The Deipnosophist

Where the science of investing becomes an art of living

About Me

- Name: David M Gordon

- Location: Summerlin, Nevada, United States

A private investor for 20+ years, I manage private portfolios and write about investing. You can read my market musings on three different sites: 1) The Deipnosophist, dedicated to teaching the market's processes and mechanics; 2) Investment Poetry, a subscription site dedicated to real time investment recommendations; and 3) Seeking Alpha, a combination of the other two sites with a mix of reprints from this site and all-original content. See you here, there, or the other site!

28 February 2005

"I should have known..."

Novice traders often hold an erroneous belief that traders are natural born, and thus, by instinct they can handle anything the market throws at them. Natural born traders see good trade setups instinctively, and can close a trade like a virtuoso. But much of this is folklore. Traders are made, not born. It is necessary to hone your trading skills through practice and experience. You cannot expect yourself to know everything right away. When you are caught off guard and you lose because of an unanticipated set of market conditions, do not berate yourself by thinking, "I'm a dummy. I should have known that." How could you know? Do you have infinite, infallible knowledge? Do you have a lifetime of trading experience? You cannot expect to trade like a seasoned trader without experience and practice.

Some people can see patterns more quickly than others can. They are artistic and see structure in a seemingly random array. Other people are math wizards who can process numbers with lightening speed. Still others can stay cool under pressure, calmly surveying the landscape and making logical, astute decisions. Everyone has a different learning curve when it comes to trading, and it is necessary to remember that. Two people can trade side by side, with one person picking up techniques faster than the other does, but that does not mean that in the end, one person will be a better, more profitable trader than the other will. Even if one of the pair was more talented than the other initially, it is quite possible that both people will end up as seasoned, master traders.

Everyone has different talents and backgrounds. Sure, if a person grew up in and around the trading industry, he or she may know a little more than the average novice, but no background ensures success. Over the course of a career, it is quite possible that a late bloomer can outperform an early rising star. If you berate yourself for not being skilled enough, or not having enough trading experience, you will sabotage your efforts. Comparisons to others are worthless. If you think you must perform up to some external standard before you are ready, you will never achieve what you are striving for. You will choke under the extreme pressure you are putting on yourself. Take your time. Give yourself an opportunity to gain the experience you need. You cannot expect to trade like a master over night.

When learning how to trade, it is vital to gain experience across a variety of market conditions. That takes time, considering that the knowledge base of many novice traders is essentially a blank slate. Most novice traders have relatively little real world trading knowledge. Over time, however, they will accumulate the requisite knowledge they need to trade like a master. Until then, it is necessary to ease up a little, if you are new to the trading business. Give yourself time. Instead of beating yourself up for having limited knowledge, begin each trading day by thinking, "Of course, I don't know what's going on. I have a lot to learn." It is better to go in with an upbeat, optimistic attitude. Do not think, "How is the market going to show me up today?" Instead, it is more inspiring to think, "I wonder what new knowledge I'm going to acquire today?" By easing up on yourself, you will be open to gaining valuable experience, and eventually, you will hone your skills and trade like a master trader.

27 February 2005

B-school for HMOs

Doctors have lost control; instead of being care givers they instead have become gate-keepers. They have on staff (at least) one employee whose sole task is to obtain "authorizations" from the various medical plans (HMOs, PPOs, POSs, etc) before any diagnostic care can be done, leave alone prescriptive attention.

Two personal examples:

- I have suffered a chronic pain in my left arm for the past 38 months. I thought losing weight and improving my physical condition would attend to that pain; alas, no. My doctor (primary care physician, or PCP in medical insurance jargon) is confident he knows the cause, but he first must receive permission before referring a specialist. Once obtained, the specialist also must receive permission to perform the various tests to confirm the cause. Then the specialist again must obtain permission before taking care of the problem. Meanwhile, I remain in pain.

- I take a statin for elevated cholesterol. The specific drug, however, that would help my condition is not covered by the insurance company's formulary; thus, for the past 9 months, I have had to endure the 'game' of an increasing dosage of the statin the insurance company does cover just to prove its inefficacy... while the patient's (my) life is in danger.

You can regale me with fine tales of how you were spared the ignominy of undiagnosed pain or spared death thanks in part to your health insurance. I would argue your story is the exception rather than the rule. Something is rotten in Denmark, as the article attests. HMOs, once regarded as savior of the entire industry, arguably are the largest contributor to the systemic problem. There is a failure in the system that lies somewhere between employer-sponsored health coverage, health insurance, doctors, and the patients. We each must give something to achieve balance.

I believe the system, as it is currently configured, is broken. What do you think...?

25 February 2005

Top 10 Trading Questions

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Often when we seek answers to combat the chaos of trading, it helps if we ask the right questions. Hence, my Top 10 trading questions.

- How will you enter trades? The key to good entries is putting on trades where there is relatively low risk compared to much higher reward. You also should write down a clear catalyst for the expected stock move.

- How will you exit trades? You should define an initial stop point for your trade, at the point where the trend is invalidated. You will also need a 'trailing stop' technique to protect your profits.

- What type of orders will you use to enter and exit? When entering, I like to use limit orders, good for the day only, while exits are often market orders. Why? Because limit orders allow me to define my risk and reward clearly on the entry of a trade, while when I need to get out, market orders allows immediate exit compared to the risk of missing my exit with a limit order.

- How much capital will you need to trade successfully? There are economies of scale as you increase the amount of capital you trade with. Costs related to commissions, quote systems and equipment begin to diminish as the percentage of capital invested goes up.

- What percentage of your capital will you invest in each trade? The amount of capital I typically use is 10% per trade in my own accounts. I know traders who commit anywhere from 5% of their account per trade to 20% of their account per trade. You goal should be to keep portfolio risk per trade at less than 2% per trade (for example if you invest 20% of your portfolio in a trade, a 10% loss on that position would lead to a 2% loss on your portfolio).

- How many positions will you focus on at once? I like to concentrate my portfolio in my best ideas, plus I like to stay focused on how each stock is acting. If my portfolio is too big (I'd say more than 7 stocks is too many to focus on), then I will lose focus and invariably miss an exit on a trade that I should have previously exited.

- What will your Trading Journal look like? In my Trading Journal, I note daily observations, particularly related to my ability to execute my trading plan. I also commit to doing a post-trade analysis every month. I note what I did right and wrong, and seek to learn from mistakes to minimize future errors in similar circumstances, while also looking for winning patterns where I seek to repeat big successes.

- What is your Position Review process? Have an end-of-day routine to close your day. Review your trades, and assess if you followed your plan. Keep a log of all your trades, and make comments on each position.

- What is your Preparation process before trading? You need defined time to prepare for the next trading day to build up your trading confidence. I prepare after the close for the next day's trading, which allows me to formulate a plan of action BEFORE I get into the heat of battle. This keeps my trading proactive instead of reactive.

- What broker will you use? Most traders mistakenly think that commissions are the number one factor they can control. In reality, commissions are a small cost compared to the broker's effectiveness at executing your trade. Your focus should be finding a broker who gets you speedy and fair execution of your orders.

Once you have defined these facets of your trading plan, you are in an excellent position to have a strategy to control your emotions when trading. Make sure to review your plan on a regular basis to create effective trading habits.

The Alphabetizer Speaks

Poetry is not to the tastes of everyone, nor even their sensibilities. This is due, in part, to the fact that proper methodologies for reading and enjoying poetry rarely are shared. Two tricks to increase your enjoyment:

- Pay attention to punctuation marks (commas, periods, etc) and adapt your pace of reading from one punctuation mark to the next. This style helps you 'get' the rhythm of the poem.

- Always note line breaks (in which a sentence or clause concludes on a second or even third line from its inception). A good poet makes use of odd-seeming line breaks.

This excellent poem (published in the Paris Review) is a fine opportunity to utilize these suggestions. Moreover, it is well-told, allusive, illusive, even elusive. I marvel at this author's talent.

The Alphabetizer Speaks

I have my reasons

have never known starvation nor plenitude

and unless the order of the world

changes, I won’t.

If the order of the world changes, I will

disappear, the way some vowels

elide into their word-bodies

or an individual blade recedes

into a field each season.

Will my daughter carry on this way?

I cannot yet tell her qualities—

if she prefers scale to chance, sequence to random.

And this may mean nothing.

I find chaos theory appealing, and eavesdrop on talk

of black holes, chasms, any abyss

that fetters sense. I relish

the desultory in many matters,

am slovenly, a slacker, a slave to caprice.

Except with the letters.

There is such thing as a calling

though I cannot speak for prophets or martyrs.

I have been summoned

by people of stature and the low-stationed,

comrade and debutante alike.

My eyes suffer, and my hands, my back.

I am my profession. It is no whim.

I do not want the world a certain way.

The world is that way, and I am a vehicle

on the road of nomenclature. I tend the road.

In my dream, all events coterminous—

no linear narrative, preceding or next.

The odd vignette, lone scene, an image

in isolation, no neighbors.

Then I awaken and pace

my thin balcony, calculating

how much of me waits above, how much

lives below, and I pose

the question of balance. My name

cues the turn home.

-- Patty Seyburn

24 February 2005

A pithy quotation

Wow! I guess some people were born with intellect and blessed to be pithy. Hmm, this reminds me: my wisdom (what little there is) and tendency for logorrhea each need improvement.

23 February 2005

Traders' Focus

Tim brings a gimlet eye to the market, and an unusual perspective: he has price confirm (and conform to) his multiple indicators of sentiment and Elliot Wave analysis. His analysis is so spot-on that I am hard-pressed to recall the times he has been wrong, if ever.

If you trade the markets, you should subscribe to Tim's Traders Focus. (Also see "Friends" in sidebar.) I proffer as example of Tim's outstanding analysis, today's comments...

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The Trader's Focus

Wednesday, February 23, 2005

a research summary of Lakeville Research, Inc.

P.O. Box 688 Lakeville, CT 06039 - tel. (860) 499-8063 tim@tradersfocus.com

In yesterday's note, we mentioned that the intraday March S&P 500 Futures pattern called for a test of the (SPH 1197-1194) range. In the noon conference call, we stated that a test of (SPH 1192) could not be ruled out, and that intraday patterns should be assumed as negative. The weekly COT data also emphasized the notion that Institutional traders had stayed in a negative posture. After slipping decisively below the (SPX 1197) stop/pivot following 12:00, the stock market remained under pressure into the closing bell.

Most of the time a decisive break on increasing volume occurs, as was the case yesterday and also once last week, we will see further reaction lows over the course of the next few sessions. The S&P 500 Cash Index (SPX -17.42 1184.16) could rebound toward the (SPX 1188-1192) range over the short-term, but there now is an increased probability for a test of the January 28-31 open gap below the market in the (SPX 1174-1171) range. This could very easily evolve into a test of the late-January lows, perhaps into the March 1-7 time frame.

The NASDAQ 100 (NDX -21.33 1494.07) already is involved in a test of the January lows as called for the in the past few weeks. We expect the NDX to move to new daily lows in the (NDX 1465-1445) range mentioned yesterday.

Over the course of the past few weeks, we have mentioned several deteriorating data points as the high probability rebound into February expiration has passed.

- COT (commitments of traders) data remains weighted to the sell-side from the standpoint of institutional or commercial traders.

- The notable negative divergence of the NDX.

- The fact that the January-February rebound began from relatively poor data points and proved to be a choppy and difficult opportunity. We had discussed several times during this rally that upside into this period could represent a final/climactic move or be subject to failure.

- European markets had moved into a toppy posture with the German Benchmark (-36.57 4286.94) drawing a bearish weekly candle in the week before last. There is an important downside pivot below the market at the (DAX 4245) mark.

- In yesterday's retail conference call, we discussed the (RLX 432.50) mark as an important downside pivot, which, if broken, could contribute to the overall toppy complexion of the stock market. The S&P Retail Index closed yesterday at (RLX 429.30)

- In addition, yesterday's put/call ratio complex declined across-the-board during the sharp stock market decline, indicating little fear or concern on the part of option participants. I would speculate that this will change as the NASDAQ 100 takes out its January lows, perhaps creating the possibility for a better short-term low in the previously mentioned March 1-7 time frame. Yesterday's CBOE Equity put/call ratio finished close to market topping levels at (.53).

In sum, while modest rebounding is possible today, further daily reaction lows are likely into the end of the week with the NASDAQ 100 breaking January levels.

I will discuss the intraday Futures patterns and the Dollar/Gold picture on this morning's conference call at 8:45 EST.

22 February 2005

When is an obituary more than an obituary?

I long ago lost count the numbers of times I have railed against improper usage of the (English) language -- too much reliance upon jargon, too many pronouns, and the prevailing confusion between the restrictive and non-restrictive clauses -- all lead to confusion for the reader or listener.

"Miss Gould" stood for clarity of speech and writing "For example, some years ago, she saw the phrase "'...and now sat stone still, chewing gum throughout the proceedings' and suggested replacing the last bit with 'sat stone still except for his jaw, which chewed gum.'"

Be still my heart. And now you are gone. At least you are remembered via an obituary that is as fine an example of clarity in writing that you could dream of.

(Yes, Miss Gould, I wrote that final sentence purposely incorrectly! ;-)

21 February 2005

Google/GOOG - one more time

Google/GOOG will repeatedly surprise (even startle) most market participants because very few truly understand what is afoot. This article explains one source of revenue for the company. Soaring revenues and earnings will help goose the stock price. Did you know, for example, that for Q3 '04, "Google's ebitda (Wall Street's proxy for operating income) totaled $321 million, vs. $322 million for nine-year-old eBay, $260 million for ten-year-old Yahoo, and $114 million for nine-year-old Amazon. Google is much smaller than those fellow dot-coms but is growing faster. Its sales and ebitda each doubled last year and the year before that. Google's operating profit margin, at more than 60%, is bigger even than Microsoft's at its peak." (Q4 numbers have been released, and exceeded Q3 by a seemingly inconceivable margin.)

So, too, will other events provide leaven to the share price, such as this probability, as stipulated several days ago by RBC Capital, "...although there is some subjectivity used to determine the selection and timing of companies to be added to the S&P 500, with GOOG's float expanded after the recent lockup expiration, the company now meets or exceeds all major criteria. We believe the stock would react favorably to such an announcement of a pending inclusion in major indices, which they believe is likely over the next six months. By our calculations, GOOG has less than half the institutional ownership of EBAY and YHOO."

Recognize, if nothing else, this one truth: the future of a company that surprises positively, repeatedly, and regularly. And all while the stock behaves as do most stocks -- like a pinball, as the shares trade hands from weak to strong, from traders and speculators to investors. Investing is not solely limited to purchasing at near $0 for some nebulously higher future price. Investing also is paying today's seemingly high price to realize tomorrow's higher price and lessened high valuation.

How can that be, you ask. A higher price connotes higher valuation, right...? Valuations typically rise with a rising share price due to rising expectations that are priced into the stock before the company has the opportunity to follow-through. Google/GOOG, however, could be that rara avis: its valuation measures likely will decline in the face of a rising share price because the share price advance will fail to keep pace with the improving fundamentals... until, that is, the capitulative run into its final high many years from now. (The obvious exception of cheapening fundamental measures will be that of market cap.)

There are, of course, better moments to purchase, such as upon that trendline I delineate in the chart below.

We draw trend lines in part to remain on the correct side of a trend, but also to note their breach (in either direction); this event represents moments to act. Of course, a breach of a trend line can in itself be meaningless for the extant trend -- i.e., the trend could continue albeit at a slower pace.

But Google/GOOG is one company to own, not merely watch its oscillations. As you know (and if you do not, then check those archives!), I perceive Google/GOOG to be a singular investment opportunity, the type of opportunity that comes along only once in a lifetime. I will startle you (and laugh now all you want), but I believe in 5-10 years' time the share price is headed for $1,000, $2000, even $4,000/ share (adjusting out any possible future share splits). I know that, between now and then, the share price will oscillate -- sometimes wildly -- but declines of the share price represent opportunities to buy (invest) rather than moments to fear. In that not-too-distant future you likely will find me laughing all the way to the bank.

Check back with me then.

FLIR Systems redux

The oft-stated breakout at (split-adjusted) $32 remains intact. Note the trend line of declining tops in the chart below:

This event -- if and when it occurs -- must happen with explosive volume (note the diminution of volume during the past many months while the presumed base built), and close convincingly above the $32 breakout.

I believe this anticipated breakout could occur as early as this holiday-abbreviated week -- arguably on Wednesday, if you insist upon a specific day. Watch for a surge in volume in advance of, or coincident to, the price breakout. Trading objective is ~$42-44, stop is $28+...

20 February 2005

Revenge of the Right Brain

- "Until recently, the abilities that led to success in school, work, and business were characteristic of the left hemisphere. They were the sorts of linear, logical, analytical talents measured by SATs and deployed by CPAs. Today, those capabilities are still necessary. But they're no longer sufficient. In a world upended by outsourcing, deluged with data, and choked with choices, the abilities that matter most are now closer in spirit to the specialties of the right hemisphere - artistry, empathy, seeing the big picture, and pursuing the transcendent..."

- "Beneath the nervous clatter of our half-completed decade stirs a slow but seismic shift. The Information Age we all prepared for is ending. Rising in its place is what I call the Conceptual Age, an era in which mastery of abilities that we've often overlooked and undervalued marks the fault line between who gets ahead and who falls behind. To some of you, this shift - from an economy built on the logical, sequential abilities of the Information Age to an economy built on the inventive, empathic abilities of the Conceptual Age - sounds delightful."

- "The Information Age has unleashed a prosperity that in turn places a premium on less rational sensibilities - beauty, spirituality, emotion. For companies and entrepreneurs, it's no longer enough to create a product, a service, or an experience that's reasonably priced and adequately functional. In an age of abundance, consumers demand something more... Liberated by this prosperity but not fulfilled by it, more people are searching for meaning. From the mainstream embrace of such once-exotic practices as yoga and meditation to the rise of spirituality in the workplace to the influence of evangelism in pop culture and politics, the quest for meaning and purpose has become an integral part of everyday life. And that will only intensify as the first children of abundance, the baby boomers, realize that they have more of their lives behind them than ahead. In both business and personal life, now that our left-brain needs have largely been sated, our right-brain yearnings will demand to be fed."

... makes this article perfect fodder for inclusion to this blog.

18 February 2005

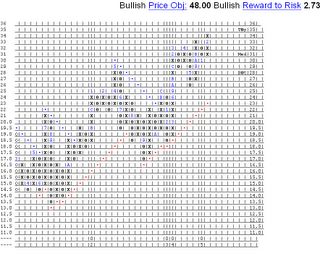

Starbucks/SBUX

After ~7 weeks of unrelenting decline, Starbucks/SBUX price now rests immediately north of its 200-day sma (simple moving average), now at ~$49.02. One of two outcomes could occur from this level.

- The 200-day sma stems the decline

- The shares break down beneath the 200-day

Should the former occur, then the shares soon will rise because the ma itself is rising! And should the latter instead occur, then at some moment soon thereafter, the shares will rally back toward the 200-day sma to prove that what once was support now is resistance.

So a purchase at this level can be either profitable or breakeven. Acknowledging the 7 weeks of near straight line decline adds fodder to the argument (at least) for a counter-trend move back toward the 50-day sma.

Whichever event occurs next, the subsequent rally -- toward the 50-day or a break beneath and rally back toward the 200-day -- will offer a significant tell for SBUX in the coming weeks and months. That is, was $64+ a final high (and thus making a statement re future growth) or merely another intermediate term high trade in its continuing long term uptrend?

Investing requires discipline, not hope or lazy thinking. One method to assure making profits consistently is to manage risk. I like my odds at this level: risk = ~$1 and reward = ~$6. Moreover, we should know soon which direction SBUX breaks. In the face of such uncertainty -- and because I believe the long term growth will continue -- I am a buyer of SBUX shares today @ $49.80 or better. I will not pay pay up, and buy at $52, $51, or even $50/share in the ignoble quest for ratification of the pattern.

At this moment, SBUX shares might represent continued risk to decline further, but having patiently bided my time until this moment, it is in truth a calculated risk, arrived at with dispassion.

16 February 2005

Startling talent

(c) David Gilbertsen

I think it is nigh time for David to again pick up brush and palette, and paint. What do you think...?

Las Vegas Futurists

Elaine Barans led the discussion of Fareed Zakaria's THE FUTURE OF FREEDOM. Elaine was especially well-informed: pithy, incisive, cogent -- and easy to look at.

I will attend future meetings. If discussing ideas at a high level of discourse interests you, then consider attending future meetings as well. (View the website's calendar for meeting dates.)

Low Morale

But this animation is brilliant, as it seduces the viewer with the acoustic version of Radiohead's Creep. All beguilingly awesome. Enjoy!

(Requires Flash and speakers on...)

Why the book club is more than a fad

Reading, as we all know, tends to be a solitary pursuit, whereas we humans in general tend to be social. What better method to achieve my prized connectedness than to combine the two? Of course, participants of these reading groups might have ulterior motives: meet other people, meet a significant other, have a good time, have adult conversations, etc. "But there is clearly something about our current social and cultural circumstances that has made this book club explosion happen now. It is partly, perhaps, about the desire to forge personal links in a fractured world."

I do not belong to a reading group, but drat, I sure wish I did!

14 February 2005

Comments re CAKE from Dorsey Wright

Cheesecake Factory/CAKE ($34.10):

The main trend of CAKE is positive and the stock has three out of five technical attributes positive. The chart patterns show several classic patterns like:

- A shakeout in September,

- A triple top in November to complete that shakeout, and most recently

- A double top at 33 to complete a bullish catapult formation.

In addition to completing this bullish catapult, the weekly momentum has flipped positive. Okay to buy CAKE here with a stop/hedge point at 29, a double bottom.

Comments above and chart (c) Dorsey Wright ~~~~~~~~~~~~~~~~~~~~~~~~~~~

Please visit a Cheesecake Factory near you (better, eat there), and note its attractiveness, its ambience, its food -- every item is yummy! -- and the long lines to get a table. This wait is true no matter which Cheesecake Factory you visit. I have had to wait at

- The two in Las Vegas,

- The one inside Macy's at Union Square in San Francisco,

- The original location in Beverly Hills,

- Newport Beach, Ca, and

- Copley Place in Boston.

So here's the thing: what are the reasons you invest? Could these attributes (not solely the wait, but the other items noted above) be an indicator of sorts...?

The Old Shepherd's Chief Mourner

Many critics consider this art (by Sir Edwin Landseer) as maudlin, mawkish, even lachrymose.

And yet I consider it to be, at minimum, a masterpiece of indirect storytelling, in addition to composition, technique, light, shading, and etc. Consider how much is said but with so little:

● Someone has died (by unknown circumstances),

● It seems noone has come to the funeral (the coffin is not yet in the ground) thus confirming a lonely existence, and

● The shepherd's dog -- likely the sole company for each other -- now misses his master. (One very subtle trick Landseer uses well is to curl inwards the dog's front right paw. Not to wax anthropomorphic, but this 'action' is among those that endears dogs to us humans. If instead Landseer had painted the dog sitting four-squarely, the dog's -- and our -- sense of loss would be missing. Techniques such as this one illustrate how art becomes Art, even a masterpiece.)

So from this scene of a funeral, our thoughts wander all the way from, "What happened?" to "What of the dog now?"

Anyone want to take this dog home...?

13 February 2005

SUSPECT

Well, that scenario is precisely what happened for me with Suspect. Purchased late Friday night, I read perhaps 10 pages before nodding off. But the little I read told me to read this novel now. And so I did. In between everything else I had to do on Saturday, I still managed to read all 360 pages before the end of the day.

Wow! If you like your mysteries layered with complexity -- not merely trying to discover who did what, but offering characters with problems, with more than two dimensions -- then take a chance with this novel.

You will be happy you did. And let me know what you think...

12 February 2005

Neal Stephenson’s Past, Present, and Future

But Neal is more than merely a great storyteller; he also is an autodidact with intriguing ideas about the world, society, and our place in it. For example, this essay is supposed to be about his Baroque Cycle of novels, but instead transmutes into a discussion of ideas...

• Speaking as an observer who has many friends with libertarian instincts, I would point out that terrorism is a much more formidable opponent of political liberty than government. Government acts almost as a recruiting station for libertarians. Anyone who pays taxes or has to fill out government paperwork develops libertarian impulses almost as a knee-jerk reaction. But terrorism acts as a recruiting station for statists. So it looks to me as though we are headed for a triangular system in which libertarians and statists and terrorists interact with each other in a way that I'm afraid might turn out to be quite stable.

• The success of the U.S. has not come from one consistent cause, as far as I can make out. Instead the U.S. will find a way to succeed for a few decades based on one thing, then, when that peters out, move on to another. Sometimes there is trouble during the transitions. So, in the early-to-mid-19th century, it was all about expansion westward and a colossal growth in population. After the Civil War, it was about exploitation of the world's richest resource base: iron, steel, coal, the railways, and later oil. For much of the 20th century it was about science and technology. The heyday was the Second World War, when we had not just the Manhattan Project but also the Radiation Lab at MIT and a large cryptology industry all cooking along at the same time. The war led into the nuclear arms race and the space race, which led in turn to the revolution in electronics, computers, the Internet, etc. If the emblematic figures of earlier eras were the pioneer with his Kentucky rifle, or the Gilded Age plutocrat, then for the era from, say, 1940 to 2000 it was the engineer, the geek, the scientist. It's no coincidence that this era is also when science fiction has flourished, and in which the whole idea of the Future became current. After all, if you're living in a technocratic society, it seems perfectly reasonable to try to predict the future by extrapolating trends in science and engineering. It is quite obvious to me that the U.S. is turning away from all of this.

This too-brief essay makes for compelling reading.

--David M Gordon / The Deipnosophist

Labels: Book review, Humanities

11 February 2005

You Won't Be Bored by this Story on Boredom

- Of course, if boredom has any foothold in shock-and-awe Las Vegas, then nowhere is safe. Kids are bored at school. The rest of us are bored at work or in marriages. The suburbs are boring. The Midwest is boring. Underneath every new bell and whistle, every fad and trend, every new celebrity, gadget, hot spot, hot town, hot neighborhood and hot club can be heard a resigned sigh. "Interesting," we say, having turned an antonym for boredom into its euphemism. "Um ... is there anything else?"

- Does our boredom point to an emptiness at the heart of our culture—or in the fabric of existence itself? Or does it suggest something is wanting with us? Historian Laird Easton described boredom in terms that Las Vegas should understand: "Much of modern Western culture," he says, "has been a wager against boredom, just as most of premodern life was a wager against death."

- ... it's safe to say that boredom comes in two basic varieties. There is small-b boredom. This is temporary boredom: the boredom of a traffic jam on the 215, cleaning the house or running errands. It's the drag of routine, the blahs that come and go on a dead Saturday afternoon when you want to be doing something but can't think of anything. The small-b boredom is at worst just an inconvenience, a headache that will pass with a good night's sleep. The big-B boredom is the silent predator that hides on the backs of progress and prosperity. It is the vague and vertiginous sense that behind the neon façade of our modern world exists a deep emptiness of purpose or meaning that no casino, no show can address. It stalks us and poisons our society—men rush to war to try to cure themselves—yet we can't even really identify its edges. This boredom is like a fog or a stale persistent odor that no amount of scrubbing can quite clean. Which kind of sucks: We can't identify its causes or find its boundaries. Sometimes it seems to be external, and other times it seems to be lodged right in our brains. But we can't seem to overcome it.

- Depression is not the same as boredom. "The depressed person feels himself or herself to be inadequate to the world, whereas the bored person finds the world itself to be inadequate..."

- It's hard not to be finicky in a supersize society that offers ever more choice. We get bored if things are too ordinary and routine. Strangely, we get bored with too much variety. Being alone bores us—surely, someone out there is having just the most fun!—and then we go out and go through the motions at a bar, restaurant, nightclub, and we think, "This is boring, and I should have stayed home." Too much activity bores us. Too much rest bores us. New music bores us because it's different from our favorites. Our favorites bore us because we've heard them too many times. Choice itself eventually wears us out.

Read the article (and the sidebar), and then let me know what you think... Is the writer full of hot air? Am I (too) easily swayed?

09 February 2005

The best online mapping software...

'Released' only yesterday, the brain trust at Google has completely re-engineered the typical interface, re-designed the maps to have a European feel (wider streets, etc), and transformed the mapping experience into something you could play with for hours on end. It is cool!

If you have read my earlier posts, then you realize that Google knows how to monetize this effort. Create a tool that attracts users, who in turn refer others (such as this blog entry), thus causing advertisers to sit up and take notice. For example, if you own a sushi restaurant, then you want it to appear in the listings when someone searches for sushi restaurants in their neighborhhood.

Minting money. Google (from googol) referred originally to one thing, but now it refers to the amounts of money this company will make. That reality applies as well for its shareholders; days such as today are opportunities for investors. Who knows -- perhaps the share price will decline in the near term even deeper than it already has? And yet, compared against the long term future for the company and its shares, who cares?

08 February 2005

FLIR Systems

"Overall, there is plenty of evidence that demand has taken control of the near-term picture and longer-term the trend is still positive and the upside price objective is $43. Ok to buy FLIR in the 30-32 area with a trading stop at $28, which would be a near-term sell signal on both the default and 1/2 pt charts. FLIR is a 3 for 5'er, and the Electronics sector [itself] is favored."

All content above this caption (c) Dorsey Wright

As many of you know already, I have been banging the drums for Flir Systems/FLIR for ~3 years now. And most recently over the course of the past 5-6 weeks I repeatedly have stated the shares near a breakout of the 6 month base it has built. This opportunity (FLIR) is a specific example of how you (as trader or investor) align your interests with those of the markets; i.e., buy the short term breakout from an intermediate term base within a long term uptrend. And within one of the periodicities (short, intermediate, and long term) is your investing time frame.

For FLIR shares, the next breakout (for those who prefer certainty with their morning coffee) would occur at ~$32, basis the close with explosive volume. BTW, this level is approximate because it occurs from a line of declining tops that is lower with each passing day.

As a position trader, I love opportunities such as this one: ~$4 of risk (a $32 purchase with a $28 stop) vs ~$12 of reward (~$32 purchase and a $43-44 objective), or a 3:1 ratio. And either likely achieved within the short term (days to weeks).

07 February 2005

The Customer is King

This essay from James Surowiecki is another example of his talent.

- "It’s certainly true that manufacturers have a lot less pull in the marketplace than they used to. But they haven’t lost it to Wal-Mart and Target. They’ve lost it to you and me. The real transformation of the past thirty years is the rise not of the American retailer but of the American consumer",

- "Wal-Mart is often spoken of as the most powerful company in the world, but it earns less than four cents on every dollar of sales, and its profit margins have stayed roughly the same year after year—which means that when it cuts costs with suppliers it passes along those savings to the customers, instead of padding its own bottom line. Wal-Mart can’t charge more; if it does, its customers will go elsewhere", and

- "It’s getting harder and harder for manufacturers to charge premium prices for so-called premium brands. Of course, this is how it should be, according to the economics textbooks. In a genuinely competitive economy, the company that ends up selling a good is going to be the one that produces (and therefore sells) it at the lowest cost. This is a case where, as the Princeton economist Alan Blinder put it, 'the economy came to resemble the model.'"

BTW, this essay is not about Wal-Mart (although my quotes selections might lead you to think that), nor is it about the ostensible purpose behind the Procter&Gamble-Gillette merger, which is its purported topic. No, this essay is about something other.

Which is as it should be in order to be considered as among the few journalists of especial note: edifying content, depth of insights, and all told entertainingly well.

What does Freedom Really Mean?

Statements such as, "Simply put, freedom is the absence of government coercion" and "The real test is not whether Iraq adopts a democratic, pro-western government, but rather whether ordinary Iraqis can lead their personal, religious, social, and business lives without interference from government" provide suasion that helps convince the reader of the soundness of his thoughts, leave alone their rightness.

His essay's conclusion, "Every politician on earth claims to support freedom. The problem is so few of them understand the simple meaning of the word" comes full circle in support of his sub-text, that words and language can themselves be appropriated, their meanings twisted, and become propaganda. The future that Orwell feared, even predicted, is here, and we are the unwitting dupes.

05 February 2005

Hilarious!

Lost in HTML

Mea culpa, I decided to take a crash course in learning (to code) HTML. And "crash" is the operative verb, as this site served as my Blue Book. (Remember those...?) This site almost disappeared in a puff of incantatory non-wisdom. If it were not for the assistance of friend, Zara Elis (Timberland Braes), it would be gone and I never would have learned anything!

But it is back, and so am I. The obvious changes are the links (see sidebar) and moving the Google searchbar to the top of the page. (Success, at last!) The sidebar is a work-in-progress, so check regularly for new inclusions. And I hope to link these recommendations to their specific pages at Amazon.com. But these tasks re the sidebar are secondary to the site's primary content.

So first I must prepare (well, collate) my taxes, then off to a party this evening where a real magician will show off his tricks, and after all that a post entitled, "The Value of Technical Analysis"...

Writing that post I know will be far easier than learning the magic of HTML.

Flirting - art or science?

- When asked about flirting, most people - particularly men - focus on the verbal element: the 'chatting-up', the problems of knowing what to say, finding the right words, etc. In fact, the non-verbal element - body-language, tone of voice, etc. - is much more important, particularly in the initial stages of a flirtation. When you first meet new people, their initial impression of you will be based 55% on your appearance and body-language, 38% on your style of speaking and only 7% on what you actually say."

- ...The impersonal interrogative comment has evolved as the standard method of initiating conversation with strangers because it is extremely effective. The non-personal nature of the comment makes it unthreatening and non-intrusive; the interrogative (questioning) tone or 'isn't it?' ending invites a response, but is not as demanding as a direct or open question. There is a big difference between an interrogative comment such as "Terrible weather, eh?" and a direct, open question such as "What do you think of this weather?". The direct question demands and requires a reply, the interrogative comment allows the other person to respond minimally, or not respond at all, if he or she does not wish to talk to you.

Note the availability of a .pdf version of this research; see link toward top right corner of the site.

02 February 2005

Europe's Crisis

But that is not it at all. The author widens his focus, and betrays his true intent: that the murder of Dutch film-maker, Theo Van Gogh and the bombings in Spain are merely pieces of a puzzle -- and that the US is neither the cause of the world's ills, nor its savior -- and especially Europe's.

"Nor is terrorism the only problem affecting Europe’s general security that, like it or not, Europe alone is going to have to deal with. The present European Union, comprising 25 states (with 15 more hoping to join), faces unique strategic challenges. Already sharing a border with the newly expanded EU are Ukraine, Belarus, Moldova, and Russia. If and when Turkey joins, Europe will include both it and Cyprus, another “Asian” state, and will then, by its own volition, be sharing borders with Georgia, Armenia, Iran, Iraq, and Syria... In short, the new European Union is forming itself smack in the cockpit of geopolitical danger. At the same time, it lacks either the material or the diplomatic wherewithal to deal with this danger in a forceful or unified manner. As the crisis of freedom in Ukraine developed this past November and December, and as Polish President Aleksandr Kwasniewski and Solidarity hero Lech Walesa headed for Kiev, the stance of the French government was, as a French commentator aptly put it, one of “embarrassment.” “It can scarcely be an accident,” the English columnist Philip Stephens dryly observed in the Financial Times, “that France’s Jacques Chirac and Germany’s Gerhard Schroeder have not missed the opportunity to keep quiet about Ukraine’s orange revolution”—an event of far greater consequence for them, and for the European Union at large, than anything the United States may or may not be doing in Iraq."

Someone (the author) finally discusses that terrorism is not the problem but a symptom. And that geo-politics, economics, social structures, military might, and international relations each contribute to the unity of the whole.

My final post re Google ("Yeah, right!")

This article, (http://www.worldchanging.com/archives/002028.html#more), explains yet another specific effort on the part of Google that will change how we use our computers and the Internet. (How far behind can Neal Stephenson's Metaverse be...?)

BTW, Wall St liked the company's earnings report; in after-hours trading, the shares jumped ~$20! Most analysts cheer about the strong results -- there are some cautious comments -- as estimates and targets are raised across the board...

- Prudential moves their target to $260 (from $200) noting they believe Google continues to gain market share in the Sponsored Search advertising market. Google's Q4 net advertising revenue, excluding TAC, grew 127% YoY to $643 mln, significantly outpacing the organic growth rate of rival Yahoo/YHOO. Firm now expects Google to earn $4.32 per share in full-year 2005 (up from $3.67), and is introducing full-year 2006 estimate of $6.08. In their opinion, an investment in Google is, in effect, an ownership stake in a company with maximum exposure to the online advertising market's fastest growing format. Reiterates Overweight.

- CSFB moves their target to $275 (from $225) saying they continue to believe that Google is the best way for investors to play the growth in online advertising.

- Merrill Lynch is more cautious, noting the company reported EPS of $0.71/share is after non-cash stock compensation expense; if this were added back, the EPS figure becomes $0.92/sh. However, reported results included $66MM of tax benefits of which $24MM is nonrecurring and the remainder tough to characterize as it is recurring conceptually, but hard to quantify. Treating only the $24MM as nonrecurring, the firm arrives at an EPS figure of $0.84/sh but including all of the tax benefits as nonrecurring, EPS is reduced to $0.69/sh. After expressing enthusiasm, the management was quick to note that they were still willing to take risks to achieve long term growth. Sees shares as fairly valued and finds it hard to really step up the plate here. Reiterates Neutral.

- Jefferies upgrades GOOG to Buy from Hold and raises their target to $230 from $160 following outstanding 4Q results. Though the co provided no guidance, firm believes that 4Q results provide incremental insight into Google's growth trajectory, which they believe is steeper than they had previously anticipated. Also, they believe GOOG is gaining share in a faster growing market.

- ThinkEquity raises its target to $290 from $200

(The earnings comments were aggregated by Briefing.com.)

01 February 2005

"What IS a deipnosophist anyway?"

A deipnosophist is a person skilled in dinner conversation. And eutrapelia (part of this blog's URL) is one of the seven moral virtues Aristotle enumerated, and denotes pleasantness in conversation.

So if you think you discern a pattern, you are correct!

Google/GOOG to report earnings today AFTER the markets close

So much anticipation for a company whose IPO was little more than 6 months ago. The highest official guesstimate (not whisper number) I have seen comes from AmTech Research ("We expect GOOG to report results that beat consensus estimates and NOT provide any financial guidance. Our official estimates call for December quarter net revenue of $580MM, EBITDA of $359MM, and pro forma EPS of $0.75. Consensus is looking for net revenue of $589MM, EBITDA of $363MM, and EPS of $0.77. We believe the upside scenario for GOOG this quarter is net revenue of $611MM, EBITDA of $385MM, and EPS of $0.81.")

At some point, however, the company will fail to meet what will be typically increasing expectations, and that day could be today. (This type of action/reaction is the bane of growth stocks everywhere.) We will know ~3 hours from now.

Nonetheless, the long term opportunity for Google/GOOG investors is extraordinarily grand. Should the shares come under selling pressure tomorrow, or in the coming weeks, you will find me with open arms.

Why? In addition to what I said earlier today, is this comment from the insightful Bill Burnham's blog: http://billburnham.blogs.com/burnhamsbeat/2005/01/the_coming_blog.html

And if instead GOOG shares rise in a manner reminiscent of the explosive rally after the report for Q3 '04 -- well, you have been warned. Of course, as I write this blog entry, GOOG shares are down ~$4. Why this occurs is anyone's guess: The price decline so far today could be the Microsoft/MSFT announcement re gunning for Google in the search space (to consider Google as merely a search company misses altogether what this company becomes), selling in advance of the earnings report, a combination of both, or merely a chart pattern that begs for a decline to build a better base before a more enduring move up in price.

But all this short term price volatility merely helps create opportunities for investors. And I want to own GOOG shares for years. Don't you?

The business of books is bad for reading

This rant offers much that I agree with: that glorious feeling of hefting a book to help decide on its purchase, the joy of discovering a new author or book, even the fact that I also am too quick to proselytize the merits of this or that book, but slow to heed the recommendations from friends and family. I even find the author's list of notable books intriguing; I looked up each with which I was previously unfamiliar. And isn't that the value of word-of-mouth publicity?

So I wonder: have you read any good books lately? Come on, be out with it...

SIDEWAYS

I agree with every word and insight and compliment the reviewer lavishes on this wonderful movie. Hurry now and see this movie the way all great movies should be seen: communally, in the theater, so that you can smile, laugh, and cry with other people at the many, many moments of pathos and bathos.

Google shares scream, "Opportunity!"

Visit their homepage (http://www.google.com). Where are the Flash or Shockwave animations? In fact, the page is pretty... spare. Their objective is to get the viewer off the website ASAP. (That little time ticker that displays the length of time needed for each search result is as much for them as it is for us; perhaps more so.) Their desire to index the world is expensive, but worth every penny to realize their vision. Imagine a library's card catalogue (which is based on the Dewey decimal system); now update that card catalogue to the digital age. The digital 'card catalogue' will have sponsored ads... as will the 'books' themselves! Make money? Google will mint money. And this indexing is but one facet of their strategy.

Brilliant, absolutely brilliant. Of course, execution will have to enter the picture, but, so far, they have executed their vision and strategy with precision, with perfection.

There always are sticky points, with the current worry being the end of the ‘lockup’ on 14 February, and the resultant near doubling of float, etc. These are valid and important arguments, but not critical — at least not for a long while. (Remember to always plot a given stock within its continuum, its lifecycle: which items are critical at the varying stages?) One item to keep in mind is that Wall St knows of the lockup expiry, and the various players already have acted on this ‘news’.

Items such as lockup expirations are merely one aspect of the bigger picture of a stock within its continuum, which is itself an aspect of what transpires at the company, which in turn is a function of the markets, which in turn is a function of geo-politics, etc. So to place a reductive filter of only one item on a smaller component in such a larger picture... Ho-hum; such limited perceptions create the type of opportunities investors seek. Including me.

For now, consider the company and its stock. While Google, the company, does its 'thing', GOOG shares bounce about like a pinball. The topology, although periodically rocky, is generally uphill. (There will be declines, so factor them into your purchase patterns. In fact, it would not surprise me to see the shares stumble to ~$160 or lower in the coming days and weeks, but such a decline would represent a welcome opportunity to buy.)

In the end, what Microsoft/MSFT achieved (from 1986-2000) and Cisco/CSCO bettered (1990-2000), Google/GOOG will surpass. The rise in GOOG shares from the IPO of ~$100 to $200 is nothing compared to what future years will bring. I hate to state it in this fashion, but Google/GOOG is a one-decision opportunity for me. Why layer complexity on top of elegance?

BTW, the argument in favor of Google/GOOG is similar to that of other stock market winners such as eBay/EBAY, Johnson & Johnson/JNJ, Starbucks/SBUX, Whole Foods Markets/WFMI, and a raft of other up&comers (such as Cheesecake Factory/CAKE). Market leaders tend to continue their winning ways for years -- even decades. Which is why I select from market leaders for my portfolio winners.

What are these "Notable" entries...?

By and large, most of what I recommend will be comparatively little-known. (What would be the value of recommending... say, The DaVinci Code when everyone does so?) I provide each title with its link at Amazon.com so that you can glean the opinions of other people. Of course, should you purchase any of the recommended titles, some income will be directed my way, so please help support your neighborhood Deipnosophist!