it builds a short term base. This time, due to the market's possible future action, it instead could be a short term top. From such a pattern, I would expect it to decline to ~$48, and breaking beneath that level, then accelerate toward $42-38. This possible decline does not end my bullish thesis for the company and its shares, it merely would interrupt it.

How and when might this market decline transpire, if [I am] correct? I would expect the ferocious portion of the decline to begin sometime within the next 5 days to 5 weeks. An arguably good single data point would be Tuesday, 2 January (2 weeks from today) -- when a typical up opening could be followed by an intra-day reversal and hugely negative close. This represents typical price action and is to be expected. Whether it occurs has yet to be determined.

Knowing only what I know now, I doubt the decline would be more than a trader's break, albeit one with an intermediate term periodicity (1 to 6 months). During such a decline, I would expect many stocks to breach their 50-day sma and then decline to their 200 day simple moving average; some would exceed that measure, others would hold there, and a few would decline not even that deep.

This post serves not as a prediction, but as a recognition of increased and increasing risk; money management, pure and simple. I do not intend this post to institute a breathless, mindless, panicked rush to sell out your portfolios. As always, examine well the merits of each portfolio holding; you might sell all shares, sell only some, hedge positions, sell short, or even ignore this 'warning' due to your long term investing time frame. Or you consider your ability to dodge possible bullets mandates you remain long and unhedged. Or you consider my analysis and perceptions to be incorrect, and thus invalid for your purposes.

But after a lengthy period of fattening your wallets, now might be a good time to consider battening down the hatches. I used to think I could buy or sell at the optimal moment; I no longer think or even try for that. The big declines of yesterday could pale in significance to what is coming. In such an event, I would rather have cash or be hedged. As always, new winners will emerge during such a decline (should it occur) -- it is always thus. Nonetheless...

Caveat emptor.

David M Gordon / The Deipnosophist

Labels: Market analyses

[click on chart to enlarge]

[click on chart to enlarge]Labels: Company analyses

More people than ever are watching more online video more frequently. But despite the surge in viewers and available content, the medium isstill nascent. A number of issues must be settled in order for theadvertising market to develop, according to eMarketer's report," Internet Video Audience. eMarketer estimates that over one-third of the US population will have viewed video on the Internet at least once per month on average during 2006. By 2010, the US Internet video audience will have grown 45.8% to 157 million, up from 107.7 million this year." For all the clips playing, online video advertising currently comprises just 2.6% ($410 million) of total Internet advertising spending ($16.4 billion) this year. Video still has a long way to go. Clips are still fuzzy or halting online. Also, because there is no search engine for video, users can't navigate to videos advertisers might be sponsoring."In light of these comments, does the marriage between YouTube and Google/GOOG still seem sudden or ill-thought? Or expensive?

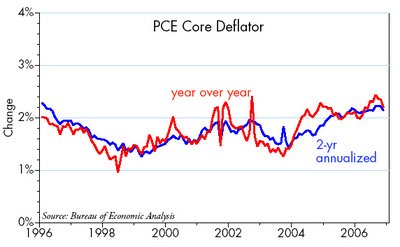

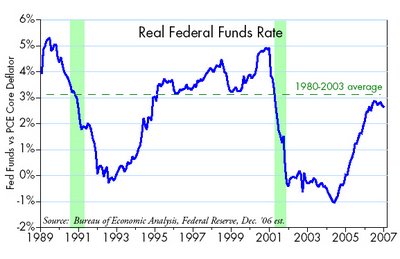

The FOMC statement today suggested that the Fed is prepared to wait at least several months, and possibly several quarters, to see how inflation pressures, which they currently classify as "elevated," respond to past tightening actions, a slower-growing economy, a weak housing market, and lower energy prices, all of which are thought to be disinflationary. The bond market has already decided on the outcome, betting on moderate growth, falling inflation, and a reduction in the funds rate target to 4.25-4.5% by the end of 2007.

Arguing against a cooling of inflation, however, is the behavior of certain key market prices that respond to monetary imbalances. So far this year the dollar has lost almost 10% of its value against other major currencies, and about 20% of its value against gold and nonenergy industrial commodity prices. This suggests that although a 2.7% real funds rate might well be "average" and close to a level which in the past has been disinflationary, in the current climate it may not be high enough.

The yin and the yang of monetary policy is a complex interaction of supply and demand dynamics that can take many months or even years to manifest itself in the general price level. It's part art and part science, with a dose of politics thrown in, all taking place in a global setting with few absolutes. Treasury Secretary Paulson later this week will urge the Chinese government to continue revaluing its currency against the dollar, a move which would likely result in the dollar losing even more of its value relative to most Asian currencies. Paulson will essentially be arguing for a reduction in Asian demand for dollars, at the same time his fellow traveller, Fed Chairman Bernanke, will presumably be reassuring the market that the Fed will be vigilant in safeguarding the dollar's value, something that is hugely important to a region of the world that holds a sizeable quantity of dollar-denominated bonds. Strange bedfellows indeed, working at cross purposes in an oriental setting. Paulson's success would only complicate Bernanke's job, making it less likely that the Fed could ease policy as much as the market is now expecting.

Labels: Economics

On the other hand, we could 'go for broke' with our $10,000 account. Here we'll be highly aggressive in search of big rewards, and we'll just deal with the fact that some months will be rough. That, after all, is the price you have to pay to get those stellar returns, right? After twelve volatile months, we've actually gotten the same monthly average return of 5% - we've just done it erratically. Even with the same monthly average, those few bad months really took their toll. This volatile account only achieved a 75.6% return - considerably less than our consistent account that gave us 5% per month.

[click on table to enlarge]

[click on table to enlarge]This is a testament to the importance of consistency, and capital preservation. In our second scenario, the reason the great months didn't help was because we had less capital to invest following a losing month. Remember, it takes a 100% gain to offset a 50% loss. And while the difference between these two returns may seem trivial, if you compound this over several years, it suddenly won't seem trivial. In fact, the difference between these two portfolios after five years of the same kind of consistent (or inconsistent) returns is nearly $20,000.

By the way, it doesn't matter how you sequence your gains and losses in scenario two - the average monthly return and the bottom line remain the same. Don't plan on taking your losses early and 'making up for them later', as it just won't help any.

So are we saying that we should all start looking for trades that are smaller - but more frequent - winners? Not at all. We have plenty of services that "swing for the fences". We're just saying that your overall results should be enhanced rather than hampered by volatility. To really find out if it is, I'd recommend that you track your trading results (returns on each trade, and success frequency) on at least a monthly basis.

Trade Smarter,

Price Headley, CFA, CMT

President & Chief Analyst

"I read your article on Under Armour - it was very interesting. I actually work with a company called Tefron/TFR that supplies Under Armour with a lot of their performance sportswear (as well as to Nike). I would be interested in hearing what you think about it."

"Whoa!," I think. "Looks very interesting, enticing, even arguably immediately actionable!" Why is that? Because the rise in price from the bottom-clearing breakout above ~$6 (not drawn) during August 2005 until the reaction high trade of $13.73 during May 2006 was accompanied by an explosion of daily volume. I will confirm it next but can guess now: this company is in full turnaround mode. Turnaround, however, from what? How bad was the slump? How strong the recovery? Will that recovery continue?

These questions I will answer later. ("Answer" in the sense of best guess; none of us know the future.) So next I wonder, "Who wrote me?" Fortunately, the writer provided links, and I discern immediately the quality of his particulars and cv; he knows whereof he speaks.

Back to the charts. I focus next on the daily bars...

[click on image to enlarge]

[click on image to enlarge]"Whoa, redux!" Not only is Tefron, in a seeming turnaround, but its shares (TFR) scream, "Buy me. Now!" I see the powerful uptrend (already noted) with the comparatively massive and explosive volume; not solely leading, but also participatory. Investors want to own this stock despite rapidly climbing prices. The last 6+ months have traced out a very shallow decline, another designation of investors' demand for the shares. This will complete itself as an intermediate term base once through the line of declining tops (shown). The company stated only 4 months ago (Q2 earnings report), "Looking ahead, the company believes that it will achieve its target for 2006 of mid-teen percentage growth in revenues and profitability levels higher than those of 2005, at around the levels seen in the fourth quarter of 2005.""Tefron manufactures intimate apparel, active-wear and swimwear sold throughout the world by such name-brand marketers as Victoria's Secret, Nike, Target, Warnaco/Calvin Klein, The Gap, Banana Republic, Mervyn's, Puma, Patagonia, Adidas, Reebok, and other American retailers and designer labels. Through the utilization of manufacturing technologies and techniques developed or refined by the Company, Tefron is able to mass-produce garments featuring designs tailored to its customers' individual specifications. For the nine months ended 30 September 2006, Tefron's revenues rose 10% to $138.1M. Net income from cont. ops. totaled $13.6M, up from $4.6M. Revenues reflect increased sales across all of the Company's product lines. Net income also reflects higher gross margins, lower financial expenses, improved operating margins due to increased production & lower labor costs."

Hmmm, as a turnaround opportunity, this company and its shares become increasingly compelling. With this limited information, then, the game is afoot. How much more might I discover, how much more might I learn before this stock breaks out with renewed vigor to the upside? Because that is precisely what the stock has prepared itself to do. Go up. So the odds are that I will purchase soon an exploratory lot -- to establish an initial position in advance of the eventual lift-off from this base and while I do more investigatory (gumshoe) work. ("The soles of my shoes, Watson, wear out quickly!") Tefron, as you would imagine, is under-followed by Wall Street; another reason for my interest. Such lack of notice provides added goose to the upside as the analysts finally chime in (when they note the rising price and trend).

I do note, however, one caveat, one cavil: its average daily volume is so thin as to be comparatively illiquid. I want to participate but not initiate; i.e., I want to participate in the stock's rise, not initiate it. Too, I do not want to become the market -- both buyer and seller -- so my need for sufficient liquidity, offset by my portfolio's requirement for profits, has me return to the notion of money management: How many shares could I purchase that would make a notable impact on my portfolio's return on investment vs the seeming illiquidity. Aye, and there's the rub: seeming illiquidity because the average daily volume will increase as the share price trends higher.

So that is how I get from there to here, or whence and thence. More due diligence yet remains, and yet I know enough that I could purchase now the shares and make money. Again I think of the reader/writer... Thank you for bringing to my notice this opportunity. Write me again. Anytime. Soon, even.

-- David M Gordon / The Deipnosophist

Labels: Market analyses

Labels: Humanities

"Its credibility with athletes sets Under Armour from at least one rival," Horan says. "If you think about it, the kids in the band wear Nike and the jocks wear Under Armour."

[click on chart to enlarge]

[click on chart to enlarge]Since its IPO, the shares have enjoyed a nice climb. Oh sure, there was an ~8 month intermediate term base (area 1), but please note that each major low in that base was higher than the one prior, as too were the highs! The shares then broke out from that intermediate term base in early-October, ran higher, and then formed a short term base (area #2). Note the low of the short term base merely nudges the high trade of the intermediate term base. Very bullish price action, as it shows signs of unstinting demand! The shares broke out this week above this base as well, with explosive volume and a breakaway gap (area 3). Barring mishaps in the general market, the shares should now proceed higher in a new up trend, accelerated in pace from the one extant (that is, the one since its IPO).

Even though the shares now trade at all time highs, there is minor price resistance at ~$51.50 (the reason the shares turned down yesterday from this level), and then again at ~$55 (and rising). This pattern and setup counts to the low-$80s, once through the levels of minor resistance. I have long held an intermediate term target of $100/share, due one part to the company's increasingly positive fundamentals, a second part to the building pattern now being realized, and a third and equal part to the recognition that Under Armour/UARM fits exceedingly well the mold of a buyout candidate; Nike/NKE is the company most often mooted. Form fitting, indeed!

Does this opportunity yet strike your fancy? Measured against the risk of a possible albeit unlikely decline to the low 40s (~$10 of risk), a further rise of $30-50/share seems especially grand. Yes, reward:risk ratios of 3:1 or better 5:1 fit well my mold of an excellent investment.

What say you (now)?

-- David M Gordon/ The Deipnosophist

Labels: Company analyses

Labels: Humanities

Labels: Company analyses

"Isis Pharmaceuticals is a biopharmaceutical company exploiting ribonucleic acid (RNA)-based drug discovery technologies to identify and commercialize novel drugs to treat diseases. The Company, with its primary technology, antisense, creates inhibitors, called oligonucleotides, designed to hybridize, with a high-degree of specificity to their RNA target and modulate the production of specific proteins associated with disease. In its Ibis division, Isis Pharmaceuticals, Inc. has developed a system, called triangulation identification for genetic evaluation of risks (TIGER) that can, with a single test, simultaneously identify from a sample a range of infectious organisms without needing to know beforehand what might be present in the sample."

I included some rationale for owning ISIS shares in the Entelechy post, and mentioned then that $10 represents an optimal purchase point for this stock; recent action had affirmed that notion and today's gap higher on the opening reifies it. (See arrows on chart above.) I remain convinced these shares will soon trade higher, much higher. Certainly, Wall Street begins to take notice. In pre-open trading, Pfizer/PFE shares are bid down ~15% whereas ISIS shares are bid higher by ~10%. And the chart tilts toward the right side of the chart -- the appropriate side, the upside.

Labels: Company analyses