"Safe and restful, sleep, sleep, sleep"

First, despite the sudden decline, Garmin/GRMN has not built a bearish pattern, including a head & shoulders top. The stock did achieve its objective as supplied by the count of the pattern previous. Now it rests, as the shares build another, different area pattern, as it seeks now the low end of this new range and before moving to higher highs. But I (we?) received the trade results we sought (profits), as the shares raced to $85 from $65. (Although I sold out earlier, at $81.) So what's next? Well, if you like how this particular pattern works, the correctly-identified cup & handle, then consider ResMed/RMD, which has shaped up so similarly as to be the same.

ResMed/RMD is a developer, manufacturer and distributor of medical equipment for treating, diagnosing and managing sleep-disordered breathing (SDB). SDB includes obstructive sleep apnea (OSA) and other respiratory disorders that occur during sleep. For the six months ended 31 December 2005, ResMed's revenues rose 43% to $273.5M. Net income rose 24% to $38.8M. Revenues reflect an increase in sales flow generators, mask systems, motors and other accessories. Among its primary competitors in this market segment is Respironics/RESP, another market leader that now is in the throes of building a large-ish base. However, ResMed is the business leader: offering best products, and at competitive prices. Readers know I prefer to purchase only leaders; leaders in their business, leaders in the stock market.

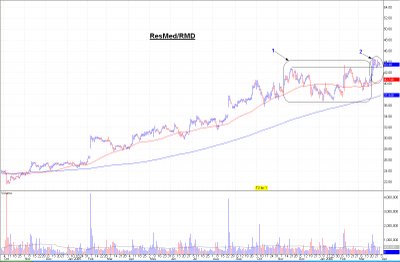

[click to enlarge]

The chart (above) shows the past 18 months of trading activity for ResMed/RMD. In a glance, viewers will see quickly that these shares are in a long-term uptrend, to ~$45 from ~$21. Look more closely, however, at the past ~5 months, as the shares have traced out a picture perfect cup & handle pattern. (Please review this blog's archives for the correct aspects and rules of the cup & handle pattern.)

From 21 November 2005 until 21 March 2006 (area 1), the shares based in the cup portion of the handle. But on 21 March, the shares broke out explosively from this portion of the pattern, achieving a new all time high. Since then, precisely 10 days ago, the shares have traced out the picture perfect handle portion of the pattern (area 2) -- drifting sideways to marginally lower in price, and on diminishing volume. While doing this, it has not traded beneath the loosely-identified trend line of former resistance, now quickly becoming important support.

So what's next for ResMed/RMD shares? Chartists who study the rules of a pattern, in addition to its appearance, would realize the handle typically and preferably endures for only 1-3 weeks; the shares today are halfway through that process. Thus, it is only a matter of time -- days only; perhaps even today! -- before the shares again move higher in price, trading above $45, and higher ($50++) soon thereafter. I am already long the shares, and continue to accumulate. In fact, I will purchase more shares today.

Objective: $50++

Trader's stop: $42-41

Investor's stop: $39-38

Do opportunities get much better than this? I like the business. I like the opportunity. And I really like the chart. I like the odds. At its current price, the reward = ~$7 (initial) and risk = ~$2, a better than 3:1 reward to risk ratio.

As always, I welcome your questions or comments.

-- David M Gordon / The Deipnosophist